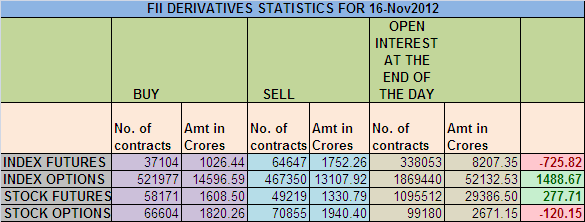

1. FII sold 27543 Contracts of Index Future,worth 725 cores with net OI decreasing by 30715 contracts.

2. As Nifty Future was down by 68 points with Open Interest in Index Futures decreasing by 30715, so FII booked profits in shorts created in Nifty and Bank Nifty Futures.NF closed at 2 months low after Fridays fall. What an irony from few point away to 52 week high 1 week before and we are now trading at 2 months low 🙂

3. NS closed at 5574 after making a high of 5560 and low of 5559.So we broke the swing low of 5585 and many stop loss got triggered and we had that fast fall till 5559. Gap exists till 5554 so still 5 points are there to be filled.

4. Resistance for Nifty has come up to 5589 and 5615 which needs to be watched closely ,Support now exists at 5554 and 5527.Trend is Sell on Rise till 5679 is not broken on closing basis.

5. Nifty Future November Open Interest is at 1.5 cores with liquidation of 19 lakh in OI,shorts booked profits NF. Cost of Carry of NF has come in negative first time in series to -2.04 and NF premium being 6 points.Here i would like to point i have discussed before the excessive high premium of NF in Nov series in tune of 40-50 points always lead to such falls and hence caution was the need of hour even though bullish voices coming out of market.

6. Total F&O turnover was at 1.29 lakh Cores with total contract traded at 2.17 lakh, PCR at 0.92 and VIX at 16.22.

7. 5800 CE is having highest Open Interest of 93 Lakhs with liquidation of 0.06 lakhs in OI premium at Rs 4 ,5700 added 12 lakhs in OI total OI at 80 lakhs ,5500 CE added 13 lakhs in OI it seems FII have bought 5500 CE as there total options buy has come to 1400 cores so 5700 becomes the immediate resistance for Nifty. 5300-6000 CE added lakhs in 26 lakhs in OI.

8. 5500 PE is having Open Interest of 69 lakhs so 5500 is strong base for Nifty base shifting activity is moving down from 5600 to 5500 . 5600 PE shedded 9 lakhs in OI as bulls were swampd away by bears and weak bulls exited as soon NS traded below 5600.5300-6000 PE liquidated 7.2 lakhs in OI.

9. FII bought 509 cores and DII sold 373 cores in cash segment.Indian Rupee ,INR closed at 2 month low of 55.36 Live INR rate @ http://inrliverate.blogspot.in/).

10. Nifty Futures Trend Deciding level is 5565(For Intraday Traders), Trend Changer at 5704 NF(For Positional Traders). (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand). Bank Nifty Future Trend Changer Level 11532.

Buy above 5590 Tgt 5614,5638,5650

Sell below 5554 Tgt 5527,5517 and 5500(Nifty Spot Levels)

Disclaimer: These are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.

Hello Sir,

As you mentioned above that, buy above 5590 tgt 5614, 5638 & 5650

sell below 5554 tgt 5527,5517 & 5500(NS levels), what are these…??

as per my understanding for buy the levels which ur given 5590, 5614… are the resistance levels and for sell the levels 5554, 5527.. are the support…, please clarify…

Dear Pravin,

If you trade based on NS you will use this levels to trade

buy above 5590 tgt 5614, 5638 & 5650

sell below 5554 tgt 5527,5517 & 5500(NS levels)

The Support and resistance mentioned helps in booking profit..

Now lets take today as an example we gave resistance at 5590 and NS made todays high as 5593 so someone holding longs can exit here or take short here with 20 point as SL

Hope it clarify

Rgds,

Bramesh