BHEL

Holding 254 stock is heading back to 267/288.

Intraday traders use below mentioned levels

Buy above 258 Tgt 262,265 and 269 SL 255

Sell below 253 Tgt 251,246 and 240 SL 255

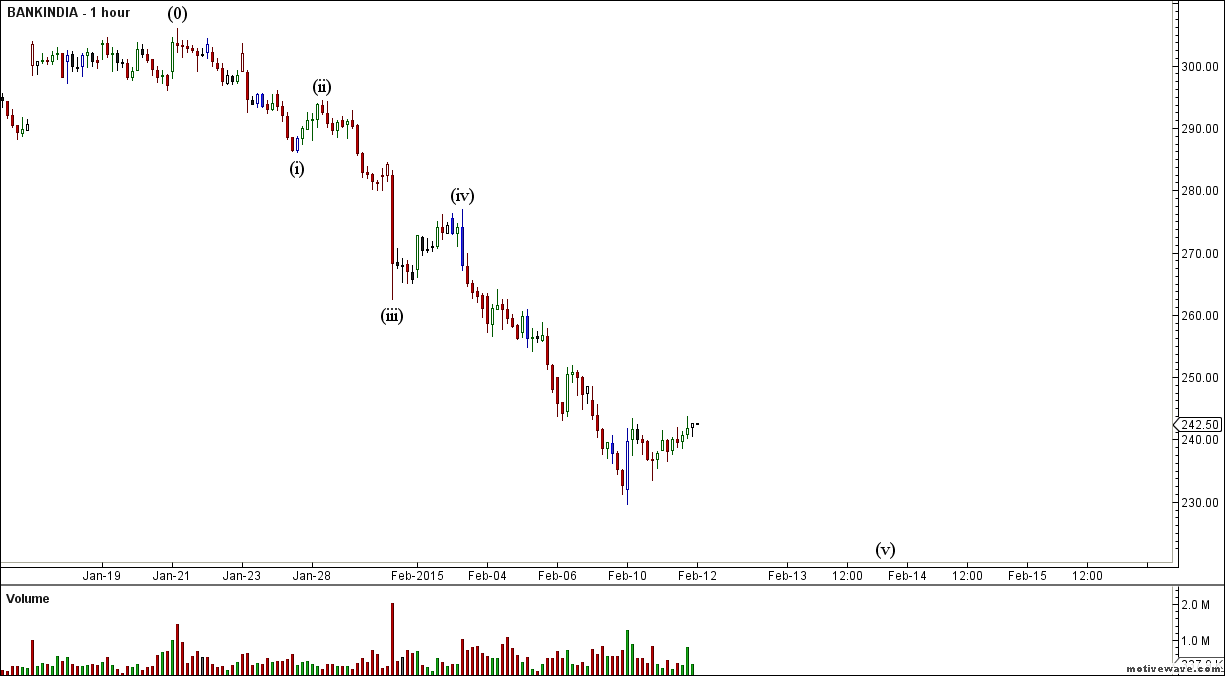

Bank India

Closing above 242 stock is heading to 246/254 and 267 in short term, Any close below 238 short term target 233/228

Intraday traders use below mentioned levels

Buy above 242 Tgt 244.5,247.7 and 251.8 SL 240

Sell below 237 Tgt 233,230 and 225 SL 240.5

Cipla

Intraday traders use below mentioned levels

Buy above 641 Tgt 645,650 and 660 SL 635

Sell below 631 Tgt 626,621 and 615 SL 635

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for January Month, Intraday Profit of 2.04 Lakh and Positional Profit of 5.12 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Please also read the detailed Disclaimer mentioned in the Right side of Blog.

The post given here are My Personal views and for learning purpose, trading or investing in stocks is a high risk activity. Any action you choose to take in the markets is totally your own responsibility. I will not be liable for any, direct or indirect, consequential or incidental damages or loss arising out of the use of this information.

Sir,

I am an ardent follower of your write ups.

I may be wrong but could not resist asking you that ur wave count for Bank of India and Cipla is wrong. What I have learned till till date is that wave 3 is the longest.

And please suggest when to count 12345 and when to count abc because i do understand impulsive and corrective moves but still i hae observed people using it at their comfort/or confusing. Why and when do v count 12345 in a corrective wave??

Please comment and share ur expertise.

Rgds

Arun Singh

EW is very subjective topic and i trade on my modified rules.

Rgds,

Bramesh

Hello Sir, i make good profit in BHEL today, as an intraday…. Thanks

Hi Bramesh,

BHEL positional call is active …though 267 achieved second target 288 was pending…..BHEL posted some ugly numbers post market hours today …

what do you think should be done if BHEL opens gap down tomorrow? Bad results already factored in??

Regards,

Sachin

Follow the levels.

Sir, I bought Bank of India shares@228.50 for short term purpose.after 3 days where it will reach.