- FIIs bought 33796 Index Future worth 1030 cores with net Open Interest increasing by 69450 contracts.FII’s went long in Nifty Futures and shorts were covered in Bank Nifty futures. Are you suffering from Fear of losing in Trading?

- Sensex closed at 2.5 Year high today, Nifty opened with a gap of 30 points and entered in the resistance zone and closed exactly at 6077 keeping market participants in state of confusion. As discussed in Weekly analysis Nifty will find it difficult to cross the range of 6077-88,Nifty Spot today made the high of 6093 and turned back. Traders trading based on Price Action Strategy can again part book in range of 6077-90. As per data analysis Nifty should show a range expansion in next 2 session. Traders Worst Enemy

- Nifty Future July Open Interest Volume is at 1.18 cores with liquidation of 22.4 lakhs in Open Interest, Rollovers have started taking place and whole 22 lakhs got rollovered in Aug series, and another 20 lakh addition mostly long with huge increase in CoC.

- Total Future & Option trading volume at 1.75 lakh with total contract traded at 2.37 lakh , PCR (Put to Call Ratio) at 1.26, .VIX trading at 16.72 falling down once it broke the rising trendline and gave an early indication of impending rally.

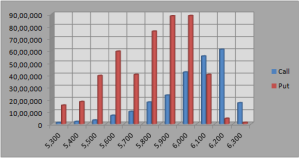

- 6200 Nifty CE is having highest OI at 60.9 lakhs with addition of 2.7 lakhs in OI, speculative money entering 6200 CE. 6100 CE liquidated 4.2 lakh in OI and having second highest OI at 55.4 lakh. 6000 CE liquidated 15 lakh in OI suggesting Expiry happening above 6000. 5900-6200 CE liquidated 21.2 lakh in OI.

- 6000 PE OI at 88.6 lakh remain the highest OI , remains strong support for market and expiry should happen above 6000. 5.1 lakh addition was seen in 6100 PE suggesting bulls are eying higher levels and preparing for final onsalught.5900-6200 CE added 8.4 lakh in OI suggesting bullishness

- FIIs bought in Equity in tune of 211 cores ,and DII bought 61 cores in cash segment ,INR closed at 59.72.

- Nifty Futures Trend Deciding level is 6099 (For Intraday Traders).Nifty Trend Changer Level 5910 and Bank Nifty Trend Changer level 11390.

Buy above 6094 Tgt 6110,6130 and 6155(Nifty Spot Levels)

Sell below 6075 Tgt 6060,6045and 6025(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863