A Market Turning Point: The Anatomy of a Violent, Dual-Capitulation Short Squeeze

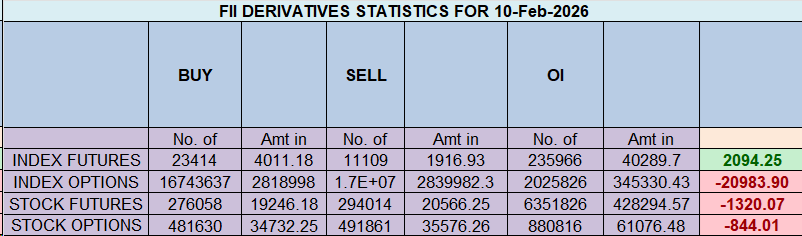

On February 10, 2026, the Nifty Index Futures market witnessed a historic and violent psychological reset. While the headline screamed a massive net buy of 10,804 contracts by Foreign Institutional Investors (FIIs), this number completely masks the true nature of the event. This was not a vote of confidence; it was a dual-sided capitulation event that has ignited a ferocious short squeeze.

The session was defined by two massive, opposing surrenders: institutional bears panicked out of their shorts while retail bulls panicked out of their longs. This chaos, occurring within a market where new conflict is already brewing (confirmed by a net Open Interest increase of 1,812 contracts), signals a major, violent turning point.

Decoding the Data: The Story of Two Surrenders

1. The FII Capitulation: The Great Short Squeeze

The FII granular data reveals the primary engine of the day’s rally.

-

They covered (bought back) a colossal 5,708 short contracts. This is not strategic buying; this is forced, panicked buying. The market moved against them so sharply that they were forced to exit their massive bearish campaign.

-

Simultaneously, they added 6,597 new long contracts. This is a stunning reversal. It shows them not just exiting their old, wrong bet but aggressively initiating a new, opposing one.

This is the very definition of a short squeeze: the biggest bears have been forced to capitulate and become aggressive buyers. However, it’s crucial to note their legacy positioning remains bearish at 19:81, showing just how massive their old short position was.

2. The Client Capitulation: The Final Surrender

At the exact same time the institutions were being squeezed, the retail clients, who had been stubbornly long, finally threw in the towel.

-

They covered (sold) a staggering 10,330 long contracts. This is a mass liquidation event, the classic signal of maximum pain where the longs finally give up, selling their positions right at the market’s potential bottom.

-

A smaller group, convinced the trend was down, even added 2,166 new short contracts, becoming the fresh fuel for the ongoing squeeze.

3. The Rising OI: A New Battle Forms from the Ashes

Incredibly, even with a net closure of over 16,000 contracts (10k client longs + 5k FII shorts), the OI still rose. This means new bulls (FIIs) and new bears (Clients) created over 18,000 brand-new contracts, a sign of immense new conflict emerging from the ashes of the old trend.

Key Implications

-

The Bear Trend is Catastrophically Over: The market has just witnessed the capitulation of both the primary bears and the primary bulls of the old trend.

-

A Violent Short Squeeze is in Full Force: The primary driver of the market is now the forced buying of trapped shorts. This is an explosive but inherently unstable type of rally.

-

A Major Market Bottom is Likely in Place: This kind of dual-sided, high-volume capitulation is the classic signature of a major market low. The selling pressure has been completely and violently exhausted.

-

Extreme Volatility is Guaranteed: A market that has just undergone such a massive psychological reset will be extremely volatile.

Conclusion

This data tells the story of a market trend that did not just end, but was violently reset in a dual-sided panic. The headline FII buy figure is an illusion; the reality is a massive institutional short squeeze happening at the same time as a mass retail long capitulation. The old war is over. A new, volatile, and upwardly biased trend, fueled by the pain of trapped shorts, has just begun.

Last Analysis can be read here

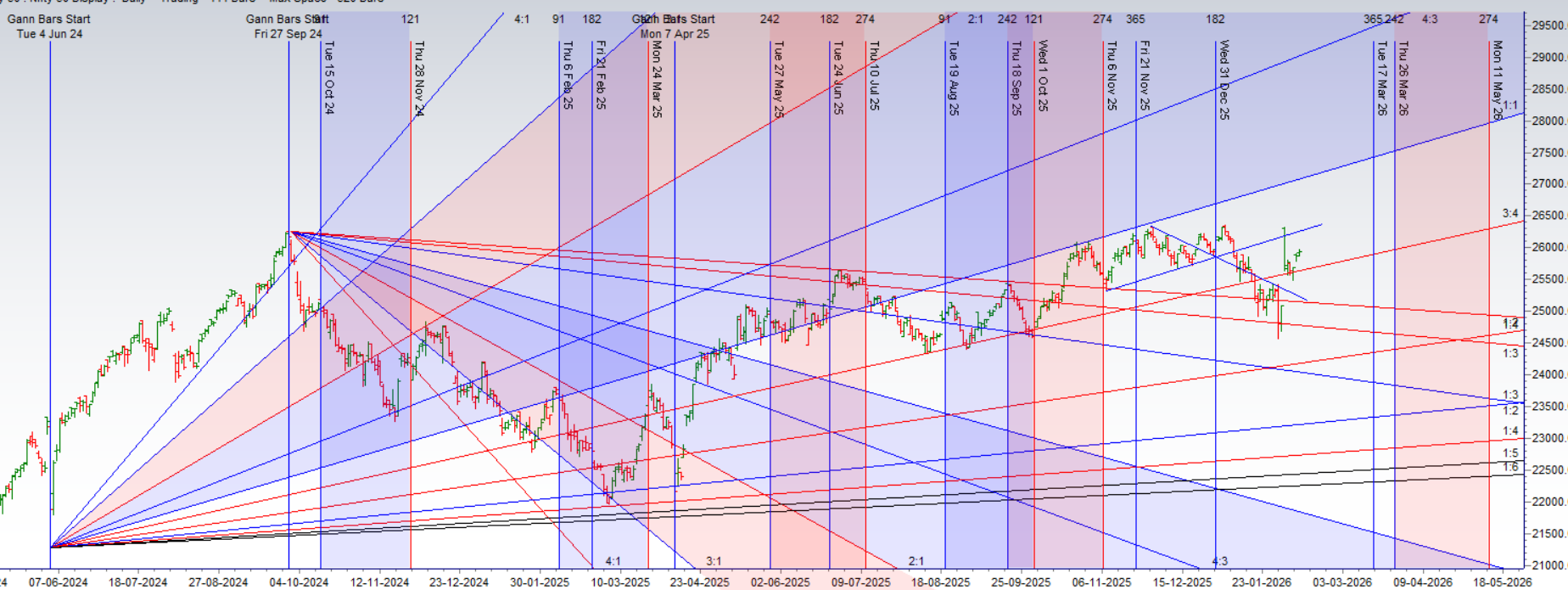

The Nifty market has once again delivered a picture-perfect validation of our astro-technical model, forming a perfect Doji candlestick on the day of the crucial Venus transit. This is not just a technical pattern; it is the market’s clear and unambiguous signal of a moment of profound indecision and perfect equilibrium. The powerful Venusian energy, instead of forcing a direction, has brought the market to a point of maximum tension, a perfect balance between bullish and bearish forces.

This is a classic and highly favorable setup, offering a good risk-to-reward ratio because the period of indecision is about to be violently resolved. A gap-up opening is expected today, which will provide the initial thrust and force the market to make its choice. The Doji’s stalemate is about to be broken.

The Bullish Mandate: Defend the New High Ground

The bulls have the clear momentum from the recent rally, and the gap-up will place them in an immediate position of strength. Their mission is now one of defense and continuation.

-

The Bullish Fortress (25,970 – 26,010): This is the critical, non-negotiable support zone. For the bulls to prove that the Doji was a mere pause and not a top, they must hold this range. A successful defense here will absorb the initial morning profit-taking and build a powerful launchpad for the next leg up.

-

The Bullish Target: A successful hold of this support zone validates the uptrend and puts the next major target of 26,130/26,200 firmly in the crosshairs.

The Bearish Opportunity: The Last Line of Defense

The bears will view the Doji as a sign of bullish exhaustion and the gap-up as their final opportunity to sell into strength at a key resistance level. They have one clear trigger that will confirm their control.

-

The Bearish Trigger (A Break Below 25,891): A decisive break below this level would be a major technical failure for the bulls. It would signal that the bullish momentum from the gap-up has failed completely, validating the Doji as a bearish reversal pattern and giving the bears their first real chance to seize control of the trend.

Conclusion

The Nifty is perfectly poised at a high-stakes inflection point. A flawless Doji pattern has formed at a key astrological juncture, setting the stage for a major directional move. A gap-up opening will force an immediate and decisive battle. The entire outcome of today’s session, and potentially the entire weekly trend, hinges on the market’s ability to hold the critical 25,970-26,010 support zone. A hold means the rally continues; a break below 25,891 signals a powerful reversal. Prepare for a pivotal session.

Traders may watch out for potential intraday reversals at 10:21,12:20,01:04,02:11 How to Find and Trade Intraday Reversal Times

Nifty Dec Futures Open Interest Volume stood at 1.49 lakh cr , witnessing liquidation of 2.7 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was closuere of SHORT positions today.

Nifty Advance Decline Ratio at 29:20 and Nifty Rollover Cost is @25405 closed above it.

In the cash segment, Foreign Institutional Investors (FII) bought 69.45 cr , while Domestic Institutional Investors (DII) bought 1174.21 cr

The Nifty options market is signaling a decisive victory for the bulls, with the market having successfully staged a breakout from its recent containment zone. A perfectly neutral-to-bullish Put-Call Ratio (PCR) of 1.02 confirms a healthy balance and an absence of fear. This shows that put writers are confident in providing support, creating a stable foundation for the current rally.

The most critical development is the divergence between the Max Pain point at 25,900 and the spot price trading substantially higher at 25,935. This is a powerful bullish signal. It indicates that the bulls have successfully overpowered the gravitational pull of the options market’s center and have inflicted significant financial pain on the call sellers at the 25,800 and 25,900 strikes. This “breakaway” from the Max Pain point is often a precursor to a strong, trending move.

This successful breakout has redrawn the market’s battlefield:

-

Resistance: The primary and most formidable ceiling is the “Great Wall of Calls” located at the 26,100 strike. The next psychological milestone at 26,000 will also act as an immediate and significant hurdle.

-

Support: The former Max Pain level and resistance zone of 25,800 has now decisively flipped to become the new primary support floor, reinforced by a massive wall of put writers. The ultimate support for the current market structure remains strong at 25,700.

In conclusion, the stalemate is broken, and the bulls are in firm command. Having successfully broken away from the 25,800 pinning zone, the path of least resistance is now clearly upwards. The immediate challenge is to conquer the 26,000 psychological barrier, with the ultimate target being the major call wall at 26,100. The downside appears well-protected.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 25550. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25933 , Which Acts As An Intraday Trend Change Level.

Nifty Spot – Intraday Chart Observation

Technical Setup: The index is approaching critical breakout levels. Watch these zones for price action confirmation:

-

Strength (Upside): Momentum is expected to pick up if Nifty sustains above 26050. In this scenario, the immediate resistance levels are 26088, 26130 and 26166.

-

Weakness (Downside): The trend technically weakens if the index slips below 25930 This could open the path towards support levels at 25900, 25872 and 25824.

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators