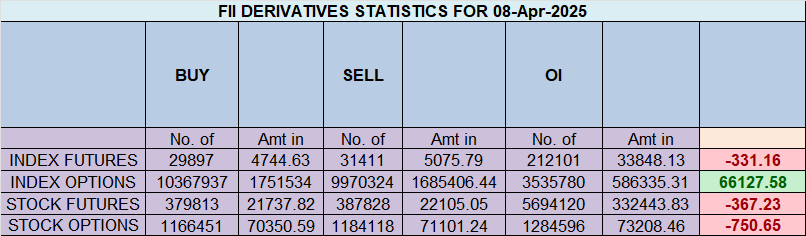

FII & Client Activity in Index Futures – April 8, 2024

Foreign Institutional Investors (FIIs) continued to maintain a bearish stance, actively shorting 5463 contracts worth ₹920 crore. This led to a net open interest increase of 4003 contracts, indicating covering of short positions

Breaking Down FII Activity

-

✔ FIIs covered: 2931 long contracts

-

✔ FIIs covered: 1417 short contracts

-

Long-to-Short Ratio: 0.32

-

Positioning: 24% Long : 76% Short

-

View: Continued pessimism, with FIIs adding significantly to shorts while trimming longs.

Client Behavior

Retail and proprietary clients showed moderate bullishness, covering longs and adding shorts

-

✔ Clients covered: 2551 long contracts

-

✔ Clients added: 344 short contracts

-

Long-to-Short Ratio: 1.33

-

Positioning: 57% Long : 43% Short

-

View: Cautiously optimistic, likely hedging positions amid upcoming RBI policy and increased volatility.

Navigating Market Corrections: A Comprehensive Guide for Investors and Traders

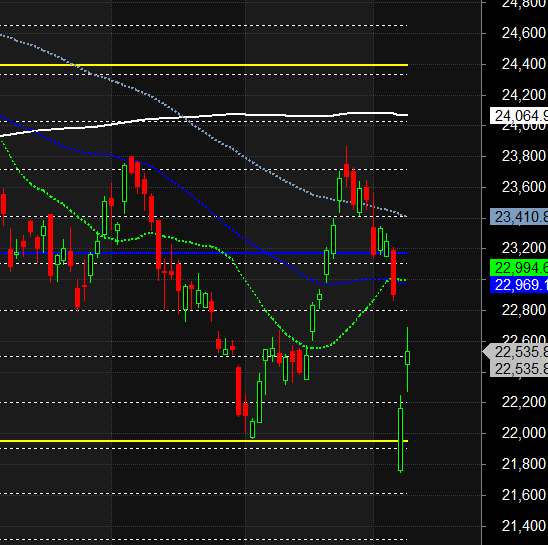

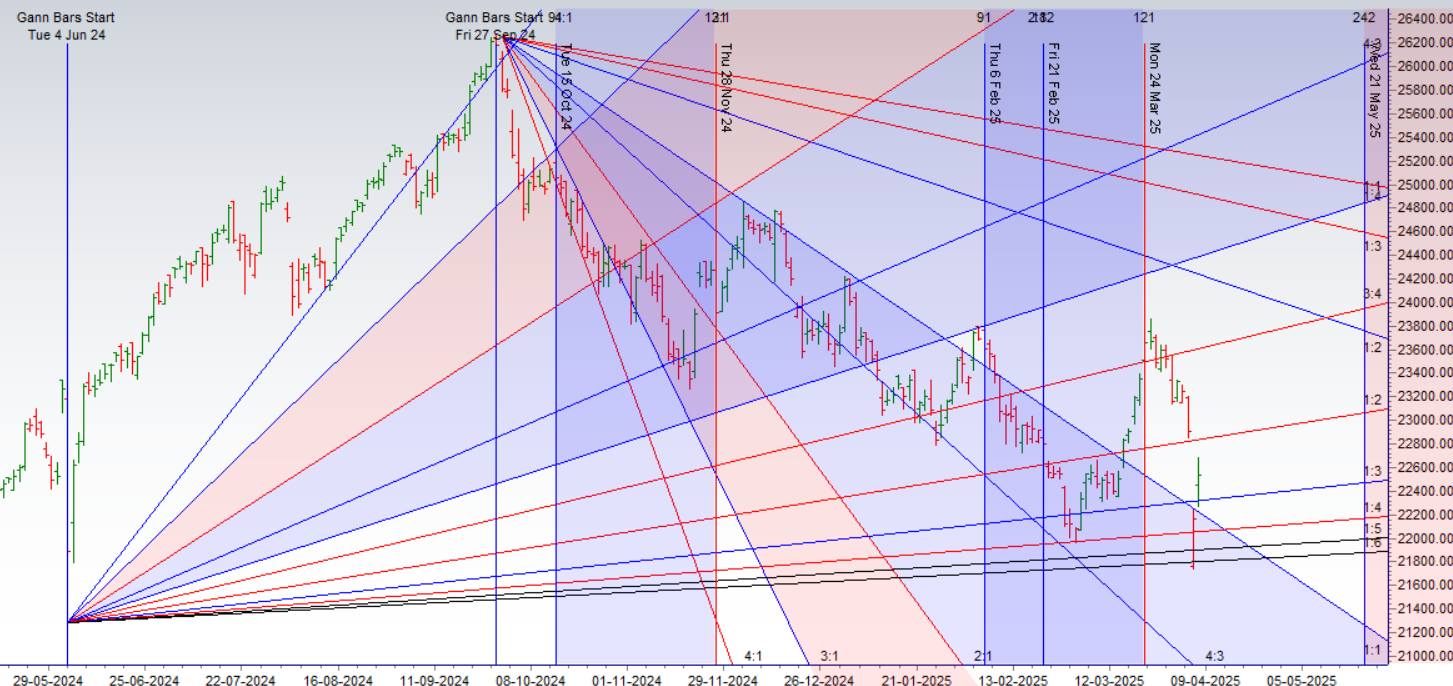

Nifty opened with a sharp gap down yesterday, formed a double bottom, and took strong support at the 1×6 Gann angle, leading to a sharp intraday recovery. Today, we’re set to open with a gap up again — but the key question remains: Can the gap sustain?

Astro Insights

-

Mercury turned direct yesterday, aligning with the recovery — once again showing how astro cycles impact market behavior.

-

Pluto Declination today could add to volatility and intraday trend shifts.

-

These cosmic shifts often coincide with turning points in the market.

Key Gann Levels & Zones

-

22336 → Monthly Gann TC (Trend Change) level — crucial to monitor throughout the day.

-

Resistance Zone: 22400–22444 → multiple technical and astro confluences.

-

Support Zone: 22200–22231 → intraday support base; if broken, may invite selling pressure.

Market Strategy

-

RBI Policy Day tomorrow → Expect cautious moves and range-bound action after gap up open.

-

Intraday traders: Watch the first 15-minute high and low to determine directional bias.

-

Sustain above 22444 → may trigger a breakout towards 22500/22610+

-

Break below 22200 → could invite profit booking or reversal.

The U.S. has imposed a steep 104% tariff on Chinese imports after Beijing refused to soften its trade stance. This is a clear escalation of the trade war, and such protectionist moves tend to act as negative sentiment drivers for global markets, including India.

Global Impact & Trading Implications

-

Trade wars historically hurt global growth and create risk-off sentiment.

-

For traders, intraday strategies are safer in such uncertain environments.

-

Carrying overnight positions is risky — hedge them properly. In volatile phases like this, the hedge often becomes more profitable than the core position.

RBI MPC Meeting – Policy Expectations

-

A 25 bps rate cut is widely expected, and markets have likely already priced it in.

-

The focus will shift to the RBI’s commentary on liquidity, inflation, and growth outlook.

️ Short Week Alert

-

Thursday is a trading holiday — expect position squaring and profit booking.

-

The last 45 minutes of today’s session will be crucial, as traders may avoid carrying risk overnight.

Key Technical Levels for Nifty

-

Bulls need a close above: 22,637 → to regain control.

-

Bears will dominate below: 22,337 → may trigger fresh downside.

-

Between 22,337–22,637: Expect continued volatile, range-bound action.

Strategy Note:

Increased global tensions + event risk (RBI Policy + holiday) = High volatility.

✅ Trade light, stay hedged, and focus on intraday setups.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 22555 for a move towards 22637/22729 Bears will get active below 22400 for a move towards 22337/22255

Traders may watch out for potential intraday reversals at 09:26,10:26,12:42,01:57,02:56 How to Find and Trade Intraday Reversal Times

Nifty April Futures Open Interest Volume stood at 1.34 lakh cr , witnessing liquidation of 4 Lakh contracts. Additionally, the decrease in Cost of Carry implies that there was closure of SHORT positions today.

Nifty Advance Decline Ratio at 49:01 and Nifty Rollover Cost is @23797 closed below it.

Nifty Gann Monthly Trade level :22336 closed above it

Nifty has closed Below its 20 SMA @ 23000 Trend has changed to Sell on Rise till below 22550

Nifty options chain shows that the maximum pain point is at 22750 and the put-call ratio (PCR) is at 0.73 .Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 22600 strike, followed by 22700 strikes. On the put side, the highest OI is at the 22400 strike, followed by 22300 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 22300-22700 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 4994 Cr , while Domestic Institutional Investors (DII) bought 3097 cr.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 22094-22751-23408-24105-24801 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

A trading strategy is the same; you need to be faithful to it for it to give back to you.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 23032. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 22574, Which Acts As An Intraday Trend Change Level.

Expiry Range

Upper End of Expiry : 22776

Lower End of Expiry : 22293

Nifty Intraday Trading Levels

Buy Above 22555 Tgt 22610, 22666 and 22729 ( Nifty Spot Levels)

Sell Below 22484 Tgt 22444, 22400 and 22343 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators