Bank Nifty May Futures Open Interest Volume stood at 19.4 lakh, with liquidation of 0.52 lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a closure of LONG positions today.

Bank Nifty Advance Decline Ratio at 01:11 and Bank Nifty Rollover Cost is @55480 closed below it.

BANK Nifty Gann Monthly Buy Level : 55941

BANK Nifty Gann Monthly Buy Level : 55254

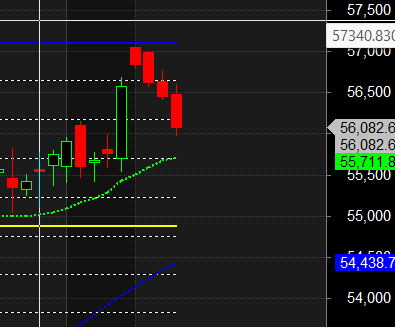

Bank Nifty closed ABOVE its 20 SMA @55711 ,Trend is Buy on Dips till above 55700

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 53548-55141-56734. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 56000 strike, followed by the 56500 strike. On the put side, the 55500 strike has the highest OI, followed by the 55000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 55000-56000 range.

The Bank Nifty options chain shows that the maximum pain point is at 56000 and the put-call ratio (PCR) is at 0.79 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Those who succeed big at anything all have the same attitude: You keep going until it happens or you die trying. Quitting is not an option.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 56287. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 56410 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 55800Tgt 55980, 56166 and 56323 (BANK Nifty Spot Levels)

Sell Below 55666 Tgt 55555, 55385 and 55127 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators