Last Week we gave Chopad level of 6873, Nifty did all 7 target on upside giving 633 points to trend follower .Lets analyze how to trade Nifty before the Lok Sabha election results.

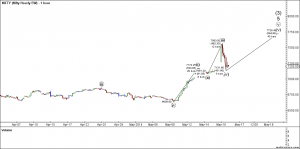

Nifty Hourly Chart

Nifty Hourly charts are trading in expanding triangle range, spurt up and than cool off and finally closing the gap. Holding 7121 is bullish in short term.

Nifty Elliot Wave Analysis

As per EW analysis it shows short term correction is over till 7121 is not broken and bounce back till 7726 is on cards.

Nifty Daily Chart

Nifty took perfect support at gann arc as shown above and bounce back heavily, Short term target as per gann arc come at 7684.

Nifty Gaps

For Nifty traders who follow gap trading there are 7 trade gaps in the range of 5300-6400

- 5285-5303

- 5448-5553

- 5680-5700

- 5780-5802

- 6091-6108

- 6328-6339

- 6401-6413

- 6493-6510

- 6641-6643

- 7130-7121

Fibonacci technique

Fibonacci fan

As per Fibonacci Arcs using gann angles target bullish move only above 7246

As per Fibo retracement ,only a close below 50% retracement of 7107 will be bearish in short term

Nifty Weekly Chart

It was positive week, with the Nifty up by 344 points closing @7203. As per Andrew Pitchfork nifty can again move back to median line. Weekly charts are still in positive quadrant as shown in below chart.

Trading Monthly charts

Monthly chart gives a target of 7800 for short term as per Fibo ratio theory

Nifty Weekly Trading Levels

Nifty Trend Deciding Level:7246

Nifty Resistance:7376,7506,7636

Nifty Support:7210,7121,7067 and 7014

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

would it be better if I square it off right now and buy CE 8000 JUN EXPIRY @ Rs 12 for 1000 qty

Yess

Rgds,

Bramesh

Hi

I bought Nifty CE 8200 10000 qty

at Rs 10, now it is priced @ Rs 1 is there any chance of retracement

Nope

Rgds,

Bramesh