- FII’s sold 30.6 K contract of Index Future worth 563 cores ,34.5 K Long contract were squared off by FII’s and 3.8 K short contracts were squared off by FII’s. Net Open Interest decreased by 38.4 K contract, so todays rise was used by FII’s to exit majority longs and partial shorts in index futures. How to survive as a full time trader

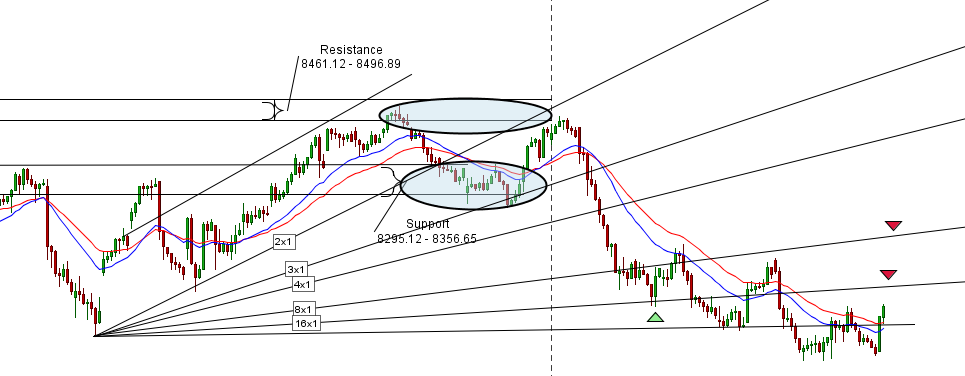

- We have been advocating the range of 7930-7950 being the demand zone for Nifty from 11 June Nifty made the following lows 7958,7940,7944 and 7946 also we have discussed in Weekly Analysis from 14 June time cycle has changed to neutral to Bullish, market obliged with 2 green close from past 2 days. Also Nifty has completed 2 crucial harmonic pattern ABCD and BAT pattern both are bullish if 7930 is held. Traders who bought should have been rewarded, As per gunner next zone of resistance comes @8088-8105, As per gann angles above 8100 we can move towards 8189/8211 odd levels. and pyrapoint, also suggests 8195 on cards. So if todays low held we can move towards the above mentioned target in next 3 trading session.

- Nifty June Future Open Interest Volume is at 1.55 core with liquidation of 3.4 Lakh, with increase in CoC suggesting longs have entered in system

- Total Future & Option trading volume was at 2.10 core with total contract traded at 4.4 lakh. PCR @0.83

- 8500 CE OI at 47.9 lakh , wall of resistance @ 8500 .8200 CE added 3.9 lakh ,so bears added majority in 8200 and are still holding 1.16 core in open position. FII bought 19.5 K CE longs and 17.4 K CE were shorted by them.Retail sold 0.17 lakh CE contracts.

- 8000 PE OI@ 52.1 lakhs so strong base @ 8000. 8100/8500 PE liquidated 2.5 lakh so bulls are still not adding to their positions, Hopefully after the US fed meeting . FII bought 12.8 K PE longs and 6.8 K shorted PE were covered by them.Retail shorted 0.20 lakh PE contracts.

- FII’s sold 521 cores in Equity and DII’s bought 644 cores in cash segment.INR closed at 64.26, lowest close in 21 months.

- Nifty Futures Trend Deciding level is 7996 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8151 and BNF Trend Deciding Level 17408 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 17820 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8062 Tgt 8088,8130 and 8152 (Nifty Spot Levels)

Sell below 8015 Tgt 7980,7952 and 7911 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Sir what are your views on market profile charts. Do you use this strategy?

MP is strategy used for trading, its very effective for intraday trading…

Sir but do you use this market profile strategy in your trading?

yes we do use it.

do you teach market profile in your cource?

Nope

Sir you said “MP is strategy used for trading, its very effective for intraday trading…” So what you teach in your course would be enough for full time trading? plz answer i am looking foward to take your course but few doubt hope you don’t mind

I wanted your view on one aspect.

As you mentioned, while ~7930 is increasingly showing zone of support, the fact that it is being visited multiple times, does it weaken the support ?

YES

Thanks for updating market view…

Good level

Very nice analysis sir……

Thanks sir

your views helped me earn 17k today thank you

As per ur TA, Nifty consolidated & made a strong Base at 7930-7950 with out violating for further downside. Even since past two trading sessions in volatile intradays movement down side was protected & guarded heavily which made the bears to cover their shorts at the fag end of tradings. So now it is very clear that the bulls should ride the markets further high other wise the bears will get the control & steer the markets ??????????…………,……,,

Follow levels and trade with discipline, Let anyone rule bull or bears.

Levels work.. any one drives the market.. is the reply of trend decider bramhesh sir. Aflatoonnnnn..

Thanks for the great insight. With the Fed meeting tomorrow positive sentiment can return here as well and take us higher. The death cross is happening 50 dma crossing below 200 dma near 8300 which is major resistance.

8104 NF /8154 NF needs to be watched

Have you used hourly chart in Fibonacci and the later chart??

yes

Very Good analysis.

Any reason for not giving your report for yesterday?

Not an expert on TA but exclusively trading in fo on your analysis and doing good

Thanks

thanks