Last week we gave the Chopad level of 18300 Bank Nifty achieved 3 target on upside rewarding discipline chopad followers .Lets analyze how to trade next week.

Bank Nifty Hourly

Bank Nifty broke its trendline and also closed below 21/34 EMA, suggesting fall till 18150/18100 is on cards. Bullish above 18550 only.

Bank Nifty Hourly EW Daily

Hourly Elliot wave analysis is shown, 18350 will play crucial levels next week.

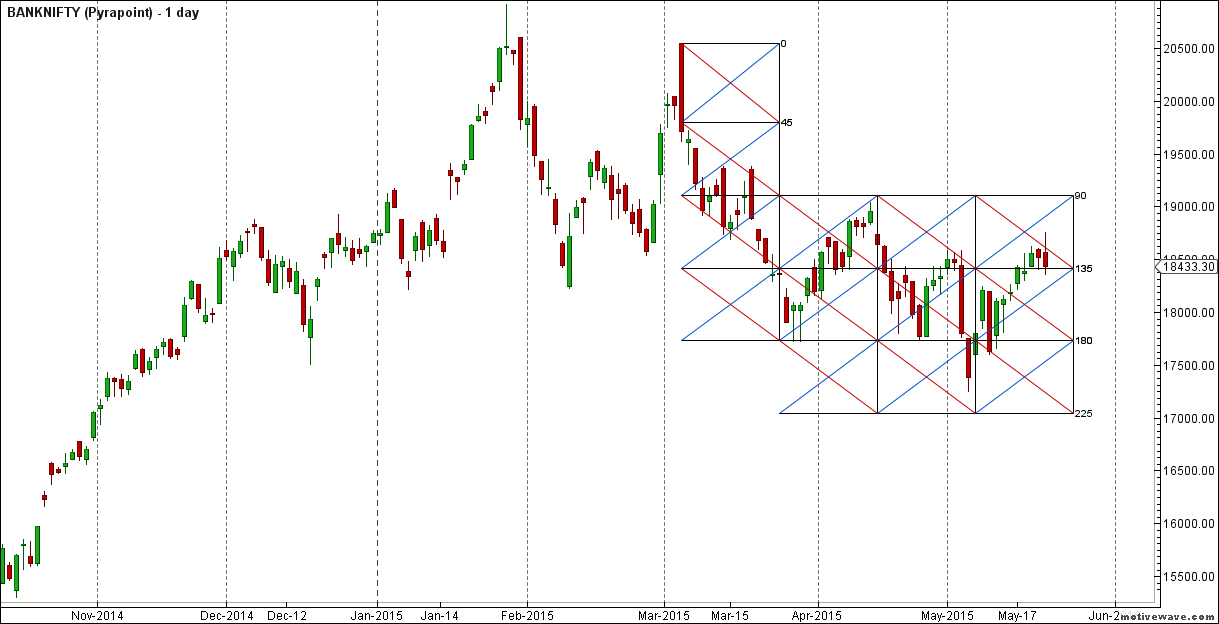

Bank Nifty Pyrapoint Indicator

Traded well in the range of Pyrapoint Analysis Support @135 degree line , resistance at 90 degree line.

