A Market in Retreat: FIIs Press Aggressive Bearish Attack Amidst a Mass Exodus

On February 13, 2026, the Bank Nifty Index Futures market gave a profound and urgent signal of a trend at its breaking point. Foreign Institutional Investors (FIIs) launched a new, aggressive wave of selling, shorting a massive 4,312 contracts in a powerful display of bearish conviction.

However, the session’s most critical and revealing piece of data was that this major institutional assault occurred within a market that was in full retreat. The net Open Interest (OI) decreased by 210 contracts. This is not the data of a building bearish trend; it is the unmistakable signature of a late-stage move, where the primary bears are pressing their advantage just as a larger wave of participants is fleeing the market.

Decoding the Data: The Story of Conviction vs. Capitulation

The key to understanding this volatile market state is the stark divergence between the FIIs’ fresh, aggressive action and the broader market’s deleveraging.

-

The FIIs: An All-Out Attack: The FIIs’ action was not a modest addition; it was a major, high-conviction bet on further decline. Adding over 4,000 new short contracts is a clear and aggressive signal that they believe the current market levels are unsustainable and a significant fall is imminent. Their action represents a major injection of new, institutional selling pressure.

-

The Main Event: The Great Unwinding: The drop in Open Interest is the most powerful signal of the day. For the total number of open contracts to fall while FIIs were actively adding over 4,000 new shorts, it means that a colossal number of other participants—totaling 4,522 net contracts (4312 + 210)—closed their positions and exited the market. This mass exodus is a classic sign of bullish capitulation, where traders who were previously long are now being forced to sell and liquidate their positions, likely at a significant loss.

This dynamic creates a particularly dangerous “perfect storm” for the bulls:

-

There is a wave of fresh, aggressive selling from convinced institutional bears (the FIIs).

-

There is a simultaneous wave of forced, panicked selling from defeated bulls who are liquidating their long positions.

Key Implications for the Market

-

A Critically Weakened Market Structure: The foundation of buying support has been shattered. The very participants who would normally defend support levels (the longs) are now contributing to the wave of selling.

-

High Risk of an Accelerated “Waterfall” Decline: This combination of new aggressive shorts and panicked long liquidation is the classic recipe for a “waterfall” event, where prices fall swiftly and sharply as the last of the longs are forced to capitulate.

-

The Path of Least Resistance is Sharply Downward: With two powerful sources of selling pressure and a vanishing pool of buyers, the path of least resistance is now unambiguously to the downside.

-

Support Levels are Extremely Fragile: Any identified technical support levels are now more vulnerable than ever. A market driven by this level of capitulation has a tendency to slice through such levels with ease.

Conclusion

Disregard any minor intraday bounces. The dominant and undeniable story is the FIIs’ aggressive new attack, occurring in perfect sync with the mass capitulation of bullish traders. The market’s internal structure has been profoundly weakened. The Bank Nifty is now in a fragile and highly dangerous state, where the conditions are perfect for an accelerated and potentially violent move to the downside.

Last Analysis can be read here

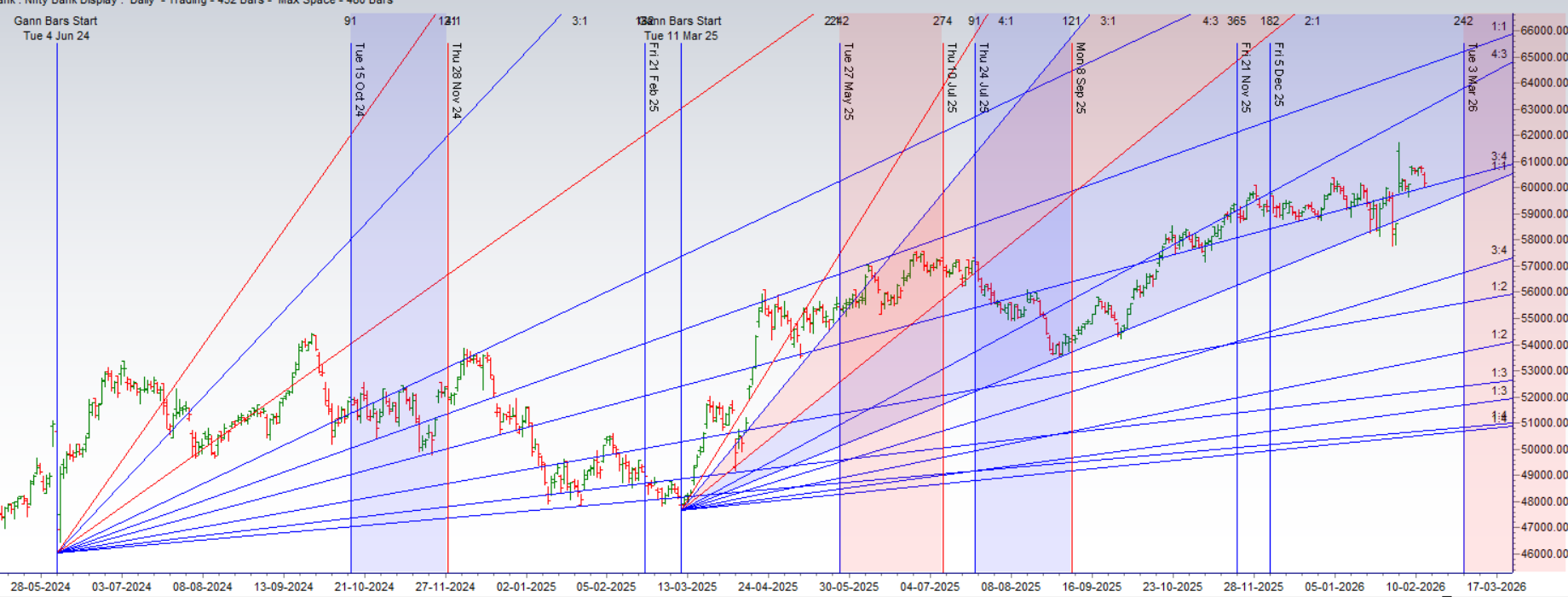

The market has once again delivered a textbook validation of our astro-technical model. The extreme compression of the four consecutive Dojis was decisively resolved to the downside as forecast, with the break of the Venus Ingress low acting as the perfect trigger. The resulting decline to 60,073 confirms that the period of indecision is over, and the bears have now seized firm control of the market’s trend.

This technical breakdown is now being compounded by a new set of complex and challenging market dynamics, suggesting the path of least resistance remains firmly to the downside.

1. The Looming Inter-Sector Rotation

The immediate headwind for the banking sector is a classic inter-market rotation. After a period of sustained weakness, IT stocks are now poised for a potential rebound. As has been the pattern, strength in IT often comes at the expense of Banks, as institutional capital rotates from one heavyweight sector to the other. A relief rally in the IT index on Monday is now a high-probability event, which will almost certainly keep the banking stocks under pressure.

2. A New Fundamental Threat: The RBI Circular

Adding a layer of fundamental bearish pressure is the new RBI circular concerning stock market financing by banks. This regulatory overhang is a direct, negative catalyst for the sector, creating uncertainty and potentially curbing a lucrative line of business. As your analysis astutely points out, this is likely to have a particularly negative impact on PSU banks, which could lead the entire banking index lower.

3. The Definitive Battle for the 60,000 Fortress

This combination of confirmed technical weakness and new fundamental/rotational headwinds has pushed the Bank Nifty to its most critical psychological and structural battleground: the 60,000 level.

-

The Bullish Counter-Attack (A Move > 60,271): The bulls are now on the defensive. To have any hope of staging a meaningful recovery, they must not only defend the 60,000 level but also achieve a decisive move and close back above the immediate resistance at 60,271. Only a move of this strength would signal a potential reversal and a retest of 60,769.

-

The Bearish Knockout Blow (A Break < 60,000): The bears are in a commanding position. Their objective is to press their advantage and deliver the knockout blow. A decisive break below the massive psychological and structural support at 60,000 would be a major technical failure, likely triggering a new and accelerated wave of selling towards the next major support at 59,774.

Conclusion

The bears are in control. A technical breakdown has been confirmed, and it is now being reinforced by negative rotational and fundamental pressures. The entire market is now watching the epic battle for the 60,000 level. A failure by the bulls to hold this line will likely trigger the next major leg down for the Bank Nifty.

Bank Nifty Dec Futures Open Interest Volume stood at 12.5 lakh, with liquidation of 1.7 Lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a closeure of LONG positions today.

Bank Nifty Advance Decline Ratio at 02:12 and Bank Nifty Rollover Cost is @59457 closed above it.

The Bank Nifty options market is in a state of high-stakes conflict, with the data painting a picture of a market caught between strong underlying support and a growing wave of bearish pressure. A deteriorating Put-Call Ratio (PCR) of 0.87 signals a clear tilt in sentiment towards the bears. This indicates that call writers are becoming more aggressive, betting that the market’s upside is now capped and creating a significant supply overhang that will challenge any bullish attempts.

This growing bearish pressure is being directly confronted at the most critical psychological and structural level: the 60,000 strike. This level is not only the Max Pain point but is also, uniquely, the home of both the highest Call OI and the highest Put OI. This has transformed 60,000 into a colossal “straddle,” a battlefield where immense positions are built on both sides.

With the current price trading slightly above this at 60,186, the bulls are clinging to a precarious lead. This setup has created a very clear and formidable set of boundaries:

-

Resistance: The primary resistance and bearish fortress is at 61,000, which now holds the highest concentration of Call OI. The 60,500 strike also presents a significant hurdle.

-

Support: The 60,000 strike is the ultimate “line in the sand.” It acts as a massive support floor, reinforced by its status as Max Pain and the huge number of put writers. A break below this would be a major bearish victory.

In conclusion, the Bank Nifty is locked in a classic and intense “pinning” scenario. While the overall sentiment is tilting bearish, the massive support at 60,000 is preventing a decline. The market is caught in an epic tug-of-war, and a major catalyst will be required to break the stalemate and resolve the battle for the 60,000 fortress.

Bank Nifty Spot – Intraday Technical Setup

Market Observation: The index is currently trading within a defined range. Traders should watch the following pivot zones for potential directional moves:

-

Strength (Upside): If the index sustains above 60250 , it indicates bullish momentum. The immediate resistance levels to watch are 60347 60514 60840 .

-

Weakness (Downside): Selling pressure is likely to intensify if the index breaks below 60108 . In this scenario, the next support zones are 59966 59745 59555 .

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators