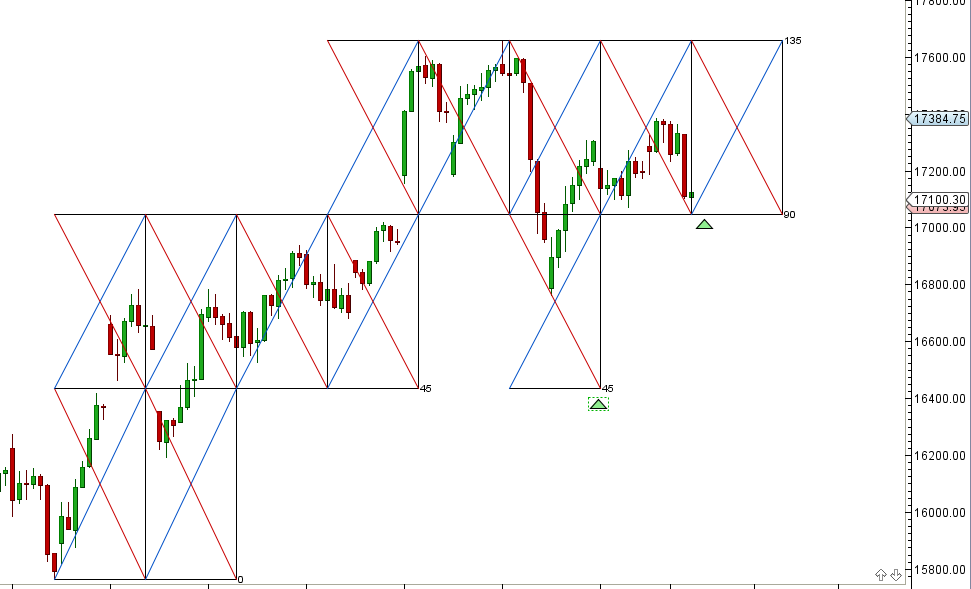

- As discussed in last analysis Bank Nifty reacted from gann line of resistance and is heading towards the first support of 17000 and ultimate target of green arc as shown in below chart around 16700/16650.Pyrapoint suggest Break of 17000 on closing basis opens possibility of nifty moving towards 16500/16400 in short term.Bullish on close above 17600.

- Bank Nifty October Future Open Interest Volume is at 21.9 lakh with liquidation of 0.04 Lakh with decrease in CoC suggesting long position booked profit today. Rollover cost @17334.

- 18000 CE OI at 4.05 lakh , wall of resistance @ 18000 .17500 PE added 50 K lakh so bears started building positions @17500 and will be difficult to cross. 17000-18000 CE added 2.5 Lakh in OI

- 17000 PE OI@ 3.6 lakhs strong base @ 17000 at start of series. 16500/17000 PE added 2.2 lakh so bulls making base strong at lower level at start of series. If 17000 is broken and sustained we can see move towards 16500.

- Bank Nifty Futures Trend Deciding level is 17339 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 17302 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 17200 Tgt 17300,17380 and 17495 (Nifty Spot Levels)

Sell below 16980 Tgt 16875,16760 and 16680 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates