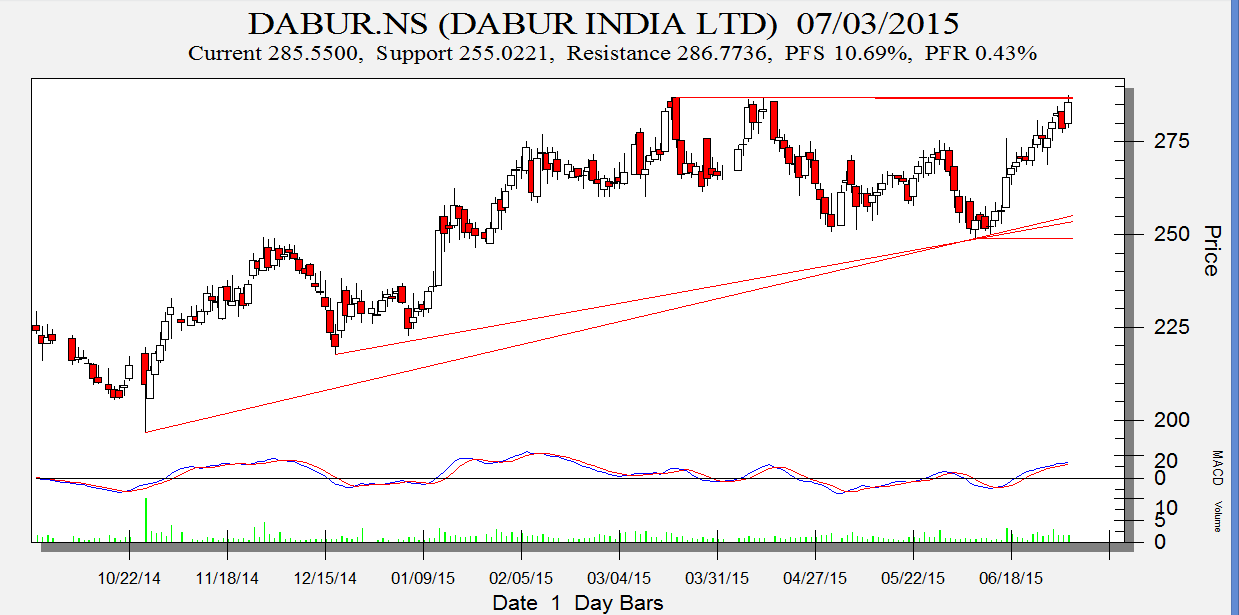

Dabur

Positional/Swing Traders can use the below mentioned levels

Close above 288 term target 300 and 322

Intraday Traders can use the below mentioned levels

Buy above 283 Tgt 285,288 and 292 SL 281

Sell below 280 Tgt 278, 275 and 272 SL 282

Axis Bank

Positional/Swing Traders can use the below mentioned levels

Close above 576 target 589 and 597

Intraday Traders can use the below mentioned levels

Buy above 581 Tgt 585,589 and 592 SL 578

Sell below 574 Tgt 570,565 and 560 SL 576

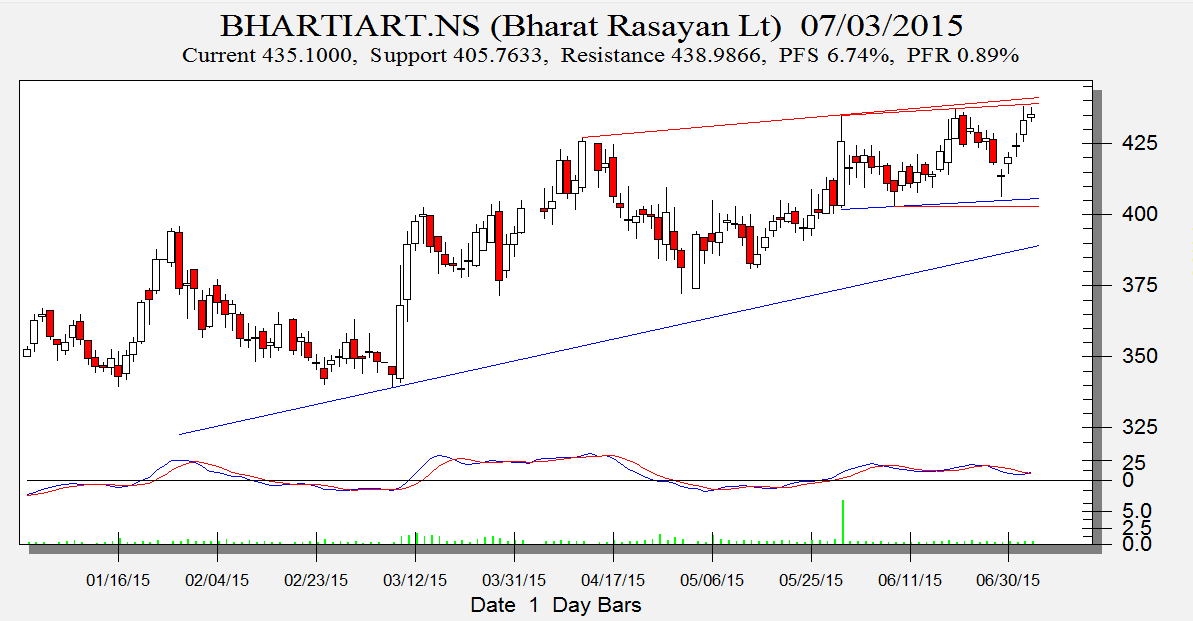

Bharti Airtel

Positional/Swing Traders can use the below mentioned levels

Any close above 432 target 450 and 466

Intraday Traders can use the below mentioned levels

Buy above 432 Tgt 435,437 and 440 SL 430

Sell below 427 Tgt 425, 422 and 420 SL 430

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for June Month, Intraday Profit of 1.97 Lakh and Positional Profit of 1.93 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Arvinf positional rocked today. Waiting for Asian paints and Axis which by the way got activated today

how can i get ramp software free.

Everything is not available for free.