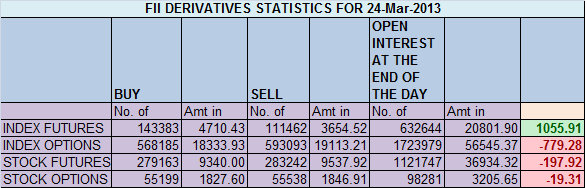

- FIIs bought 31921 contracts of Index Future worth 1056 cores (54.5 K Long contracts were added and 22.3 K short contract were added) with net Open Interest increasing by 76.9 contracts, so FII’s added both longs and shorts in Index Futures.

- Nifty made a new life high again today 6591,lead by banks.Advance decline was negative which means that in spite of markets closing at a new high, most stocks actually closed in the red. Nifty is near its trendline resistance also. Range of 6600-6620 is crucial resistance zone,hence unable to cross we may see a pullback in market. Nifty has rallied 638 points and the trend is now 30 days old, suggesting things looks overdone and a pullback is very much on cards.

- Nifty Future March Open Interest Volume is at 2 cores with addition of 3.9 lakhs in Open Interest,so addition of longs.

- Total Future & Option trading volume at 2.06 lakh with total contract traded at 2.4 lakh , PCR (Put to Call Ratio) at 1.07,Cash market volumes were subduded suggesting rise was backed by short covering only.

- 6600 Nifty CE is having highest OI at 57.5 lakhs , is having the highest OI and resistance for the market,6500 CE saw liquidation of 10.9 lakh suggesting panic in bear camp ,6300-6700 CE liquidated 19.8 Lakh in OI.FII’s sold 15.3 K contract of CE and 8.6 K CE were shorted suggesting rise was used by FII’s to exit Call options not a bullish sign.

- 6400 PE is having highest OI at 68.1 lakh with addition of 10.6 lakhs , 6500 PE added 8.4 lakhs,suggesting bulls wants to hold 6500, Huge addition of 32.3 lakhs in 6600 PE shows overconfident bulls and expiry should happen below 6600. 6300-6600 PE added 42.9 Lakh in OI .FII’s bought 7.7 K contract of PE mostly in 6600 PE and 8.6 K PE were shorted mostly in 6400 and 6500 PE.

- FIIs bought 1465 cores in Equity and DII sold 770 cores in cash segment.INR closed at 60.8 lowest in 8 months.

- Nifty Futures Trend Deciding level is 6590 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6458 and BNF Trend Changer Level (Positional Traders) 11700 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6593 Tgt 6615 ,6635 and 6650 (Nifty Spot Levels)

Sell below 6580 Tgt 6563,6540 and 6520 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

Please explain how advance decline is negative. I checked on the NSE and for nifty50 advance/decline is 41/9.

Overall A/D was negative which incluse small and mid caps

Hi bramesh. good article. have a query. you have mentioned “6500 CE saw liquidation of 10.9 lacs suggesting panic in bull camp”. could this not be short covering by call writers?.

Hi Jay,

Your understanding is correct