Last week we gave Chopad Levels of 8499 ,Nifty opened gap down @ 8443 and did 3 target on upside rewarded Chopad followers . Lets analyze how to trade market in crucial RBI Policy week.

Nifty Hourly Chart

Nifty Hourly charts has broken on upside and above its 21/34 EMA, till 8380 is not broken hourly trend remains on upside.Resistance at upper side comes @8500

Nifty Hourly Elliot Wave Chart

Hourly charts if rising in abc pattern 8528 should be logical target.

Nifty Pyrapoint Analysis

As per Pyrapoint Analysis able to sustain above its 135 degree line, suggesting move towards its 90 degree line which lies near 8540 .Support @135 degree line @8400

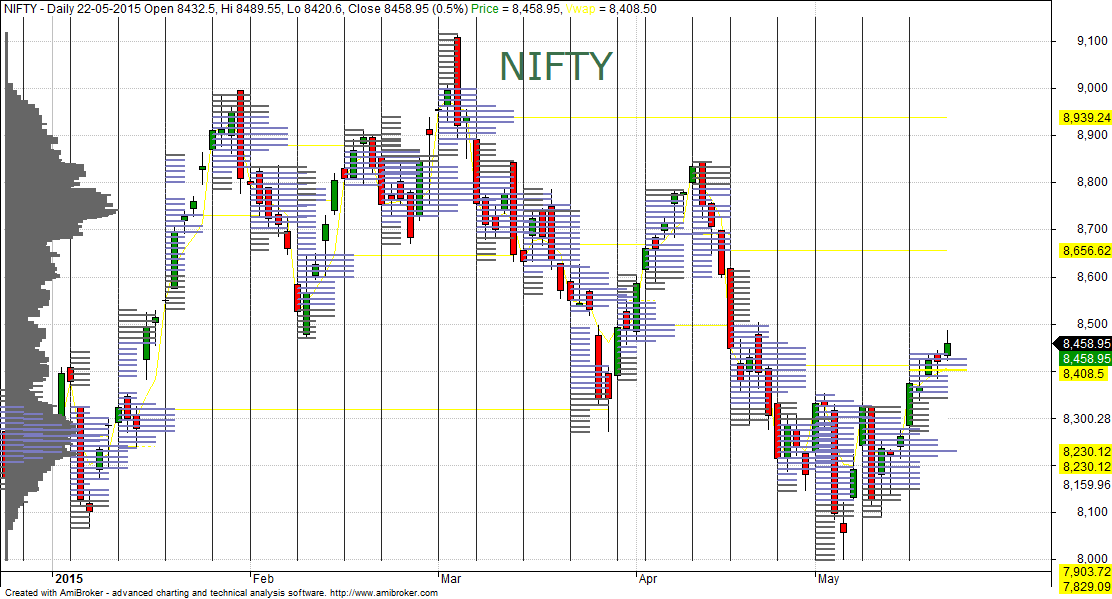

Nifty Market Profile

Nifty as per Market profile 8483 should be closely watched in coming week,8653 is target on upside and 8230 on downside if 8360 is broken.

Nifty Andrew Pitchfork

Bulls near Close above AF upper line for momentum to come, else will bear attack again and drag towards median line.

Nifty Gunner

Coming week if 8424/8400 is protected we are heading to 8560/8624 odd levels.

Nifty Harmonic

We have been discussing the same from past 3 weeks If butterfly pattern needs to form Nifty should bounce sharply in coming week till 8400/8600.

8400 done waiting for 8600

Nifty Daily Elliot Wave Chart

As per EW more legs are left to the rally use dips around 8000/7900 to take exposure to quality large and mid caps stocks. NO leveraged positions this for cash market traders.

Nifty MML

8592 is logical target as per MML. Support at 8280

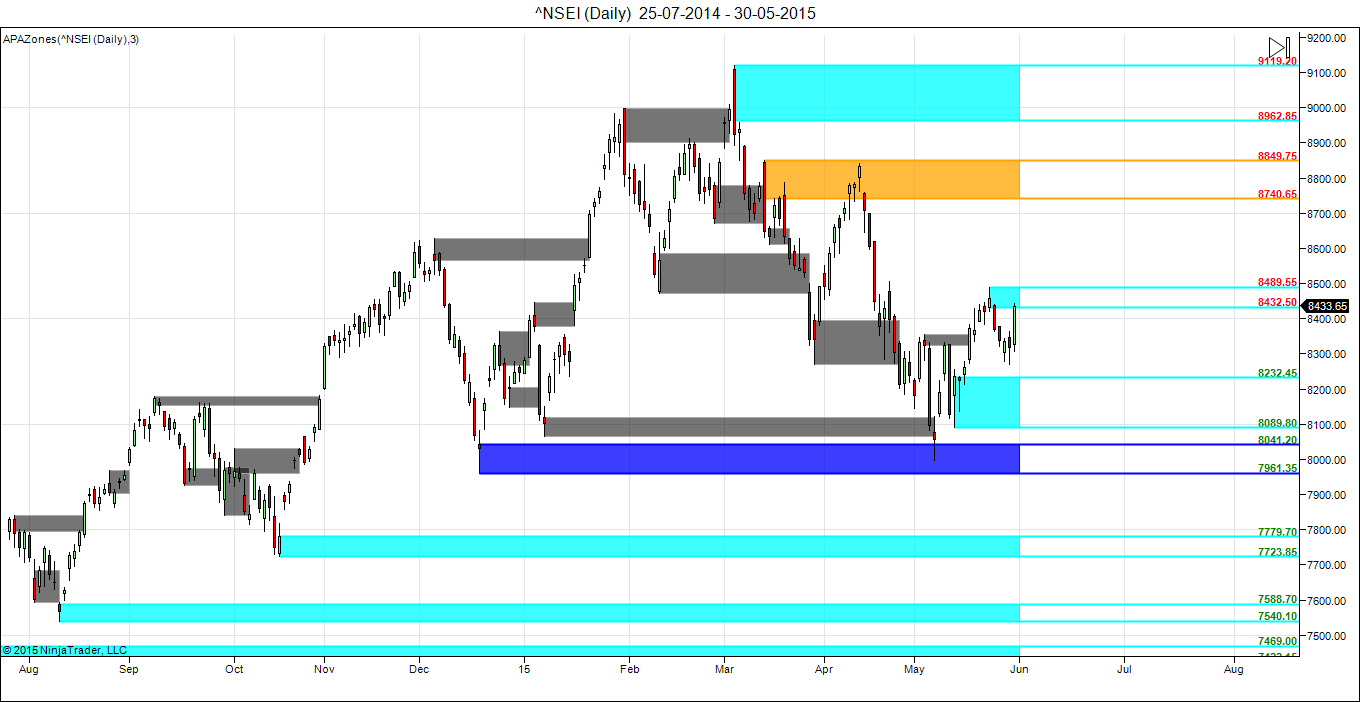

Supply Demand

Entering in Supply zone.

Nifty Gann Date

Nifty As per time analysis 02 June/05 June is Gann Turn date , except a impulsive around this dates. Last week we gave 26 May/28 May Nifty saw a volatile move .

Gann Emblem

3 June is Gann Emblem Date

Nifty Gaps

For Nifty traders who follow gap trading there are 14 trade gaps in the range of 7000-9000

- 7067-7014

- 7130-7121

- 7276-7293

- 7229-7239

- 7454-7459

- 7526-7532

- 7598-7568

- 7625-7654

- 7780-7856

- 7927-7974

- 8057-8089

- 8262-8271

- 8365-8391

- 8937-8891

Fibonacci technique

Fibonacci fan

Close above 38.2% retracement zone heading towards 50%

8521/8558 is 61.8% and 50% retracement number so keep a eye on this.

Nifty Weekly Chart

It was negative week, with the Nifty down by 25 points closing @8433 , and closing below its 20 WSMA and above its 50 SMA. Nifty Weekly formed hammer pattern on weekly charts. Breaking weekly high of 8489 nifty can move towards 8580 which is 20 WSMA, price action needs to closely watched. As per time analysis next cycle till 14 June will be neutral to bearish. Gunner weekly charts also suggests nifty unable to cross red arc can see pullback till 8400 odd levels.

Trading Monthly charts

After 2 months of bearish candle, May 2015 showed a positive candle. Although the body (Close–Open) of May 2015 was inside the body of April 2015, it is a ‘harami’ candle suggesting that a momentary halt to the fall on the monthly chart was witnessed.

Nifty PE

As per PE ratio has again up to 23.12, Result season is going bad unable to upgrade the earning can see nifty moving in bubble category.

Nifty Weekly Chopad Levels

Nifty Trend Deciding Level:8450

Nifty Resistance:8490,8558,8663

Nifty Support:8380,8321,8208

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Hello guys.. After policy review market will be down. But market may surprise if rbi cut rate by huge difference

99% are betting on a fall after this RBI related rally but market has a tendency to surprise the majority. keeping fingers crossed.

No naked shorting at this moment as market may give huge surprise on up move. Checked Nasdaq PE number and it is also 21.46 and surely we are far better market than US considering Rate rise in US and cut in our country. Earnings can improve significantly and market is forward looking. PE of 26 is quite possible (Target 9570)

Hi Bramesh Ji what is chances of 25% rate cut

I am not an Economist.

Dear bramesh

Supply and demand is not up to date.. ..?

Thanks its updated..

Rgds,

Bramesh

great stuff, am looking to sell a pre RBI rally on tuesday in the 8550-8570 zone, lets see how far this rally goes, new lows are likely after this move up completes.