Bank Nifty Futures Analysis: FIIs Intensify Bearish Bets with Fresh Shorts

FIIs Reinforce Bearish View on Bank Nifty

Foreign Institutional Investors (FIIs) continued to display a bearish outlook on the Bank Nifty Index Futures market. Their key actions included:

-

Net Shorting: FIIs added to their net short positions by selling 910 contracts.

-

Value of Shorts: The total value of these new short positions amounted to ₹159 crore.

-

Open Interest (OI) Movement: The market saw a significant net open interest (OI) increase of 1,604 contracts.

Analysis: Why the Rise in Open Interest is a Strong Bearish Signal

The most critical takeaway from this data is the combination of shorting and rising open interest. Here’s what it means:

-

Shorting with Rising OI = Fresh Bearish Positions: When short positions are created and the total number of open contracts (OI) increases, it indicates that new money is entering the market to build fresh bearish bets. This is a sign of strong conviction from sellers.

-

Contrasted with Short Covering: If FIIs were merely closing out old long positions, the open interest would likely decrease. The increase confirms that this is an aggressive, bearish move rather than simple profit-taking.

For traders, this action by FIIs serves as a strong signal that institutional players anticipate further downside or weakness in the banking sector.

Last Day Analysis can be read here

Indecision and Coiling Volatility in Bank Nifty

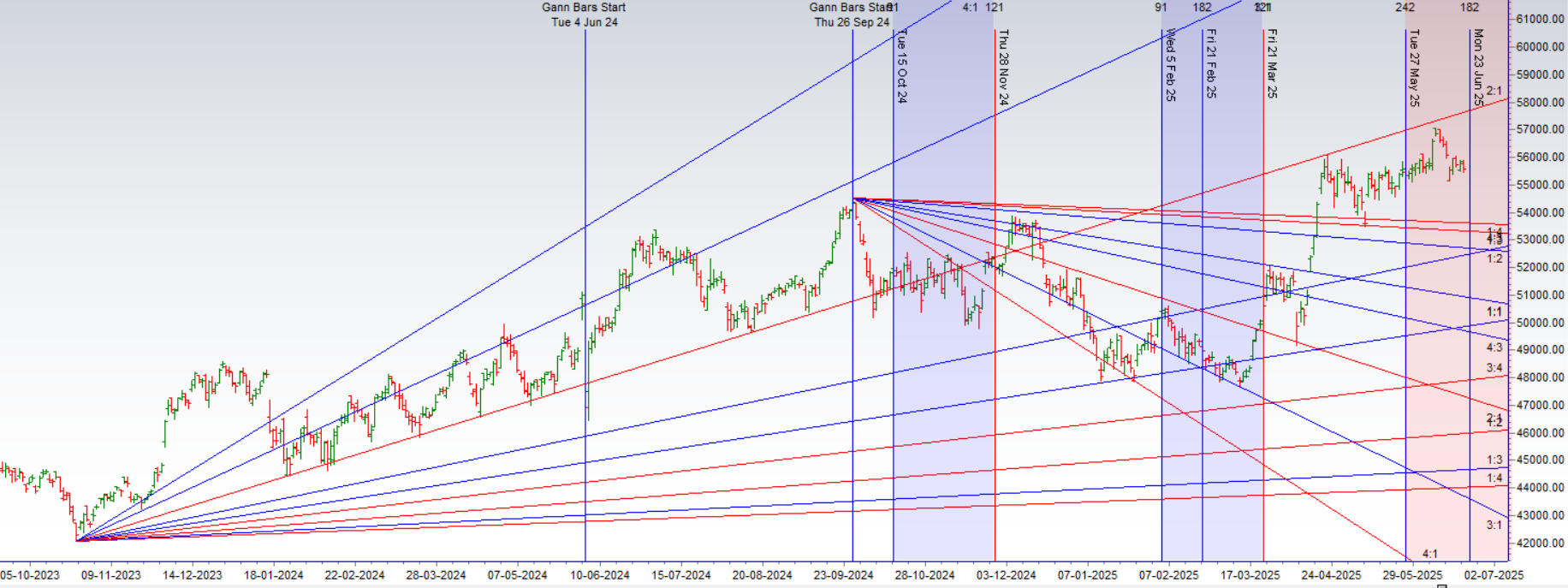

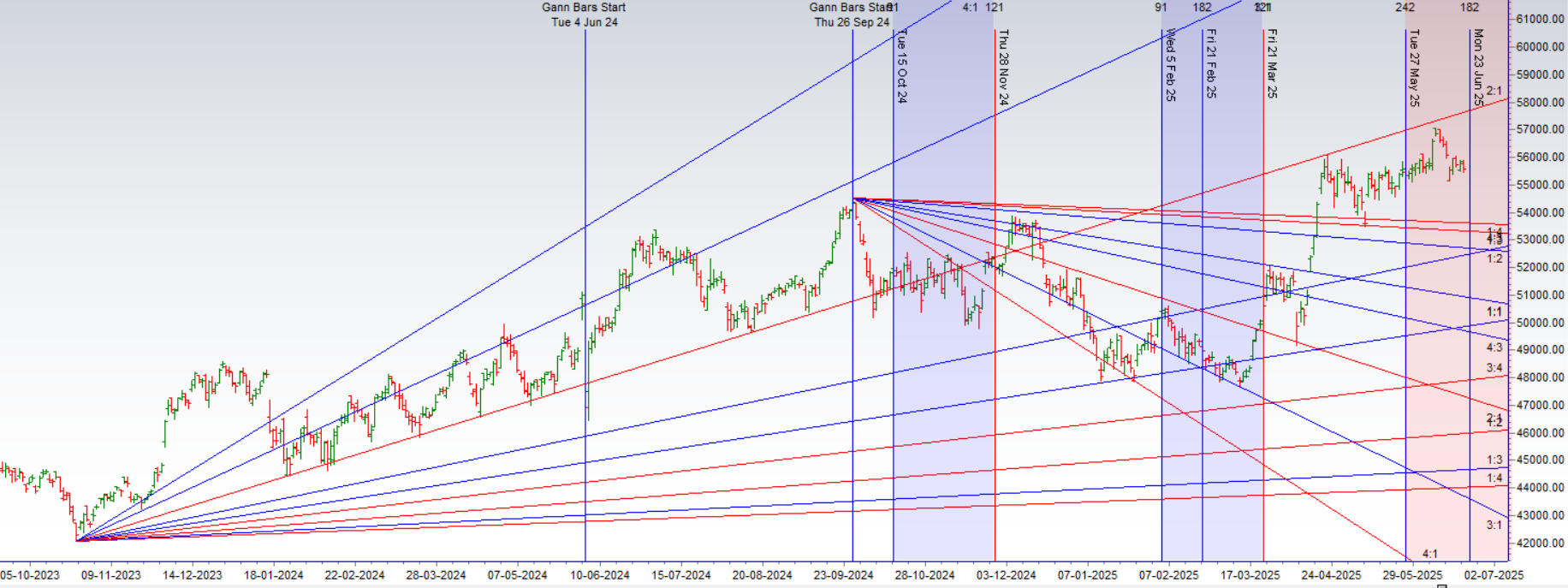

Bank Nifty is exhibiting classic signs of indecision and building energy for a potential major move. A convergence of technical patterns and timing factors suggests traders should be on high alert.

1. Technical Pattern: The Perfect Doji

-

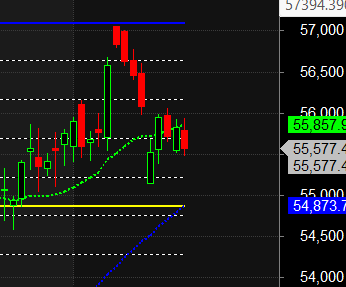

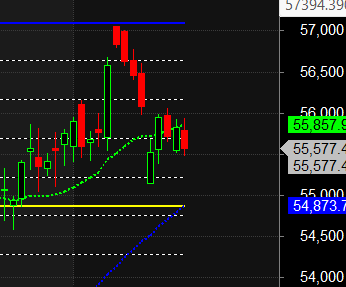

Today’s session, which coincided with an Eclipse Echo date, resulted in a perfect doji candlestick on the daily chart.

-

What it means: A doji signifies a stalemate between buyers and sellers, where the open and close prices are nearly identical. This reflects extreme market indecision and often precedes a new directional move.

2. Volatility Compression: The NR21 Pattern on the Weekly Chart

-

On the larger weekly time frame, Bank Nifty is forming an NR21 candle.

-

What it means: An NR21 (Narrow Range 21) occurs when the current week’s price range is the narrowest it has been in the last 21 weeks. This pattern signals a significant contraction in volatility. Periods of low volatility are almost always followed by periods of high volatility, meaning a powerful breakout or breakdown is likely imminent.

3. Timing and Strategy: Gann Date and Hedging

-

Adding to the significance, this weekend aligns with a Gann seasonal date, a key timing signal for traders who follow W.D. Gann’s methods.

-

Recommended Strategy: Given the high degree of uncertainty and the potential for a large gap opening next week, carrying any overnight positions with a hedge is a prudent risk management strategy.

4. The Key Level to Watch: 55,534

-

Critical Support: Bank Nifty is currently hovering just above the crucial support level of 55,534, which was the low on the day of the RBI policy announcement.

-

The Bearish Trigger: A decisive close below 55,534 would confirm a breakdown. This could trigger a swift fall towards the psychological level of 55,000 and potentially lower.

Conclusion: The combination of a daily doji, a weekly NR21 pattern, and key timing factors has put Bank Nifty in a coiled spring formation. The trigger level is clearly defined at 55,534, and a break of this support could unleash significant selling pressure.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 55889 for a move towards 56363/56839. Bears will get active below 55349 for a move towards 54909/54675/54442

Bank Nifty May Futures Open Interest Volume stood at 17.6 lakh, with liquidation of 0.48 lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a closure of LONG positions today.

Bank Nifty Advance Decline Ratio at 05:07 and Bank Nifty Rollover Cost is @55480 closed below it.

BANK Nifty Gann Monthly Buy Level : 55941

BANK Nifty Gann Monthly Buy Level : 55254

Bank Nifty closed BELOW its 20 SMA @55857,Trend is Sell on Rise till below 56000

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 53548-55141-56734. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 56000 strike, followed by the 56500 strike. On the put side, the 55500 strike has the highest OI, followed by the 55000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 55000-56000 range.

The Bank Nifty options chain shows that the maximum pain point is at 56000 and the put-call ratio (PCR) is at 0.65 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Those who succeed big at anything all have the same attitude: You keep going until it happens or you die trying. Quitting is not an option.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 56138 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 55784, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 55620 Tgt 55714, 55864 and 56008 (BANK Nifty Spot Levels)

Sell Below 55470 Tgt 55343, 55198 and 54970 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators

Related

sir,

ritical Support: Bank Nifty is currently hovering just above the crucial support level of 55,534, which was the low on the day of the RBI policy announcement.

this has been broken due to Iran….what if it escalates can 55000 be broken ?

regards

h.mehta

yes