- FII’s sold 28.7 K contract of Index Future worth 752 cores,18.1 K Long contract were squared off by FII’s and 10.6 K short contracts were added by FII’s. Net Open Interest decreased by 7.5 K contract. So You Want To Trade For A Living?

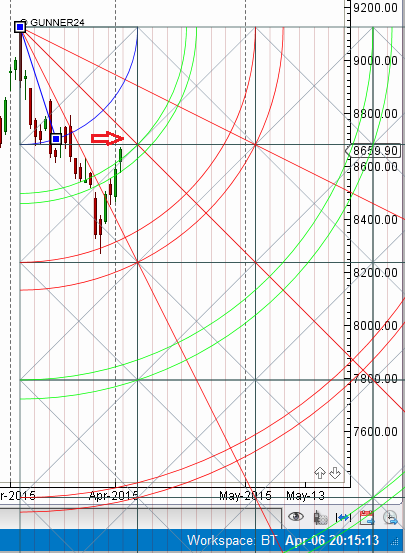

- Nifty continued with its rally and is now near its 38.2 % retracement level as discussed in Nifty Weekly Analysis Also as per Gunner we are near the trend change point as seen in below chart. So next 2 days price action will suggests are we heading for higher levels or will see some pullback. Pyrapoint Analysis also suggests 135 degree line @8673/8693 range will be trend deciding level for RBI day. Looks for spike near 50 SMA @8723 levels if unable to sustain can show pullback of 50/80 levels from highs.

- Nifty April Future Open Interest Volume is at 1.86 core with liquidation of 3.7 lakhs with decrease in cost of carry suggesting long position got closed in today. Net OI is decreased 32.3 lakhs in 5 trading sessions.Nifty Future are near its rollover range of 8630 suggesting now OI is neutral and RBI decision will affect the next market move for the series.

- Total Future & Option trading volume was at 1.53 core with total contract traded at 3.5 lakh. PCR @0.96 suggesting sentiments is turning bullish. Rise in past 4 sessions is accompanied by fall in volumes.

- 8800 CE OI at 33.3 lakh , wall of resistance @ 8800 .8300/8600 CE saw liquidation of 3.6 lakhs ,so bears have covered allcovering their position which were added in past 3 sessions . FII bought 61.6 K CE longs and 5.8 K CE were shorted by them.

- 8400 PE OI@ 40 lakhs so strong base @ 8400. 8600/8700 PE added 11 lakh so bulls are making position for higher levels. FII bought 5.3 K PE longs and 14.4 K PE were shorted by them.

- FII’s bought 936 cores in Equity and DII sold 170 cores in cash segment.INR closed at 62.18.

- Nifty Futures Trend Deciding level is 8646 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8537 and BNF Trend Deciding Level 18647 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18388 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8668 Tgt 8693,8727 and 8760 (Nifty Spot Levels)

Sell below 8630 Tgt 8600,8573 and 8540 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

sir

Recently i saw bearish engulfing in monthly chart in march,, high of market was 9119 and resent low was 8270 means total 849 points , after RBI policy market make high 8694 that is 50% retracement from low (8270+424= 8694) and stochastic 70%…means space for upside is 100 point more up to 8794 and after 100point retracement will be 61.8% and stochastic will 95%….do u think after above condition market will be correct ???????

Nope they are not correct

Thank you Mr.Bramesh, keep it up…..

Thanks.

Great input, reading every day. Thank you

Hi Bramesh brought huge quantity of Put option 8300 and 8400..how the market will react

Can see pullback if RBI disappoints.

your risk management matters ; “market can go in any direction” – Please keep this point always

sir ..before we were able to zoom the charts by clicking on it.but now the feature is not there

Try now should be working now.