For the reference of readers i have made the performance sheet for the Month of March Expiry, can be accessed from http://tradingsystemperformance.blogspot.in/ .

- Calculation are based on trading with 1 lot of Stock Futures

- Rs 100 is deducted as Brokerage and Taxes

DLF

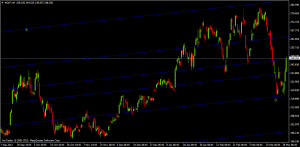

DLF share we analyzed on 25 March stating bottom should be made near 227-225 odd range, Stock rallied 25 march unable to sustain higher levels again revisited the low of 227.9 formed double bottom and also took support at fibonnaci channels and rallied as expected came in today.Above 254 rally can further continue till 261-64 range.

DLF share we analyzed on 25 March stating bottom should be made near 227-225 odd range, Stock rallied 25 march unable to sustain higher levels again revisited the low of 227.9 formed double bottom and also took support at fibonnaci channels and rallied as expected came in today.Above 254 rally can further continue till 261-64 range.

Buy above 254.5 Tgt 257.5,259.5 and 263 SL 252.4

Sell below 250.7 Tgt 248,245.5 and 242 SL 252.4

Cairn India

Cairn is trading in a perfect down trending channel,and is giving pullback after touching the bottom of channel. Stock is near important falling trend line resistance of 287.

Buy above 287 Tgt 290,294 and 298 SL 285

Sell below 282 Tgt 279.5,277.8 and 274.5 SL 285

Bajaj Auto

Bajaj Auto is forming a perfect symmetrical triangle which will soon give a breakout, stock has formed an Inside day candelstick today, giving hints of a possible breakout move in next 2-3 trading session,

Bajaj Auto is forming a perfect symmetrical triangle which will soon give a breakout, stock has formed an Inside day candelstick today, giving hints of a possible breakout move in next 2-3 trading session,

Buy above 1790 Tgt 1818,1833 and 1852 SL 1780

Sell below 1770 Tgt 1761,1754 and 1741 SL 1780

- All prices relate to the NSE Spot

- Calls are based on the previous trading day’s price activity.

- The call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Dear Mr. Bramesh,

Thanks for your articles.

I have doubt about calculation of profit in your blog for the swing calls in March.

You have taken targets achieved as 1st, 2nd and 3rd. In reality no one knows whether after achieving target 1, they may not be sure of target 2 or 3 getting achieved. Hence it is not correct to calculate the maximum target achievement without any basic formula for exit.

Dear Selvaraj,

As an amateur not knowing the strategist yes i agree its not possible to know to book profit at 1 or 3 tgt but i am calculating profit as per my trading strategy we are pretty sure where to book profit. Secondly if you see the results closely the day even 2 tgt is missed by 1 points i have taken only 1 tgt as profit booking.

My basic aim of showing and sharing the sheet is to make traders aware profit can be made even if you book at 1 tgt only .

Hope it helps!!

Rgds.

Bramesh