- August Series Nifty corrected 5.8 % was worst series after Aug 2013 when Nifty corrected 8.8%.Nifty and Bank Nifty Bat pattern continue to show the effect as market has recovered 281 points from the low. 8032 is 38.2% retracement 8045 is gann 1×1 line and 8065 is pyrapoint resistance needs to be watched tomorrow.Strong support near 7900/7880 zone.

- Nifty September Future Open Interest Volume is at 2.10 core with addition of 43 Lakh,Rollover stand at 65 % and avg cost of rollover @ 7998.

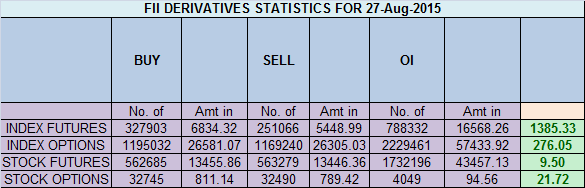

- Total Future & Option trading volume was at 5 Lakh core with total contract traded at 7 lakh . PCR @0.98.

- 8200 CE OI at 22 lakh , wall of resistance @ 8200 .7800/8200 CE added 16.2 lakh in OI so bears added position today in 7900/ 8000 CE.

- 7800 PE OI@ 36.4 lakhs strong base @ 7800. 7900/8200 PE added 23 lakh so major addition was seen in 7800/7900 PE bulls making strong ground with start of series.

- FII’s sold 3.3 K cores in Equity and DII’s bought 2.5 K cores in cash segment.INR closed at 66.04 trading at 2 year low.1997 Asian Currency Crisis happening again

- Nifty Futures Trend Deciding level is 7955 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7955 and BNF Trend Deciding Level 17265 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 17265 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7990 Tgt 8026,8045 and 8088 (Nifty Spot Levels)

Sell below 7920 Tgt 7900,7888 and 7850 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Hello

could you kindly suggest some books on nifty for beginners ?

When gap up occurs like today, we are not able to trade since it never comes back to your entry point. Is there any strategy when huge gap ups or gap down occur?

I use gap theory which is covered in my trading course.

Rgds,

Bramesh

These gap up are eating my money.

HELLO BRAMESH,

I HAVE ONE QUESTION YOU SAID ROLLOVER STAND AT 5 HOW DO YOU CALCULATE THAT NUMBER.. PLEASE HELP

65%

Sir, what about oi. Any short covering?