Market Insight: FIIs Hit the Pause Button on Bank Nifty, Signaling a Market Stalemate

The FII activity in Bank Nifty on July 29 presents a picture of profound indecision and a strategic pause. The net purchase of a mere 127 contracts is statistically insignificant, indicating that FIIs have chosen to remain on the sidelines, neither adding to bullish bets nor initiating aggressive bearish ones. This “Neutral” stance is the key takeaway, suggesting a market in perfect equilibrium, likely awaiting a decisive trigger before committing to a direction.

This neutrality in Bank Nifty stands in stark contrast to the aggressive bearish positioning seen in the broader Nifty 50 index. This divergence is critical, implying that while FIIs may be bearish on the overall market, they are hesitant to short the banking sector at current levels, or are waiting for further confirmation before doing so. The market is coiled, and the current calm likely precedes a significant move.

Detailed FII Activity Analysis: The Definition of Neutrality

The headline figure of “Buying 127 contracts” can be misleading if taken in isolation. In the high-volume world of Bank Nifty futures, this number is negligible.

-

Net Action is Close to Zero: A net buy of 127 contracts indicates that the number of new long positions created and old short positions covered was almost perfectly balanced by the number of new short positions created and old long positions covered.

-

No Conviction: This is not a bullish signal; it is a “do-nothing” signal. FIIs are not committing fresh capital to drive the index higher, nor are they betting on a decline. They are essentially holding their existing positions and waiting. This lack of participation from the most influential market players is often a sign that the market is at a critical inflection point.

Decoding the Open Interest (OI) Change: A Market-Wide Stalemate

The net Open Interest increase of a mere 53 contracts for the entire market (across all participants) reinforces the theme of indecision.

-

What it means: An OI change this small signifies that for every new long contract opened by a trader, a new short contract was opened by another, resulting in a market-wide stalemate.

-

No Dominant Force: Neither the bulls nor the bears were able to establish dominance. This suggests that price is likely trapped in a narrow range as both sides await a catalyst. When OI is flat, it often means the market is consolidating or “coiling” before its next major move.

Conclusion:

The FII data for Bank Nifty screams indecision. The market is in a delicate balance, and the current quiet should not be mistaken for stability. It is more likely the “calm before the storm.”

Last Analysis can be read here

The market is coiled for an explosive move as a rare confluence of a pivotal US Federal Reserve decision, the Bank Nifty’s monthly expiry, and a significant astrological event creates a perfect storm of potential volatility. The next 24-48 hours are set to be decisive, with the technical level of 56388 acting as the ultimate battleground. The outcome of this clash will likely determine whether the series ends in a blaze of glory for the bulls or a capitulation to the bears, setting the tone for the month ahead.

1. The Global Catalyst: The US Fed Rate Decision

Tonight, all eyes are on the US Federal Reserve. The market is buzzing with the possibility of a rate cut, a move that would typically be bullish for global equities. However, the nuance lies not just in the decision itself, but in the accompanying commentary and forward guidance.

-

Scenario A: Dovish Rate Cut: If the Fed delivers a rate cut and signals more to come, it would inject a significant dose of liquidity and optimism into the global system. This is the most bullish outcome and could lead to a substantial gap-up opening for Bank Nifty tomorrow.

-

Scenario B: “Hawkish” Rate Cut or a Hold: If the Fed cuts rates but signals it’s a one-off “insurance cut,” or if they hold rates steady while maintaining a cautious tone, the market could interpret this negatively. This could trigger a risk-off sentiment, leading to a gap-down opening.

The verdict tonight will set the opening scene for tomorrow’s expiry drama.

2. The Domestic Driver: Bank Nifty Monthly Expiry

Compounding the Fed’s impact is the Bank Nifty’s monthly derivatives expiry tomorrow. Monthly expiries are inherently volatile as traders and institutions rush to roll over, hedge, or close their positions.

-

Amplified Volatility: The Fed’s decision will act as a massive volatility amplifier. A large gap opening (up or down) will instantly put huge pressure on options writers. Those who have sold Calls will be in trouble on a gap-up, potentially triggering a massive short squeeze. Conversely, Put writers will face immense pressure on a gap-down, which could accelerate the decline.

-

A Magnet for Price Action: The price will likely be drawn to levels with the highest open interest as bulls and bears fight to secure a favorable closing price for their options positions.

3. The Intraday Wildcard: Chiron Retrograde

Adding another layer of unpredictability to today’s session is the Chiron Retrograde. In financial astrology, Chiron is often called the “wounded healer.” Its retrograde period can signify a time of re-visiting old market “wounds,” weaknesses, or unresolved price levels.

-

Impact on Today’s Session: This suggests that today’s price action could be erratic and unpredictable. We may see sharp, unexpected swings without a clear catalyst as the market tests vulnerable points. This astrological event primes the market for the volatility that the Fed and expiry will unleash.

4. The Technical Battleground: 56388 – The Line in the Sand

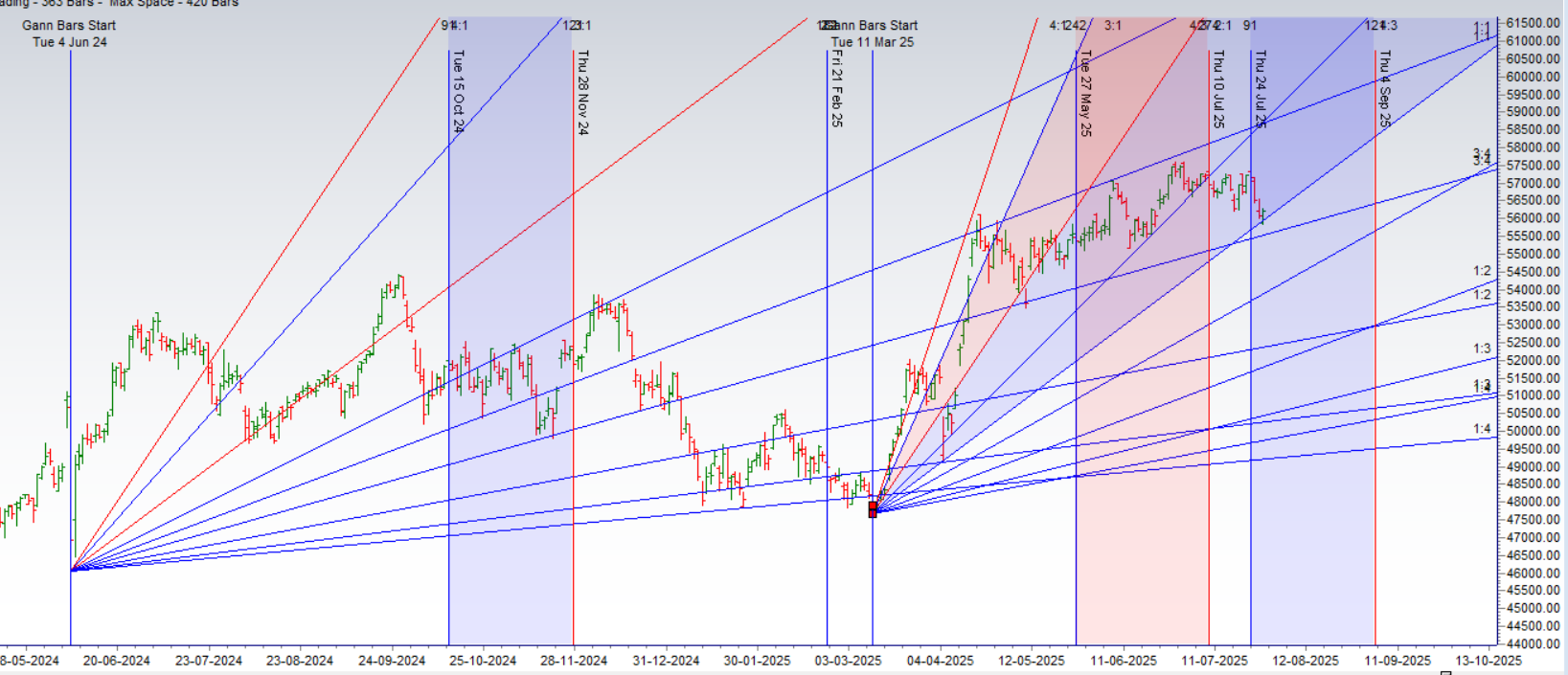

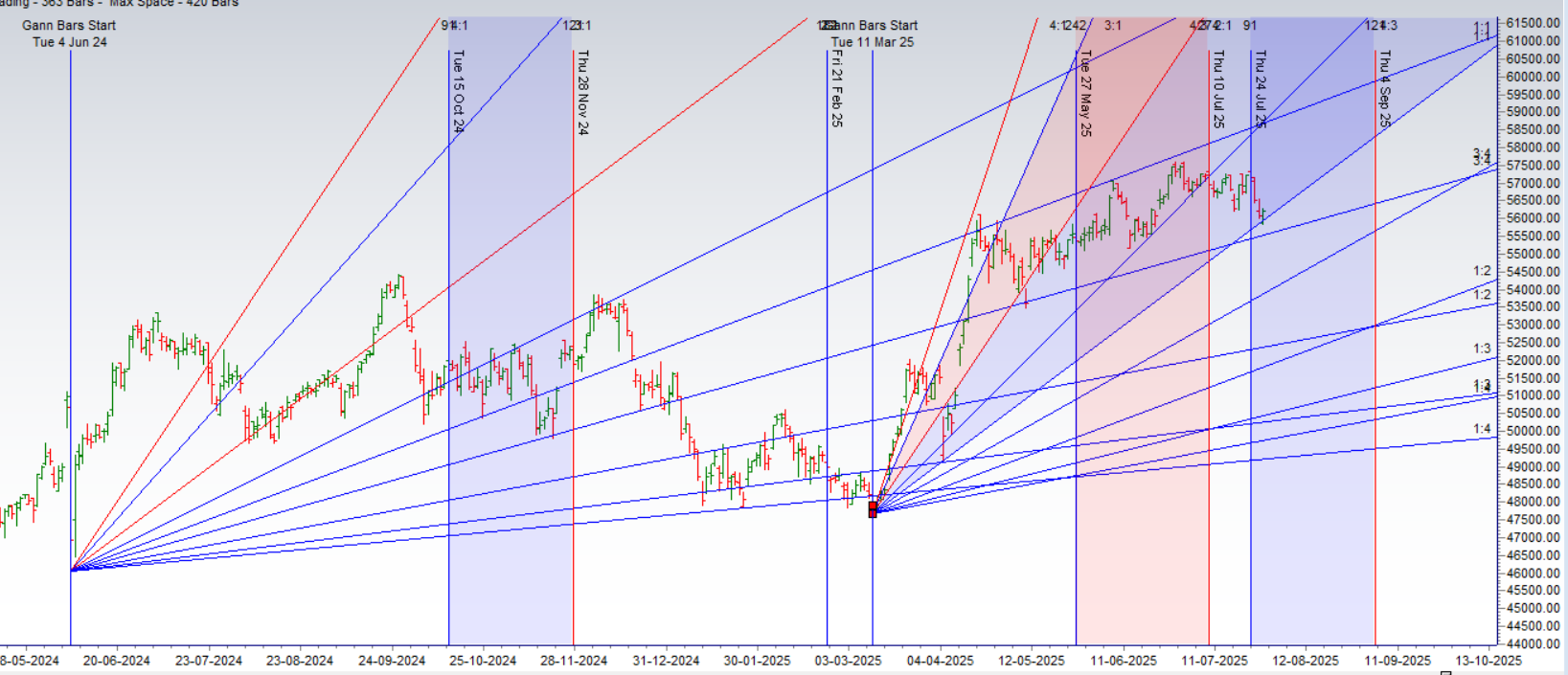

All these factors converge on one critical technical level: 56388. As the octave point of the recent major range (57628-55149), this level represents the market’s current point of equilibrium. It is the dividing line between bullish control and bearish dominance.

The Game Plan:

-

The Bullish Scenario: For bulls to maintain control, they must achieve a decisive close above 56388 today. Holding this level as support would signal that the market has absorbed the pre-event jitters and is ready to challenge the upper end of the range near 57628, especially if the Fed delivers a dovish surprise. A close above this level today would empower bulls to dictate terms on expiry day.

-

The Bearish Scenario: If the bulls fail to conquer 56388, or if the price is rejected from this level, the bears will seize control. A failure here would be a significant sign of weakness, suggesting that the path of least resistance is downwards. This would embolden bears to push for an expiry at the lowest point of the series, potentially targeting the range low of 55555 as their ultimate prize.

Conclusion:

The stage is set for a high-stakes showdown. Today is about the battle for 56388 amidst the volatility from the Chiron Retrograde. Tomorrow is about reacting to the Fed’s verdict and surviving the expiry war. Traders should exercise extreme caution. The risk of being caught on the wrong side of a violent, news-driven move is exceptionally high. Watching the market’s reaction around the 56388 pivot will be the key to navigating the impending storm.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 56315 for a move towards 56552/56788. Bears will get active below 56079 for a move towards 55843/55555.

Bank Nifty July Futures Open Interest Volume stood at 13.1 lakh, with liquidation of 2.8 lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a additon of SHORT positions today.

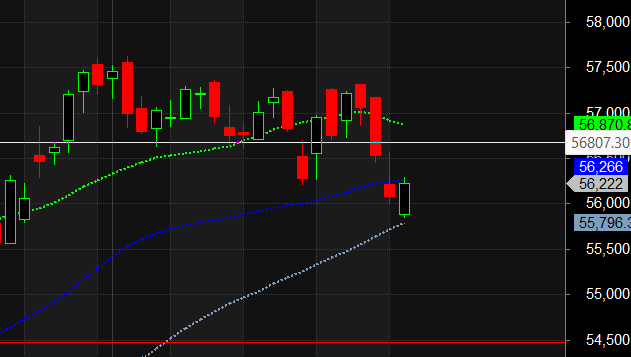

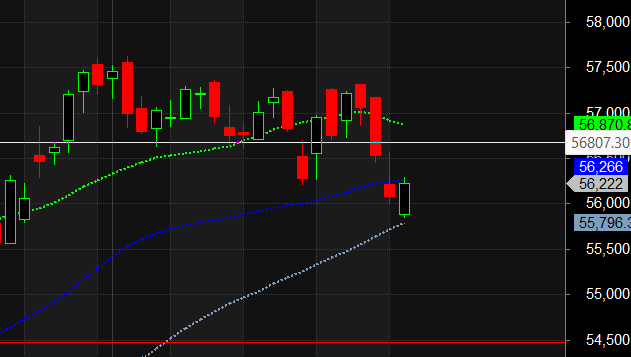

Bank Nifty Advance Decline Ratio at 07:05 and Bank Nifty Rollover Cost is @56875 closed above it.

BANK Nifty Gann Monthly Buy Level : 57730

BANK Nifty Gann Monthly Sell Level : 57021

Bank Nifty closed Below its 50 SMA @56266 ,Trend is Sell on Rise till below 56500

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 53548-55141-56734-58422. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 56500 strike, followed by the 57000 strike. On the put side, the 56000 strike has the highest OI, followed by the 55000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 56000-57000 range.

The Bank Nifty options chain shows that the maximum pain point is at 56500 and the put-call ratio (PCR) is at 0.60Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Don’t trade on emotion. Trading is a numbers game, and it’s important to make decisions based on logic and analysis, not emotion.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 57028. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 56173 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 56200 Tgt 56315, 56434 and 56552 (BANK Nifty Spot Levels)

Sell Below 56079 Tgt 55961, 55843 and 55729 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators

Related