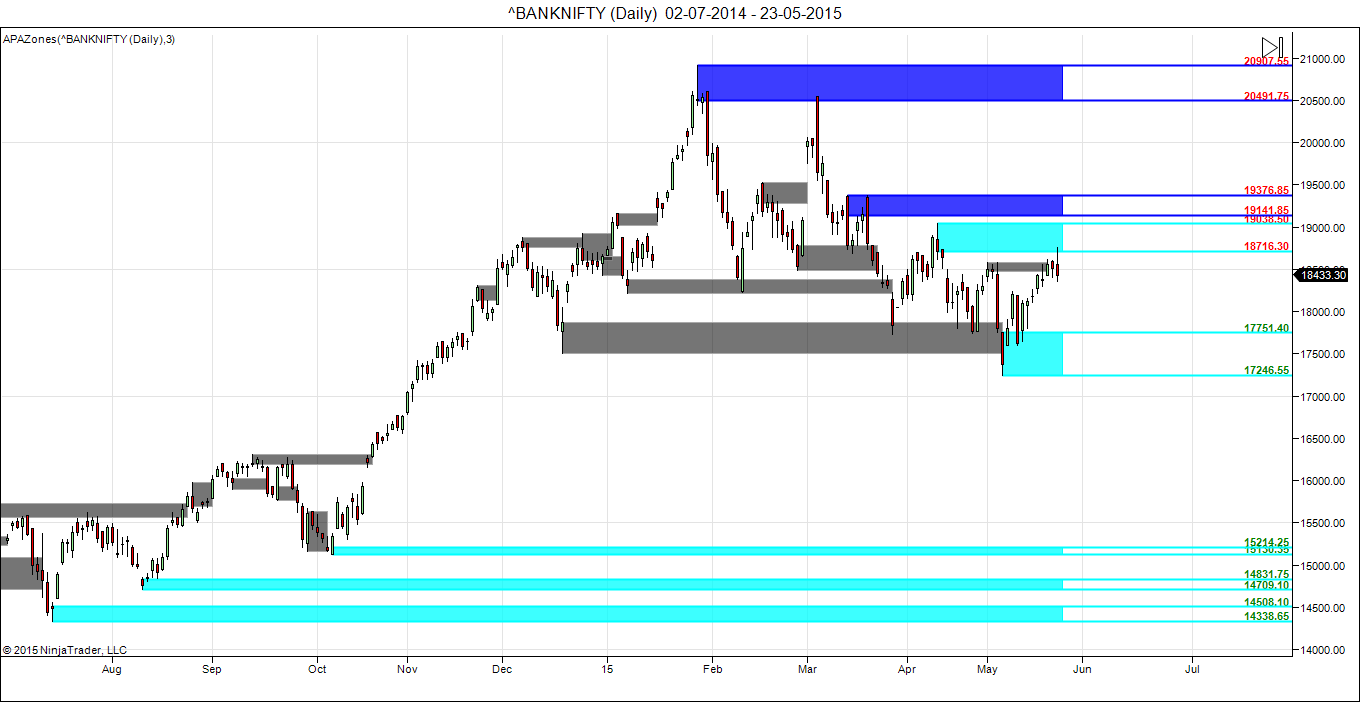

Supply Demand Zone

Self Explanatory chart depicting Supply and Demand zone. Rejected from demand zone and fall on 300 points 🙂

Bank Nifty Channel

100 DMA price again got rejected suggesting supply pressure on upside.

Bank Nifty Harmonic

As discussed in last week analysis Next round of up move above 18260 for 18500/18600.

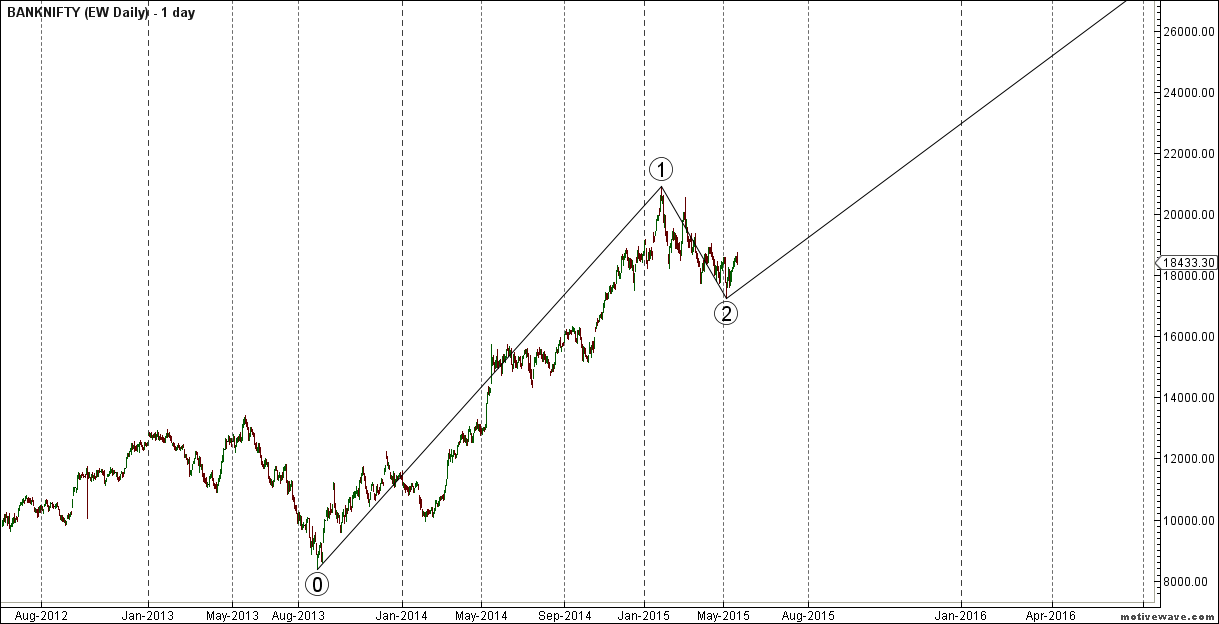

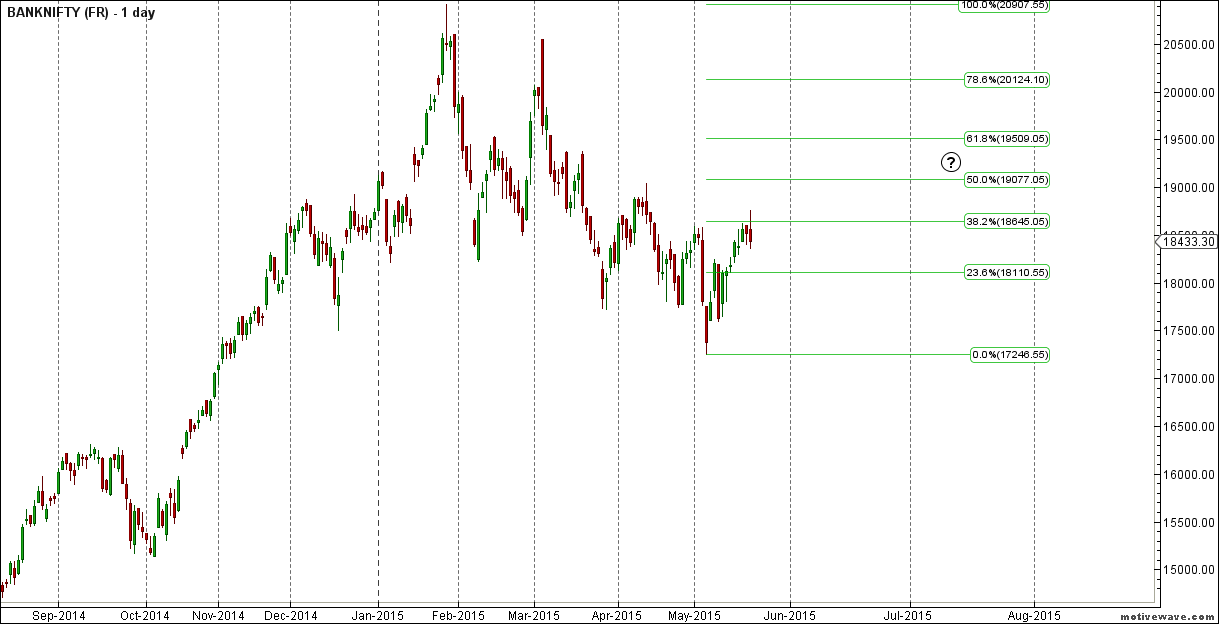

Bank Nifty EW Daily

Use dips to keep accumulation quality banking stocks. Long term targets are still pending as shown above.

Bank Nifty Daily Gunner

On Daily chart near important Gunner resistance @1*2 line,close above it will lead to trend change

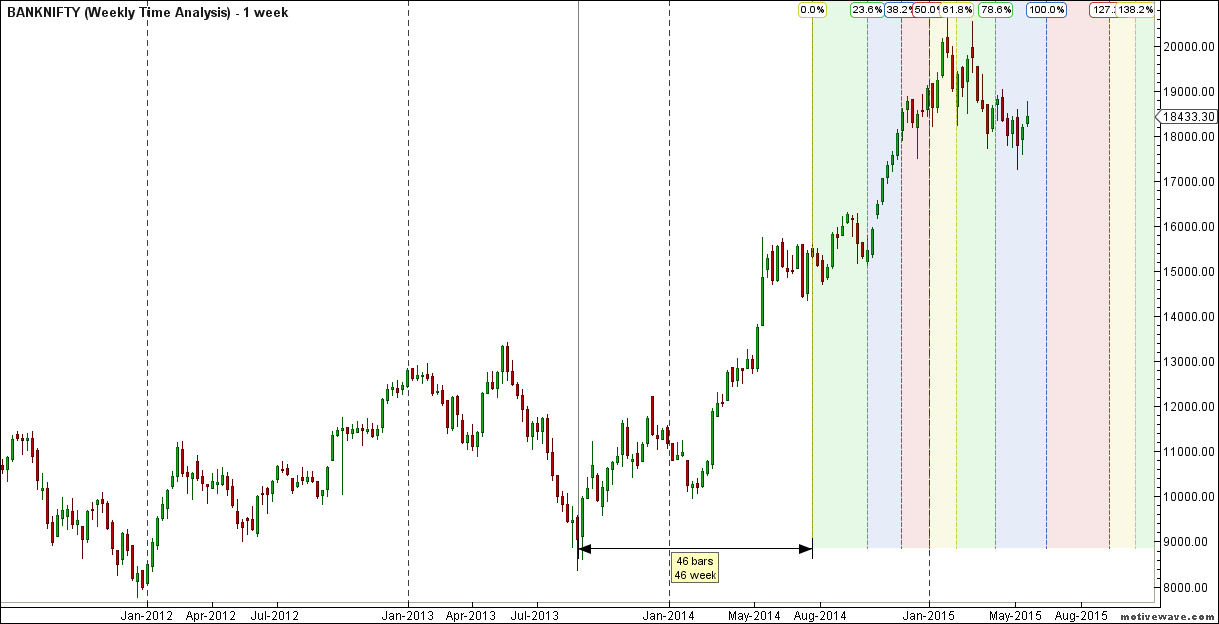

Bank Nifty Gann Dates

Bank Nifty As per time analysis 26 May/28 May is Gann Turn date , except a impulsive around this dates. Last week we gave 18 May/22 May and Bank Nifty saw a volatile move on both the days .

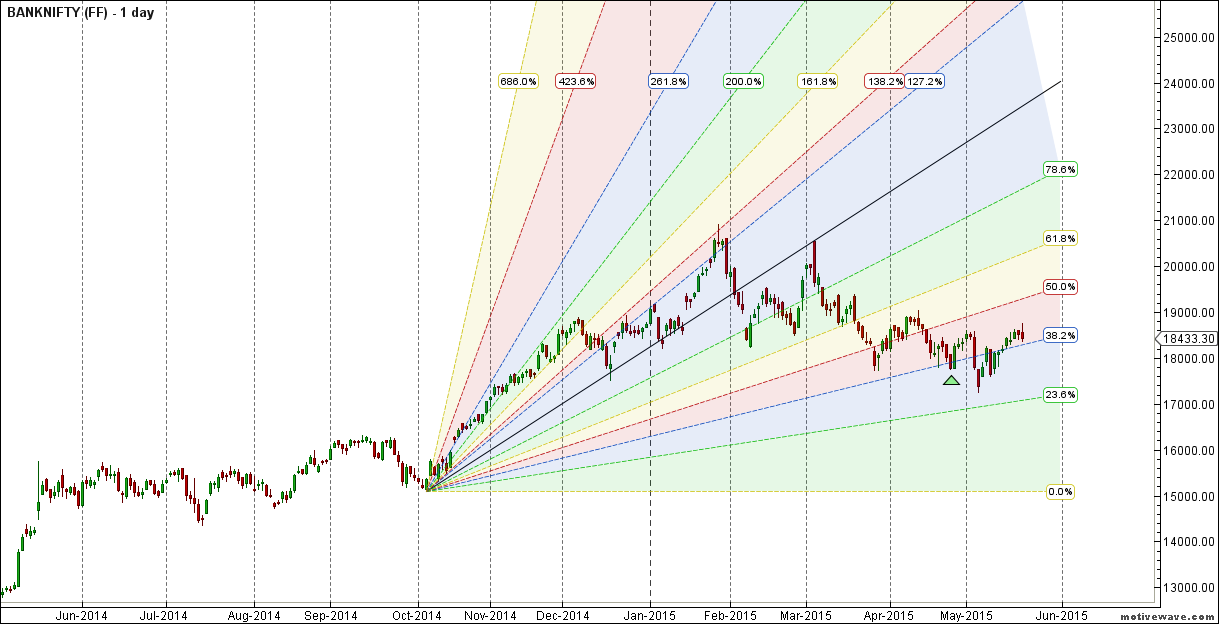

Fibonacci technique

Fibonacci Fans

Close near its 38.2 % retracement as per FF

38.2/50 % number is 18505/18894 should be watched.

Bank Nifty Weekly

It was positive week, with the Bank Nifty up by 250 points closing @18433 , price again got rejected near its 20 WSMA and holding 50 WSMA .Bulls will get momentum above 20 WSMA only support at 18000 range. We are in neutral to negative time cycle till 14 JUne.

Bank Nifty Weekly Gunner

Bank Nifty Monthly

Bank Nifty On Monthly chart prices got reject on higher end of Fibonacci channel now held the 78.6% retracement.

Bank Nifty Weekly Chopad Levels

Bank Nifty Trend Deciding Level:18426

Bank Nifty Resistance:18556,18686,18816

Bank Nifty Support:18296,18166,18036

Levels mentioned are Bank Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

I think there is major resistance in the 18,600 zone, major underperformance friday after the SBI results, will take down the rest of the market with it soon i think, looking or a nifty top between 8530 and 8570.

Thanks !!