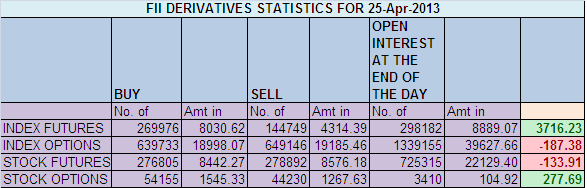

- FIIs bought 125227 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 3716 cores with net Open Interest decreasing by 102440 contracts.Worlds Best Technical Analyst

- NS closed at 6 weeks High 5916 after making high of 5925 and low of 5854, Nifty Opened Gap up but did gave a dip till 5854 near to our buying level of 5856 and gave a sharp rally in last 30 min of trade. As discussed yesterday expiry will be volatile due to Inside Day Candel formation hope traders were able to monetize on volatility. Next all important resistance zone comes in the range of 5945-5972. We have Weekly closing tommrow and Bulls will try to close Nifty above 5900.

- Nifty Future May Open Interest Volume is at 1.50 cores with addition of 60 lakh in Open Interest with fall in Cost of Carry of Nifty Future to showing traders are closing short position positions .Nifty Future April and Nifty Future May Premium difference is Just 5 points instead of usual price difference of 35-50 points suggesting we can see a pullback in last 3 days of April Month.

- Total Future & Option trading volume at 3.17 lakh Cores with total contract traded 3.3 lakh , PCR (Put to Call Ratio) at 1.17 and VIX crashed to 14.2

- 5900 Nifty CE is having highest OI at 41.6 lakhs with addition of 4.3 lakhs in OI , 6000 CE added 8.6 lakhs in OI remains the wall of resistance.5500-6200 CE added 45 Lakhs in OI

- 5800 Put Option is having highest Open Interest of 48.6 lakhs with addition of 24.8 lakhs in OI ,5700 PE added 18.8 lakhs and net OI at 45.6 lakhs so 5800 should give a strong support to Nifty. Still no major addition in 5900 PE suggesting 5900 can break and we can see a pullback.5500-6200 PE added 85 Lakhs in OI

- FIIs bought in Equity in tune of 1449 cores,and DII sold 1269 cores in cash segment ,INR closed at 54.1 Live INR Chart for market hours and currency traders

- Nifty Futures Trend Deciding level is 5935 (For Intraday Traders).Nifty Trend Changer Level 5911 and Bank Nifty Trend Changer level 12684

Buy above 5925 Tgt 5943, 5972,6000(Nifty Spot Levels)

Sell below 5895 Tgt 5872,5854 and 5830(Nifty Spot Levels)

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Sir

what about nifty gap it formed today 5837-5853 if it breaks 5900 tomorrow it will again come down to fill gap in order to move up.

Thanks

Sumit