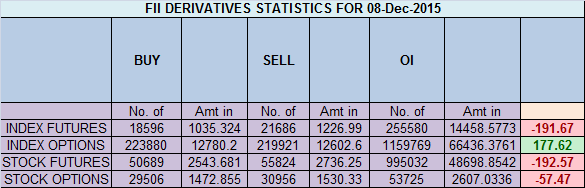

- FII’s sold 3 K contract of Index Future worth 191 cores ,3.6 K Long contract were liquidated by FII’s and 0.05 K short contracts were liquidated by FII’s. Net Open Interest decreased by 4.1 K contract, so today’s fall in market was used by FII’s to exit long and exit shorts in Index futures. Are You a Trader or a Gambler?

- Nifty opened below the demand zone of 7767 made high of 7771, bears pushed price again below 7767 and able to close below it. Probability of Nifty hitting 7539 is increasing till nifty trade below 7767 zone and once 7642 is increasing. Bank Nifty breaks demand zone,EOD Analysis

- Nifty December Future Open Interest Volume is at 1.92 core with liquidation of 0.89 Lakh with decrease in CoC suggesting long position were closed today. Nifty closing below rollover cost 7896.

- Total Future & Option trading volume was at 1.64 Lakh core with total contract traded at 1.11 lakh , PCR @0.62 approaching oversold zone.

- 8000 CE OI at 65.8 lakh , wall of resistance @ 8000 .7600/8200 CE added 27.7 lakh in OI as bears added position at higher level most of addition was seen in 8000/7800 CE.FII bought 0.7 K CE longs and 7 K CE were shorted by them .Retail bought 43 K CE contracts and 7.6 K CE were shorted by them.

- 7500 PE OI@ 55.6 lakhs strong base @ 7500. 7600/8000 PE liquidated 0.75 lakh so bulls started feeling the pain as nifty continued with its fall .FII sold 12.7 K PE longs and 2.4 K PE were by shorted them .Retail bought 5.2 K PE contracts and 7.1 K PE were shorted by them.

- FII’s sold 518 cores in Equity and DII’s bought 590 cores in cash segment.INR closed at 66.81.

- Nifty Futures Trend Deciding level is 7763 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7903 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Traders following TC levels have been handsomely rewarded.

Buy above 7720 Tgt 7753,7771 and 7805 (Nifty Spot Levels)

Sell below 7665 Tgt 7633,7581 and 7540 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

7000 before budget? Hmmmm

7000 — ABOVE OR BELOW – WE ARE TRADERS CLOSELY CHASING MARKET VEHICLE LIKE A SHADOW WITH MASTERJI’s GUIDANCE

sir, sell below 7665 not 7765..i guess its wrong…

sell below 7665 ( type mistake)

Thanks its corrected