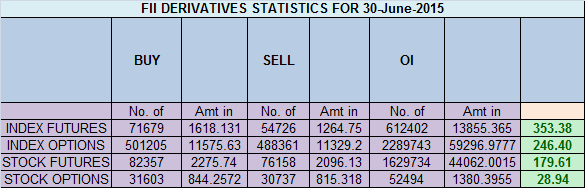

- FII’s bought 16.9 K contract of Index Future worth 353 cores ,33.6 K Long contract were added by FII’s and 16.7 K short contracts were added by FII’s. Net Open Interest increased by 50.3 K contract, so todays rise was used by FII’s to enter longs in index futures 95% of Retail Forex Traders Lose Money – Is This Fact, or Fiction?

- Nifty saw consolidation in most past of day in range of 8300-8340 and finally broke out in last hour of trade, moves are coming in last 1 hour in past few trading sessions. Nifty is entering the new quadrant as per gunner so there is high probability of 8423 breaking and heading towards 8470 which is near 1*2 gann line. Higher High Higher low formation are forming uptrend continues. Strong support at 8300 zone below than 8250.

- Nifty July Future Open Interest Volume is at 1.63 core with addition of 11.2 Lakh, with increase in CoC suggesting longs have entered in the system today.NF Rollover range @8357 should be kept close eye on,holding below bears are in control above it bulls have upper hand.

- Total Future & Option trading volume was at 1.49 core with total contract traded at 4.3 lakh. PCR @0.94

- 8500 CE OI at 34.8 lakh , wall of resistance @ 8500 .8000/8500 CE added 5 lakh so bears added in minor quantity and 16 lakhs overall. FII bought 0.7 K CE longs and 12.2 K CE were shorted by them.Retail bought 0.55K CE contracts.

- 7900 PE OI@ 57.2 lakhs so strong base @ 7900. 7900/8500 PE added 12.6 lakh so bulls added aggressively today and have added 33.2 lakh suggesting bulls are still in control of market . FII bought 42.4 K PE longs and 24.4 K PE were shorted by them.Retail bought 0.55 lakh PE contracts.

- FII’s sold 551 cores in Equity and DII’s bought 580 cores in cash segment.INR closed at 63.64

- Nifty Futures Trend Deciding level is 8340(For Intraday Traders). NF Trend Changer Level (Positional Traders) 8344 and BNF Trend Deciding Level 18195 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18237 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8378 Tgt 8398,8423 and 8450 (Nifty Spot Levels)

Sell below 8345 Tgt 8318,8300 and 8270 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Excellent

Hi Bramesh Ji GM

Its for the first time am seeing DII’s in full control of market and FII’s on selling mood yet market is rising 7940 odd levels to 8400

How long this can continue

And again if FII’s start buying can we se 9300 levels from here on

Follow levels and trade them with discipline.

As per two days back positional call for Maruti….sell below 4037….I have short position with 1℅ Stop loss…..should I continue for holding short position?

Or your call on Maruti positional call is closed?

Please read this http://www.brameshtechanalysis.com/2014/08/how-to-trade-intraday-and-positional-calls/

I vouch with your analysis of nifty hitting 8470 odd levels in coming days.Nifty should hit a meaningful top before major domestic political event hits on 21 july in the name of monsoon session.