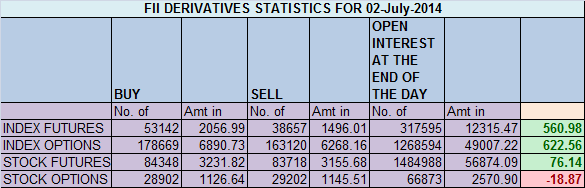

- FII’s bought 14.4K contract of Index Future worth 560 cores, 22.5 K Long contract were added and 8 K short contracts were added by FII’s.

- Nifty made a fresh life high today, this is the 3 gap in 3 days, things looks overdone in extreme short term and market will consolidates its gains, Any break below 7677 can lead to a swift fall till 7634 odd levels. Volumes are not supporting this rise.

- Nifty Future July Open Interest Volume is at 1.45 cores with addition of of 9.1 lakhs in Open Interest, suggesting long addition.

- Total Future & Option trading volume at 1.26 lakh core with total contract traded at 2 lakh. PCR @0.86. PCR cooled off suggesting call writing at higher levels.

- 8000 CE OI at 67.8 lakh saw addition of 5.2 lakh so speculative buying started in 8000 CE keeping pre budget rally in mind, 7800/7900 CE saw no major addition suggesting highs will not be sustained . FII’s bought 23.8 K CE longs and 17.7 K CE were shorted by them.

- 7500 PE OI at 41.6 lakh saw addition of 7.5 lakh so support of 7500 looks strong, 7600 PE also added 9.3 lakhs suggesting support is rising up. FII’s bought 13.2 K PE longs and 3.8 K PE were shorted by them. Looking at option data FII are planning to go in budget session fully hedged.

- FIIs bought 1290 cores in Equity and DII sold 407 cores in cash segment.INR closed at 59.7.

- Nifty Futures Trend Deciding level is 7733 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7621 and BNF Trend Changer Level (Positional Traders) 15340 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7730 Tgt 7745,7766 and 7800 (Nifty Spot Levels)

Sell below 7710 Tgt 7690, 7677 and 7585 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates