Decoding the Volatile Week Ahead for Global Markets (July 21-25, 2025)

Brace for impact. The celestial stage is set for one of the most dynamic, conflicted, and potentially transformative trading weeks of the year. We are heading into a cosmic crossfire, where powerful forces of support, aggression, and structural breakdown are all set to collide, culminating in a dramatic and volatile finale.

This is a week of extremes, with a rare bearish rule putting a timer on the market, a mid-week planetary battle, and a grand, climactic power struggle on the day of the New Moon. For the prepared trader, this volatility is an opportunity. For the unprepared, it is a significant threat.

Let’s break down the astrological script to navigate the chaos and see how it is likely to impact our key markets: Nifty, Bank Nifty, Sensex, Gold, and Crude Oil.

The Overarching Theme: A Ticking Clock on a Major Move

Before we dive into specific assets, one powerful rule looms over the entire week. On Tuesday, July 22nd, we trigger Bayer Rule 2. This is a highly specific rule in financial astrology which states that when the speed difference between Mars (aggression, action) and Mercury (trading, speed) hits 59 minutes, a significant down-move is expected within the next three trading days.

This puts a bearish timer on the market. From Tuesday’s open, the clock is ticking for a potentially sharp, high-momentum decline to materialize by Friday’s close. This is our guiding bearish thesis for risk-on assets this week.

Gold: The Flight to Safety

Gold’s story this week will be the inverse of the equity markets. As a classic safe-haven asset, it is set to thrive on the very chaos and fear that will plague stocks.

-

The Narrative: Every major conflicting and bearish aspect for equities is a bullish catalyst for Gold. The week’s theme of conflict, breakdown, and power struggles is the perfect environment for capital to flee to the safety of precious metals.

-

Key Aspects: The Bayer Rule 2, which signals a stock market decline, is inherently bullish for Gold. Thursday’s deceptive rally in stocks may cause a temporary dip in Gold prices, which would likely represent a prime buying opportunity for gold bulls. Friday’s Sun-Pluto opposition is exceptionally bullish for Gold. Pluto rules underground wealth and the breakdown of traditional financial systems—the exact scenario where Gold shines brightest.

Bottom Line for Gold: The path of least resistance is firmly up. Dips should be viewed as buying opportunities. The celestial setup is perfectly aligned for a powerful rally in Gold, likely culminating in a major breakout on Friday as the equity markets face their climactic stress test.

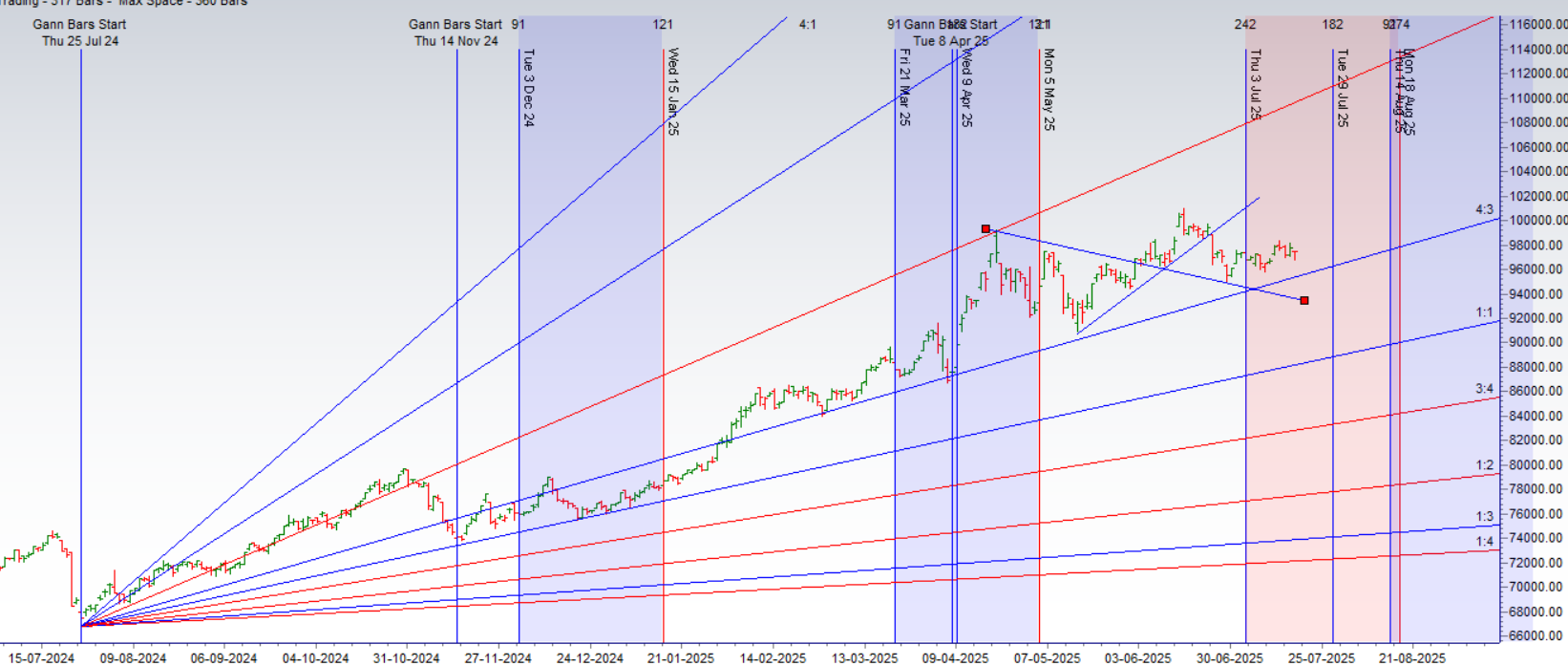

MCX GOLD Gann Angle Chart

Gold has broken above its 03 Jul Time cycle date high,heading higher towards 99k

MCX GOLD Supply Demand Zone

MCX GOLD Supply Demand Chart : Demand in range of 96000-95900 , Supply in range of 99000-99287

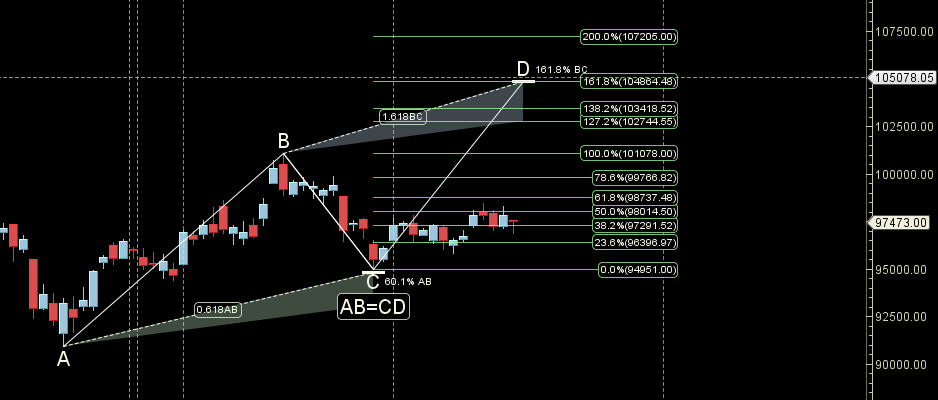

MCX GOLD Harmonic Analysis

Price has reacted from its C Leg of AB=CD heading towards 99000-99500.

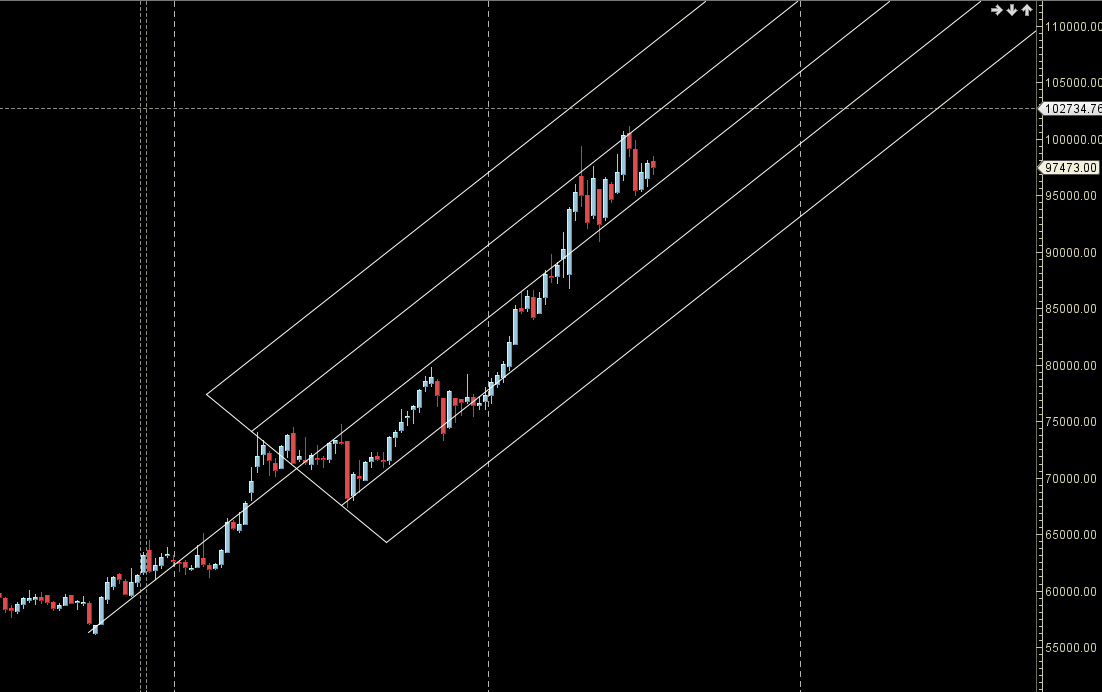

MCX GOLD Weekly

Price has formed Weekly Bullish Candel with higher high

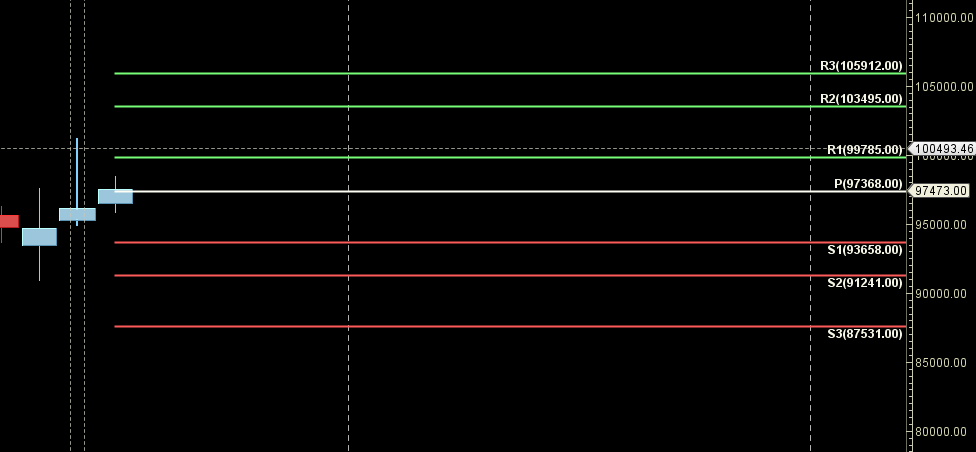

MCX GOLD Monthly

99785 Monthly Resistance and 97368 Monthly Support.

GOLD Astro/Gann Trend Change Date

Key Pivot Dates: Watch July 22

GOLD Weekly Levels

Weekly Trend Change Level:97432

Weekly Resistance:98057,98684,99314,99945

Weekly Support: 96808,96187,95568,94951

Levels Mentioned are for Current Month Future

Learn More:

W.D. Gann Trading Strategies – Learn how to decode markets using price, time, and geometry.

Trading Using Financial Astrology – Discover how planetary motion impacts market behavior and how to trade it effectively.

Ready to Trade Like a Time-Master?

Join our one-on-one mentorship to master astro-timing, Gann analysis, and institutional-grade setups.