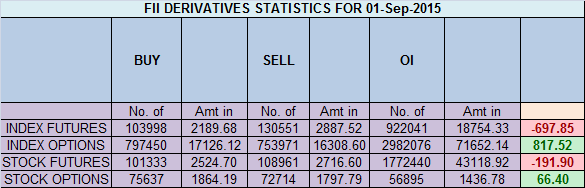

- FII’s sold 26.5 K contract of Index Future worth 697 cores ,10 K Long contract were squared off by FII’s and 15.8 K short contracts were added by FII’s. Net Open Interest increased by 5.4 K contract, so today’s fall in market was used by FII’s to exit long and enter shorts in Index futures How to Prepare Successful Trading Plan Part-I

- We have been discussing in previous analysis 7948-7961 is important zone of support below that we can see market moving to sub 7800 zone. Nifty opened with gap down made high of 7929 and started the decline to sub 7800 levels. Pyrapoint was able to capture both top and bottom of todays trade with move from 180 to 225 degree as shown in below chart. Break of todays low will see nifty breaking previous swing low of 7767 and heading towards 7637 where next pyrapoint support stands.

- Nifty September Future Open Interest Volume is at 2.21 core with addition of 0.10 Lakh with rise in OI and fall in CoC suggesting short position have been added. Rollover stand at 65 % and avg cost of rollover @ 7998.

- Total Future & Option trading volume was at 2.05 Lakh core with total contract traded at 6.8 lakh . PCR @1.03.

- 8200 CE OI at 33.2 lakh , wall of resistance @ 8200 .7900/8200 CE added 18 lakh in OI so bears added major position today in 8100/8000 CE and added 40 Lakh. FII bought 20.4 K CE longs and 30.7 K CE were shorted by them.Retail bought 149 K CE contracts and 73.3 K CE were shorted by them.

- 7600 PE OI@ 31.3 lakhs strong base @ 7600. 7900/8100 PE liquidated 5.8 lakh so no major liquidation was seen by bulls with a 200 point fall. FII bought 93 K PE longs and 40 K PE were shorted by them.Retail bought 1.1 K PE contracts and 64.3 K PE contracts were shorted by them.Options IV’s are very high so better avoid buying options.

- FII’s sold 675 cores in Equity and DII’s bought 681 cores in cash segment.INR closed at 66.26 trading at 2 year low.1997 Asian Currency Crisis happening again

- Nifty Futures Trend Deciding level is 7852 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7967 and BNF Trend Deciding Level 16730 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 17172 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7821 Tgt 7850,7870 and 7894 (Nifty Spot Levels)

Sell below 7740 Tgt 7711 ,7663 and 7637 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Sir, What is the significance of GANN emblem date?

no trade zone is very large 7740 to 7281 that’s 81 points excepting very large swings?