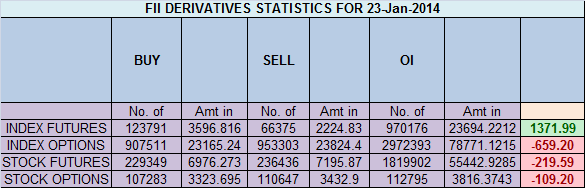

- FII’s bought 57.4 K contract of Index Future worth 1371 cores, 61 K Long contract were added by FII’s and 3.6 K short contracts were added by FII’s. Net Open Interest increased by 64.7 K contract ,so FII’s added long in majority and added partial shorts in index future.

- Nifty made new life high today @ 8866 with another DOJI candlestick formation, as per my perceptive last rally we saw from 7723 to 8627 was 904 points long and took 33 days to complete, the current rally which started from 7961 till 8866 is now 905 points which is equal to last rally and consumed 27 days and also the maximum rally we have seen in 1041 points so still there is room for upside. Nifty is trading well above its 34 HEMA@ 8774 so till its held bulls are in control. But one caution sign is momentum has slowed down considerably in past 3 session Reduction in the same exhibits alarming signal which warns that the current trend is into its last stages and it’s the time to pack up the profits.Also max correction we have seen is 88 points so if pullback in this range use this to buy. As i always say do not try to pick tops and bottom, go with the trend. As Monday is trading holiday and Greece election results on weekend so expect another gap up/gap down opening on Tuesday.

- Nifty Future Jan Open Interest Volume is at 2.27 core with addition of 0.98 lakh in OI, fresh long addition seen.

- Total Future & Option trading volume was at 3.51 lakh core with total contract traded at 4 lakh. PCR @1.34 this shows excessive bullishness caution advised on longs with strict SL.

- 9000 CE OI at 43.9 lakh so wall of resistance @ 9000 .8400/8700 CE saw huge liquidation of 21.8 lakhs so bears continued with their covering of Calls. FII bought 9.9 K CE and 25.2 K CE were shorted by them.FII’s have started shorting CE so cautious on longs.

- 8700 PE OI@ 46.5 lakhs so strong base @ 8700. 8800/8700 PE added 21 lakh in OI so bulls are preparing ground for further assault and climbing over 8900. FII sold 11 K PE and 19.4 K PE were shorted by them.

- FII’s bought 2019 cores in Equity and DII sold 1299 cores in cash segment.INR closed at 61.43.

- Nifty Futures Trend Deciding level is 8844 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8716 and BNF Trend Deciding Level 20115 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 19813.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8840 Tgt 8860,8888 and 8920 (Nifty Spot Levels)

Sell below 8820 Tgt 8795,8761 and 8727 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

From T.Srinivas: Sir, Your site is not updated tll now? Sir, hope you are fine !

All is well Thanks for your concern.

RGds,

Bramesh

FII’s can invest another 2000 cr in this series nifty may se around 9000

Bramesh sir I fallow your 3 stock daily from 3 trading sasiton nd some erning daily your prediction is good I watch both label buy nd sale then trade any side I hats of you

Please have a look at hourly rsi….seems divergence is there

Thank u sir for information which is excellant for investor/traders

Excellent analysis. I have one doubt . How can I find huge short positions (by fii’s or professional traders) in options .Will VWAP reflect it. Pl, guide me. That’ll use to find the trend of stocks or indices.. Thanks in advance…