A Hollow Victory: FIIs Buy into a Mass Exodus, Signaling Major Trend Exhaustion

On February 12, 2026, the Bank Nifty Index Futures market presented a profoundly deceptive picture of institutional strength. While Foreign Institutional Investors (FIIs) continued their bullish campaign, buying a solid 1,942 contracts, this positive headline was completely overshadowed by a far more powerful and alarming event: a massive collapse in net Open Interest (OI), which plummeted by 3,016 contracts.

This is not the signal of a healthy, advancing market with broad-based conviction. This is the textbook signature of a late-stage, dangerously exhausted trend. The FIIs’ buying was a lonely act of confidence in a market where the vast majority of participants were aggressively running for the exits.

Decoding the Data: The Mechanics of a “Hollowed-Out” Market

The key to understanding this critical market state is the immense divergence between the FIIs’ buying and the collapse in overall market participation.

-

The FIIs: The Last Bulls at the Party: The FIIs continued to demonstrate their bullish bias, adding to their long positions and providing the primary upward pressure on the price. In isolation, their action is bullish. However, context is everything, and the market context here is one of retreat.

-

The Main Event: The Great Deleveraging: The massive drop in Open Interest is the single most important market signal of the day. For OI to fall by over 3,000 contracts while the FIIs were actively buying nearly 2,000, it means that a colossal number of other participants—totaling nearly 5,000 net contracts—closed their positions and fled. This mass exodus is composed of two powerful groups acting in concert:

-

Bulls Taking Profit: A huge number of traders who successfully rode the rally are now rushing to the exits, selling their long positions to lock in gains before a potential top.

-

Bears Capitulating: The last of the trapped bears are also buying back their positions to close them out, finally surrendering.

When both the winners (bulls) and the losers (bears) of a trend are closing their positions en masse, it is the ultimate sign that a major trend cycle has run its course.

-

Key Implications for the Market

-

Profound Trend Exhaustion: A market that is still nominally rising but on the back of a massive collapse in participation is a market that is running on fumes. The “fuel” for the rally—a steady stream of new buyers—has been replaced by a stampede of profit-takers.

-

A Brittle and Extremely Vulnerable Market Structure: This mass deleveraging “hollows out” the market. With fewer active participants and thinning liquidity, the market becomes fragile and highly susceptible to a sharp, sudden reversal. A small amount of determined selling can now have a disproportionately large and rapid impact.

-

The Risk/Reward Has Decisively Shifted: The primary risk is no longer “missing out on the rally.” The primary risk is now being the last one to buy at what could be a significant market top. Chasing the trend at these levels is exceptionally dangerous.

-

A Classic Topping Signal: This is a classic “end of move” data signature. The conviction that drove the trend has evaporated, replaced by a widespread and urgent desire to take profits and reduce risk.

Conclusion

Disregard the FII buying figure as a sign of broad market strength. The overwhelming and dominant message from the market’s internals is the colossal collapse in Open Interest. This signals a full-scale retreat by the broader market and profound trend exhaustion. While the price may not have reversed yet, the underlying foundation of the rally has been critically and perhaps fatally weakened. The Bank Nifty is now in its most fragile state, highly vulnerable to a sharp and sudden correction.

Last Analysis can be read here

The Bank Nifty is in a state of almost unprecedented compression and indecision, having formed an incredible four consecutive Doji candlestick patterns. This is a historic display of a market in perfect, high-stakes equilibrium—a powder keg of volatility where the bullish and bearish forces have fought to an absolute standstill.

This fragile and artificial peace, as your analysis astutely points out, is being engineered. With the IT sector in a confirmed downtrend (a lingering effect of the Uranus transit), PSU Banks are being actively used to manage and prop up the index, preventing a wider collapse. This is not a sign of organic market strength; it is a sign of a market being held together by a thread, just as it approaches a major, pre-calculated timing window for a major move.

The Celestial Triggers: The Fuses to the Dynamite

This technical powder keg is now being met by two independent and powerful astrological events, both signaling that the period of quiet is about to be shattered.

-

Mars Yod Jupiter (The “Finger of God”): A Yod is a rare and fated aspect that points to a non-negotiable turning point or a decision that must be made. With Mars, the planet of action and aggression, pointing directly at Jupiter, the planet of expansion and banking, this aspect is forcing a powerful and decisive resolution specifically within the financial sector. The indecision is over.

-

Bayer Rule 15 (The “Major Move” Confirmation): This important rule links a “Major Move” to Venus reaching an extreme in its heliocentric speed. With Venus again at the heart of this signal, the focus on the banking sector is amplified. This independent rule provides a powerful confirmation that the coming move is not expected to be minor or temporary.

The Definitive Battle Lines: The Breakout or the Breakdown

This confluence of extreme technical compression and powerful cyclical timing has created an unambiguous set of triggers. The resolution of the four Dojis will not be subtle.

-

The Bullish Breakout Scenario: The bulls have a clear and definitive trigger that will unleash the immense stored energy to the upside.

-

The Trigger: A decisive and sustained move above 60,800.

-

The Targets: A successful breakout targets a high-velocity rally towards 60,930, 61,063, and ultimately 61,196.

-

-

The Bearish Breakdown Scenario: The bears will be looking for the artificial support to finally crack.

-

The Trigger: A decisive and sustained break below 60,439.

-

The Targets: A breakdown here would likely trigger a rapid and cascading decline towards 60,009 and a more significant fall to 59,644.

-

The Intraday Plan

For a day with such immense explosive potential, the tactical plan must be disciplined. The first 15 minutes’ high and low will be the essential compass to navigate the initial chaos and identify the session’s true, dominant direction.

Conclusion

The Bank Nifty is at one of its most critical and explosive junctures. An exceptionally rare period of extreme consolidation is being forced to a resolution by powerful and fated astrological events. The artificial support from PSU Banks makes the situation even more fragile. Watch 60,800 and 60,439. The one that breaks first is likely to unleash a powerful, sustained, and historic trend.

Turning Trading Regrets into Tuition: How to Learn from Your Worst Decisions

Bank Nifty Dec Futures Open Interest Volume stood at 14.3 lakh, with liquidation of 1.5 Lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a closeure of LONG positions today.

Bank Nifty Advance Decline Ratio at 04:10 and Bank Nifty Rollover Cost is @59457 closed above it.

The Bank Nifty options market is in a state of high-stakes, bullish tension, having staged a powerful breakout that is now defying the market’s structural gravity. A near-neutral Put-Call Ratio (PCR) of 0.91 signals a cautious balance, indicating that while fear is absent, call writers are actively trying to cap the powerful rally, creating a tense standoff at these elevated levels.

The most critical dynamic at play is the significant divergence between the Max Pain point, anchored at 60,300, and the spot price, which is trading substantially higher at 60,739. This is a highly bullish but unstable situation. It signifies that the bulls have successfully stretched the market far beyond its financial center of gravity, inflicting immense financial pain on the call sellers who were defending the lower strikes. This creates the classic conditions for a “short squeeze,” where these sellers could be forced to buy futures to cover their losses, further accelerating the rally.

This powerful breakout has completely redrawn the market’s battlefield:

-

Resistance: The primary and most formidable ceiling is the “Great Wall of Calls” located at the 61,000 strike. This is the next major target for the bulls and the last line of defense for the bears.

-

Support: The 60,300 Max Pain level acts as a magnetic pivot. The most critical support floor, however, is the former resistance fortress at 60,000, which now holds the highest concentration of Put OI.

In conclusion, the stalemate is broken, and the bulls are in a commanding but potentially overstretched position. The market is in a classic “bullish breakout” phase. The path of least resistance remains upwards, targeting 61,000, as long as the bulls can successfully defend the new 60,000 support floor against the inevitable profit-taking pressure.

Bank Nifty Spot – Intraday Technical Setup

Market Observation: The index is currently trading within a defined range. Traders should watch the following pivot zones for potential directional moves:

-

Strength (Upside): If the index sustains above 60800 , it indicates bullish momentum. The immediate resistance levels to watch are 60965 61125 61300 .

-

Weakness (Downside): Selling pressure is likely to intensify if the index breaks below 60450. In this scenario, the next support zones are 60299 60104 59900 .

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

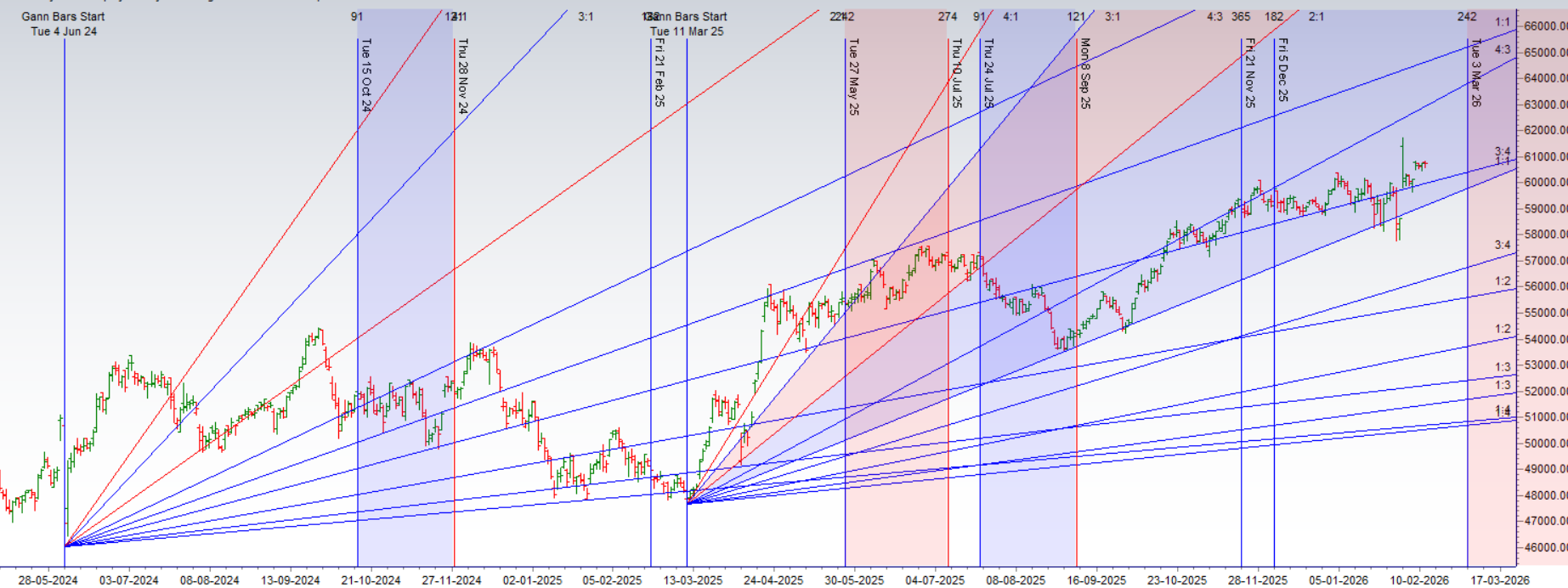

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators