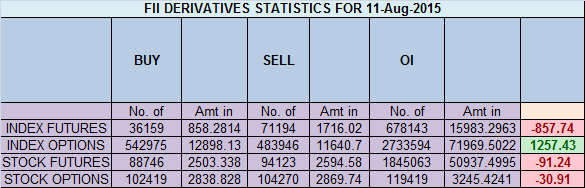

- FII’s sold 35 K contract of Index Future worth 857 cores ,16.8 K Long contract were squared off by FII’s and 18.1K short contracts were added by FII’s. Net Open Interest increased by 1.2 K contract, so today’s fall in market was used by FII’s to exit long in index futures and enter shorts .When You fail as a trader

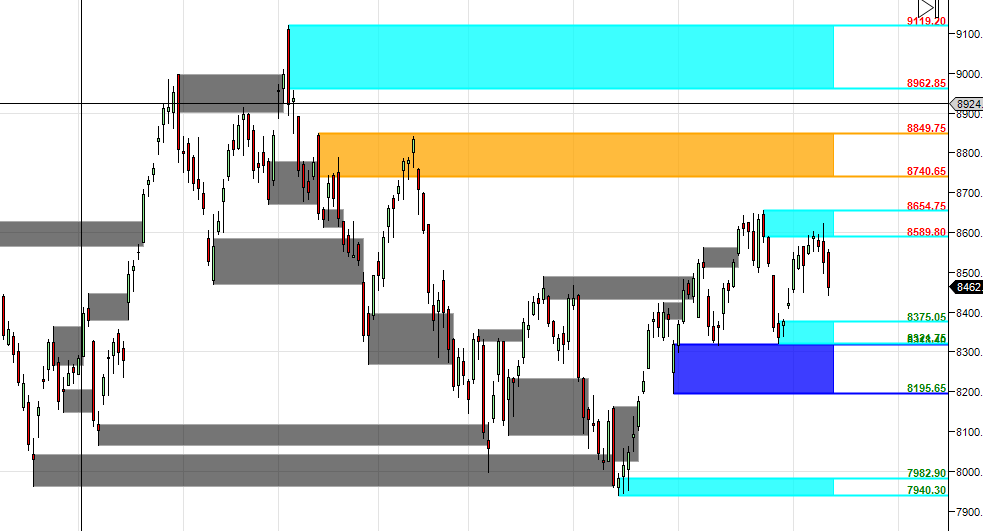

- Nifty formed lower low and lower high as it was unable to cross crucial supply area as discussed in Weekly analysis.This is what we discussed yesterday Gann Box with hourly charts are also shown with support and resistance so got resisted at 8×1 line and saw a quick fall till 3x1line, breaking today low of 8497 will see Nifty moving towards 2×1 line @8454. Support now lies in range of 8375-8400 range, Gann Box break of 8441 will see Nifty coming down to touch the major support of 2×1 line around 8420/8400 range. Gunner also see market might take support around the red arc so shorts needs to be caution and part profit booking should be done in range of 8375-8400.

- Nifty August Future Open Interest Volume is at 1.65 core with liquidation of 0.36 Lakh, with decrease in CoC suggesting short positions got closed today.NF Rollover price came at 8503 and NF and close below it.

- Total Future & Option trading volume was at 2.23 core with total contract traded at 4.1lakh . PCR @0.94

- 8800 CE OI at 49.1 lakh , wall of resistance @ 8800 .8400/8800 CE added 18.2 lakh in OI so bears continue to add 27.2 lakh in 2 trading session. FII bought 17.9 K CE longs and 2.6 K CE were shorted by them.Retail bought 107 K CE contracts and 33.3 K CE were shorted by them.Retailers are long suggesting fall can continue.

- 8200 PE OI@ 62.7 lakhs strong base @ 8200. 8300/8600 PE liquidated 23 lakh so major liquidation was seen in 8500 PE still bulls are holding and 49 lakh from start of series . FII bought 47.7 K PE longs and 3.9 K PE were shorted by them.Retail sold 83.9 K PE contracts and 25.6K shorted PE contracts were covered by them.

- FII’s sold 736 cores in Equity and DII’s bought 130 cores in cash segment.INR closed at 64.21

- Nifty Futures Trend Deciding level is 8504 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8553 and BNF Trend Deciding Level 18812 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18911 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .Both Levels were triggered on downside and shorts are active.

Buy above 8487 Tgt 8510,8531 and 8556 (Nifty Spot Levels)

Sell below 8440 Tgt 8417,8400 and 8372 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Bramesh ji, just to correct, Net Open Interest increased by 1.2 k in Index futures. Please correct.

thanks its updated

i guess as per charts this predection is correct.. all depends on hourly chart