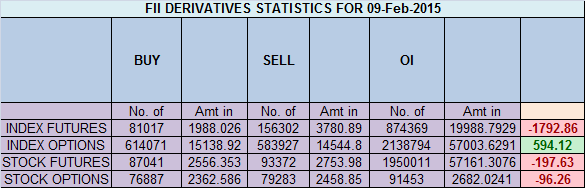

- FII’s sold 75.2 K contract of Index Future worth 1792 cores, 29.2 K Long contract were squared off by FII’s and 46 K short contracts were added by FII’s. Net Open Interest increased by 16.8 K contract ,so FII’s squared off long in Index Futures and added huge shorts in index futures.

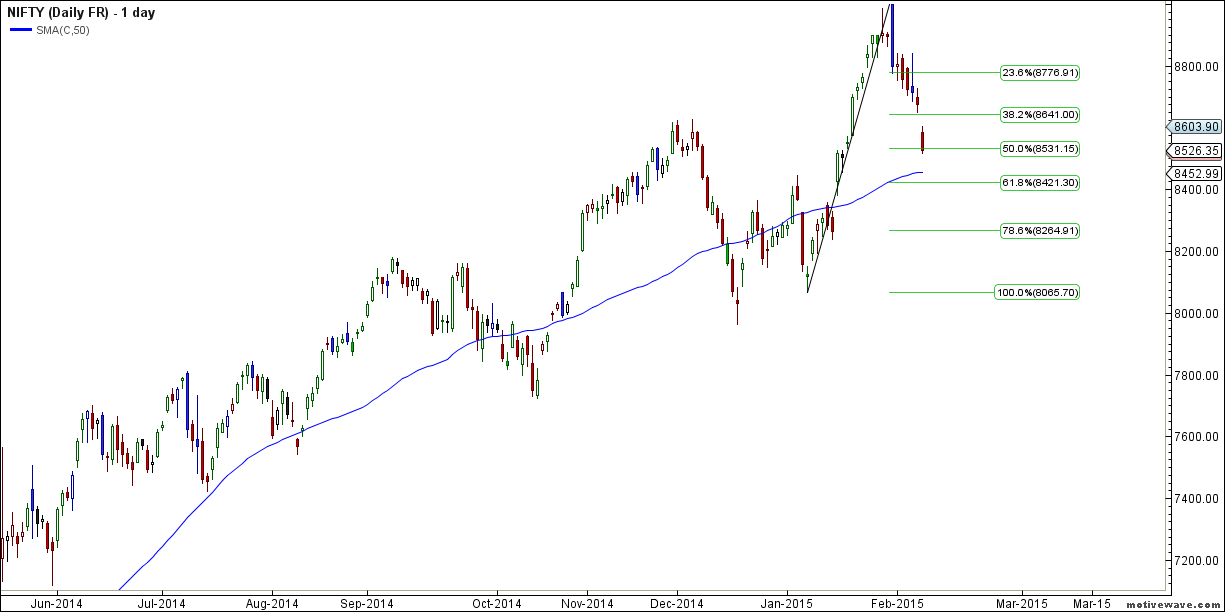

- Nifty corrected for seventh day in a row with correction of 520 points and Bank Nifty has corrected 2500 points, Fall has been in straight line and its first time after 2000 when Nifty has corrected 7 days in a row. As per Gann Analysis 10/11 Feb are very important date and sharp and swift reversal should be seen in next 2 sessions. Greece Worries, Delhi election results and Bad Results are spooking the market, use these dips to start getting exposure to quality large and mid caps stocks.

- Nifty Future Feb Open Interest Volume is at 2.48 core with liquidation of 1.5 lakhs so long liquidation seen with fall in Cost of Carry.

- Total Future & Option trading volume was at 1.94 core with total contract traded at 4.7 lakh. PCR @0.78, again at lower end of range so expect relief rally soon.

- 9000 CE OI at 58.9 lakh so wall of resistance @ 9000 .8400/8900 CE added 11.9 lakhs and 40 lakhs in 3 days so bears are holding shorts , and creating resistance at higher levels. FII sold 25.2 K CE and 24.1 K CE were shorted by them.

- 8300 PE OI@ 40.4 lakhs so strong base @ 8300followed by 8500. 8600/8800 PE saw liquidation of 9.8 so bulls have started panicking and are losing ground to bears. FII bought 124 K PE and 44.7 K PE were shorted by them.

- FII’s sold 660 cores in Equity and DII bought 496 cores in cash segment.INR closed at 62.16.

- Nifty Futures Trend Deciding level is 8600 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8812 and BNF Trend Deciding Level 18616 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 19077.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8550 Tgt 8580,8605 and 8638 (Nifty Spot Levels)

Sell below 8516 Tgt 8493,8460 and 8420 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Sir you are absolutely creckt oi in option call nd put saying a sarp bounc back about to come in 2 or 3 days

retracement will start only if nifty closes above 8600

Dhananjay people are fearful to lose their profit so the shorts will be covered at the small upturn to book profit which will lead to further profit booking as fear of losing profit will increase ….

Gann and tech analysis captures this statistical phenomenon …

Fii’s data need not to look at current scenario, they can cover all shorts in minutes,

Hi, can you explain why we can expect a turn in 2 days. As you said bulls are closing their positions then why it will swing back. Fibonacci 61% is near so that can be the turning point but looking at fii data it may go down to 100% also.

Intention of this question is to learn. Nothing else.