The Dam Breaks: Retail Capitulation Ignites a Bearish Firestorm as FIIs Press the Attack

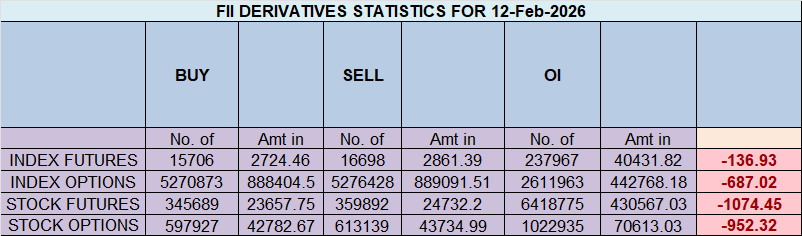

On February 12, 2026, the Nifty Index Futures market witnessed a catastrophic breakdown in bullish sentiment, signaling a powerful and dangerous acceleration of the prevailing downtrend. Foreign Institutional Investors (FIIs) continued to press their advantage, shorting a net 1,767 contracts. However, the day’s real, earth-shattering story was a dual-sided event: a mass surrender of retail longs occurring simultaneously with a massive surge in new, aggressive bearish bets, confirmed by a huge increase in Open Interest of 2,085 contracts.

This is not the data of a simple downtrend. This is the data of a market in panic, where the very foundation of bullish support has just collapsed.

Decoding the Data: The Anatomy of a Panic

1. The Main Event: The Great Client Capitulation

The single most important market event of the day was the behavior of the retail clients. Their actions revealed a complete psychological breakdown:

-

They covered (sold) a staggering 5,411 long contracts. This is not a strategic adjustment; it is a mass liquidation event, a full-scale surrender driven by fear and the pain of mounting losses. This has removed a massive pillar of buying support from the market.

-

In a classic sign of panic, a different group of clients added 3,173 new short contracts. This signifies a complete psychological flip, where former bulls or sideline-sitters are now chasing the downward momentum, adding fresh fuel to the bearish fire.

2. The FIIs: The Relentless Predators

The FIIs’ actions were a picture of cold, predatory precision. While clients were in a state of panic, the FIIs methodically pressed their advantage. By adding new shorts and further reducing their minimal long exposure, they have reinforced their position of maximum bearish conviction. Their final positioning remains at a profound extreme (22% long vs. 78% short), showing they see this weakness not as a bottom, but as a confirmation of their bearish thesis.

3. The Ominous Surge in Open Interest

This is the most critical and dangerous signal of all. In a session where over 5,000 old longs were liquidated, for the OI to still rise is a sign of immense, fresh bearish conviction. It proves that new, aggressive short-sellers (including both FIIs and a new wave of panicked retail) are flooding into the market. A market that is falling on rising open interest is a market in a strong, healthy, and accelerating downtrend.

Key Implications

-

A Bearish Trend in Full Acceleration: This is not an exhausted trend. This is a trend that has just found a new, powerful source of fuel: retail panic.

-

A Waterfall Decline is Now a High Probability: The legacy positioning of clients is still enormously long (73:27). This massive, trapped base of old longs is now in a state of extreme vulnerability. Any further drop is likely to trigger a second, even more violent wave of forced selling, leading to a “waterfall” decline.

-

The Path of Least Resistance is Sharply Downward: The market structure is now profoundly weak. Rallies, if any, will be fleeting and are highly likely to be met with overwhelming selling pressure.

-

A Classic Panic Signal: A massive exit of old longs combined with a surge of new shorts is the textbook signature of a market transitioning from a downtrend into a full-blown panic.

Conclusion

This data signals a major and dangerous escalation of the bearish trend. The key takeaway is the capitulation of the retail bulls, occurring simultaneously with a surge in new, conviction-based shorting (rising OI). The bullish support structure has broken. The market is now in a fragile and perilous state, where the conditions are perfect for a rapid and painful acceleration to the downside.

Last Analysis can be read here

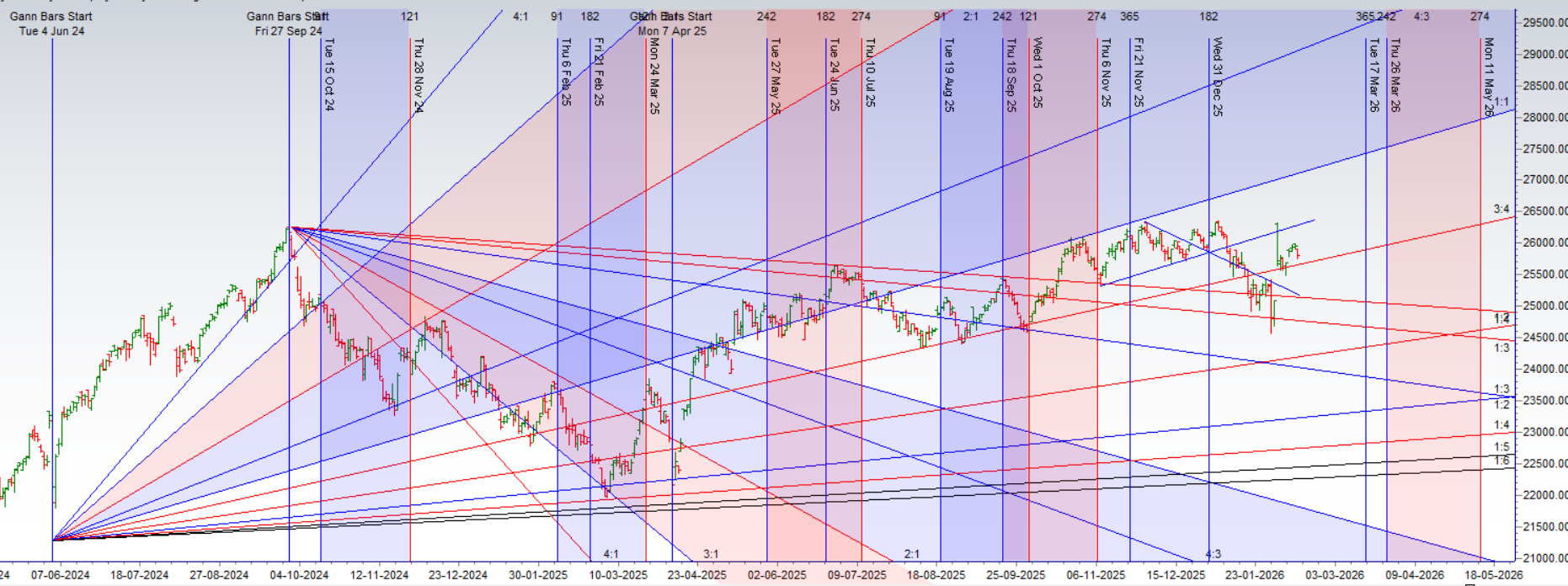

The market has once again bowed to the power of our astro-technical model. As forecast, the Nifty broke the crucial Venus Ingress low, a move that was exacerbated by heavy, sustained selling in IT stocks. The bearish momentum has taken hold, and the market is now set for its next major test.

A gap-down opening is expected tomorrow, which will immediately plunge the Nifty into its first, and perhaps most critical, line of defense. This is happening just as two major astrological events converge on the all-important weekly close, creating a perfect storm for a major, trend-defining move.

1. A Powerful Cosmic Duo: The Triggers for a “Major Move”

The expected volatility is not random; it is being primed by a rare and powerful confluence of two independent astrological cycles:

-

Mars Yod Jupiter (The “Finger of God”): This is a rare and fated aspect that points to a non-negotiable turning point or a decision that must be forced. With Mars (action, aggression) pointing at Jupiter (expansion), this suggests a powerful and decisive resolution is imminent.

-

Bayer Rule 15: This important rule directly forecasts a “Major Move” when Venus reaches an extreme in its heliocentric speed.

The simultaneous activation of these two cycles on a weekly closing day is an extremely potent signal that the market’s current state of consolidation is about to be shattered.

2. The Definitive Battle for the Weekly Close

This immense cosmic energy is being focused directly on a very specific and critical price zone. The entire fate of the weekly close will be decided here.

-

The Bullish Last Stand (25,677 – 25,691): This is the first and most critical support fortress. The bulls’ only mission is to defend this line against the opening onslaught. A hold here would be a major victory, absorbing the bearish pressure.

-

The Bearish Breakdown Trigger (A Break Below 25,666): The bears are in command. A decisive and sustained break below this level would confirm that the support has shattered, likely unleashing a powerful and rapid fall towards the next major support zone of 25,456-25,484.

3. The Intraday Compass

For navigating the high-velocity moves expected today, a clear tactical plan is essential. The first 15 minutes’ high and low will be the ultimate, unbiased guide. It will cut through the initial gap-down chaos and reveal the session’s true, dominant trend.

Conclusion

The stage is set for a high-stakes weekly close. Confirmed bearish momentum is driving the Nifty towards a critical support zone, just as a powerful astro-cyclical storm is gathering. The battle for the 25,677-25,666 zone will be decisive. A break here is expected to trigger the “Major Move” to the downside. Prepare for a session of extreme significance and volatility.

Traders may watch out for potential intraday reversals at 09:22,12:18,01:49,02:47 How to Find and Trade Intraday Reversal Times

Nifty Dec Futures Open Interest Volume stood at 1.52 lakh cr , witnessing addition of 2.9 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was addition of SHORT positions today.

Nifty Advance Decline Ratio at 29:20 and Nifty Rollover Cost is @25405 closed above it.

In the cash segment, Foreign Institutional Investors (FII) bought 108 cr , while Domestic Institutional Investors (DII) bought 276 cr

The Nifty options market is screaming a message of intense bearish pressure and a market firmly in the grip of sellers. A profoundly negative Put-Call Ratio (PCR) of 0.61 is the clearest evidence of this, signaling that the open interest in call options has massively overwhelmed that of puts. This is a direct result of aggressive call writing, reflecting a market where sellers have high conviction that any attempt at a rally will be brutally suppressed.

This heavy bearish sentiment has trapped the index in a high-stakes battle right at the Max Pain point of 25,800. With the spot price trading almost exactly at this level (25,807), the market is pinned at the point of maximum financial pain for option buyers, a classic signature of large institutional sellers controlling the range.

The participant activity reveals a powerful divergence fueling this dynamic:

-

Retail traders are fueling the call supply, acting as massive net sellers of call options.

-

In a classic professional countermove, Foreign Institutional Investors (FIIs) are expressing cautious optimism, acting as significant net buyers of both calls and puts, a “long strangle” strategy that bets on a large move in either direction.

This conflict has forged a clear and formidable battlefield:

-

Resistance: A “Great Wall of Calls” stands at the 26,000 psychological strike, acting as the ultimate ceiling. The 25,800 Max Pain level itself is the immediate and most formidable resistance zone.

-

Support: On the downside, the first significant support floor, defended by put writers, is located at 25,600. The ultimate line of defense for the bulls remains the major support level at 25,500.

In conclusion, the Nifty is locked in a bear grip, dominated by negative sentiment and overwhelming overhead supply. While FIIs are positioned for a volatility explosion, the path of least resistance remains sideways to down, with sellers in firm control.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 25607. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25889 , Which Acts As An Intraday Trend Change Level.

Nifty Spot – Intraday Chart Observation

Technical Setup: The index is approaching critical breakout levels. Watch these zones for price action confirmation:

-

Strength (Upside): Momentum is expected to pick up if Nifty sustains above 25737. In this scenario, the immediate resistance levels are 25777, 25800 and 25840.

-

Weakness (Downside): The trend technically weakens if the index slips below 25666 This could open the path towards support levels at 25630, 25600 and 25575.

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators