A High-Conviction Breakout: FIIs Lead a New Wave of Buying as Fresh Capital Floods into Bank Nifty

On February 9, 2026, the Bank Nifty Index Futures market delivered a powerful and high-quality bullish signal, confirming that the current uptrend is not only healthy but is also gaining momentum with strong institutional backing. Foreign Institutional Investors (FIIs) took a clear leadership role, accumulating a substantial 2,224 contracts worth ₹405.56 crore.

However, the most critical and confirming piece of data was the concurrent increase in net Open Interest (OI) of 778 contracts. This is the market’s definitive stamp of approval on the rally. It is the classic signature of a healthy, expanding bull trend, fueled not by the nervous covering of old shorts, but by the confident initiation of new longs.

Decoding the Data: The Mechanics of a Confident Bull Run

This combination of significant institutional buying and rising overall market participation is a textbook signal for a powerful, sustainable trend.

-

FIIs Seize Command: This is not tentative buying; it is a proactive and confident accumulation of long positions. The FIIs’ action demonstrates a strong belief that the market has significant further upside. By stepping in with such force, they are creating a powerful institutional “bid” under the market, which fundamentally alters the prevailing psychology and provides a strong foundation of support for higher levels.

-

The Open Interest Validation: This is the crucial element that validates the entire bullish thesis. A rally on falling OI is weak, as it is fueled only by exiting shorts. A rally on rising OI, as seen here, is a sign of immense health and strength. It proves that new capital is actively flowing into the market with conviction. The FIIs’ buying was so powerful that it easily absorbed all the profit-takers in the market and still had enough demand to meet new sellers, forging 778 brand-new, active contracts. This is a sign of a broadening, healthy, and vibrant trend.

Key Implications for the Market

-

A New, High-Momentum Phase has Begun: This data signals the beginning of a high-momentum, confident phase of the bull market, led by the market’s most powerful players.

-

“Buy the Dip” Mentality is Now Entrenched: With this level of institutional commitment, any market weakness or intraday consolidation will be viewed by a growing pool of participants as a prime buying opportunity, not a reason for fear.

-

The Path of Least Resistance is Firmly Upward: The sheer force of the institutional flow has created a powerful tailwind. Fighting this trend is now the equivalent of swimming against a strong current.

Conclusion

This is a high-quality, unequivocally bullish signal. The clear leadership from the FIIs, combined with the powerful confirmation from the surge in Open Interest, signals that the Bank Nifty is not just in an uptrend; it is in a healthy, expanding, and high-conviction bull phase, with all the underlying dynamics now firmly in place for a sustained move to higher levels.

Last Analysis can be read here

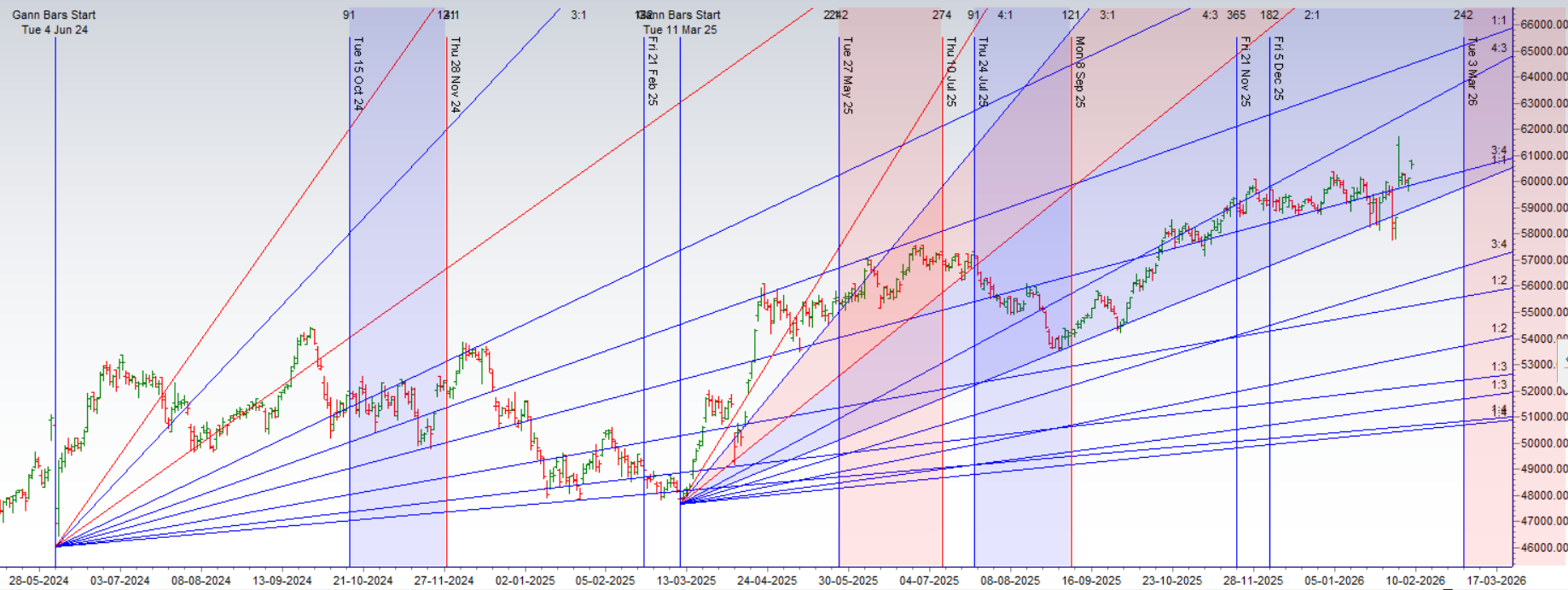

The Bank Nifty has executed a flawless move, hitting our 60,769 target with the precision that has become the hallmark of our astro-technical model. The perfect confluence of Gann price levels and astrological cycles provided the high-energy fuel for the last major rally. Now, having conquered that objective, the index has arrived at a new, and even more significant, cyclical inflection point. A major battle for control of this new high ground is imminent.

1. The Astrological Catalyst: The Venus Sign Change and Its Bellwethers

Today, a new and highly significant astrological event takes center stage: a Venus sign change. In financial astrology, Venus is a primary ruler of the banking and finance sector. An ingress into a new sign is a major event that often coincides with a significant shift in trend or sentiment. The market’s next move will be powerfully influenced by this Venusian energy, and as your analysis correctly identifies, its primary channels will be the sector’s most powerful leaders: HDFC Bank and ICICI Bank.

These two stocks are the “canaries in the coal mine.” Their strength or weakness today, especially in the opening minutes, will be the ultimate litmus test, revealing the market’s true internal reaction to this potent cosmic trigger.

2. The Confirmation Signal: The PSU Bank Litmus Test

Adding another layer of sophisticated, inter-sector analysis, a crucial confirmation signal for any potential weakness will come from the PSU banking stocks. If a correction begins and is isolated only to the private banks, it may be a temporary blip. However, if the PSU banking index also begins to show weakness and starts correcting, it would be a powerful sign of broad-based, systemic selling, adding significant weight to the bearish case.

3. The Definitive Battleground: A High-Stakes Fight for Control

This powerful confluence of a technical peak and a cyclical catalyst has created a clearly defined, high-stakes battlefield. The session will be a tug-of-war fought over a critical support zone.

-

The Bullish Continuation Case: The bulls have a clear and urgent mission. They must defend the crucial support range of 60,666 – 60,700. A successful hold of this fortress would signal that the market has absorbed the cyclical energy and is ready to launch the next leg of the rally. A successful defense here puts a move towards the next major target of 60,975 firmly on the table.

-

The Bearish Reversal Case: The bears will be looking for any sign of faltering from the leading private banks. An inability of the bulls to hold the support zone, confirmed by weakness in PSU banks, would be their trigger. A break below this support is expected to trigger a quick and cascading fall towards the major support level at 60,271.

The Intraday Plan

With a powerful Venus ingress promising a day of high energy and conviction, the tactical plan must be clear and disciplined. The first 15 minutes’ high and low will once again serve as the unwavering compass, guiding trades through the expected volatility and revealing the session’s dominant trend.

Turning Trading Regrets into Tuition: How to Learn from Your Worst Decisions

Bank Nifty Dec Futures Open Interest Volume stood at 16.2 lakh, with addition of 2.1 Lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a addiiton of LONG positions today.

Bank Nifty Advance Decline Ratio at 09:05 and Bank Nifty Rollover Cost is @59457 closed above it.

The Bank Nifty options market is in a state of high-stakes, bullish tension, having staged a powerful breakout that is now testing the market’s structural limits. An exceptionally neutral Put-Call Ratio (PCR) of 1.01 signals a perfect balance between bullish and bearish participants. However, this neutrality masks a dramatic underlying conflict: the current market price is significantly defying the options market’s center of gravity.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 59875. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 60721 , Which Acts As An Intraday Trend Change Level.

Bank Nifty Spot – Intraday Technical Setup

Market Observation: The index is currently trading within a defined range. Traders should watch the following pivot zones for potential directional moves:

-

Strength (Upside): If the index sustains above 60777 , it indicates bullish momentum. The immediate resistance levels to watch are 60865 61000 61225 .

-

Weakness (Downside): Selling pressure is likely to intensify if the index breaks below 60666 . In this scenario, the next support zones are 60500 60299 60104 .

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators

I like the efforts you have put in this, regards for all the great content.