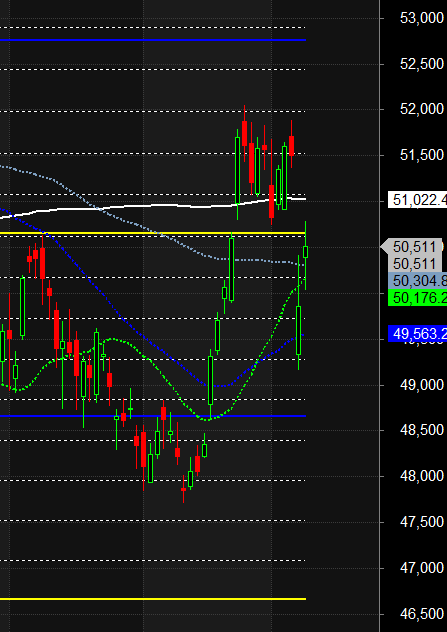

Bank Nifty took support at the Gann angle, as illustrated in the chart below. While Bank Nifty managed to hold its ground, Nifty made a fresh low, highlighting a notable divergence between the two major indices.

Key Market Insights

-

RBI Policy Day Tomorrow:

With the upcoming RBI policy announcement, expect range-bound movement as both bulls and bears may prefer to stay cautious after today’s strong gap-up. -

Astrological Confirmation:

Once again, astrology played its part in volatile conditions — the market bounced exactly after Mercury turned direct, affirming the effectiveness of planetary timing in uncertain environments. -

Pluto Declination Today:

Pluto’s declination is another critical astro event that can bring sudden reversals or momentum shifts. As always, watch the first 15-minute high and low to help define the intraday trend.

Levels to Watch

-

Support Zone: 49,900–50,000 → Bulls must defend this area post-gap-up to maintain upside momentum.

-

Upside Triggers: Sustained move above 50,250–50,500 can bring back buying interest.

-

Downside Caution: A breach below 49,800 may invite quick profit booking or sharp selling.

The U.S. has imposed a steep 104% tariff on Chinese imports after Beijing refused to soften its trade stance. This is a clear escalation of the trade war, and such protectionist moves tend to act as negative sentiment drivers for global markets, including India.

Global Impact & Trading Implications

-

Trade wars historically hurt global growth and create risk-off sentiment.

-

For traders, intraday strategies are safer in such uncertain environments.

-

Carrying overnight positions is risky — hedge them properly. In volatile phases like this, the hedge often becomes more profitable than the core position.

RBI MPC Meeting – Policy Expectations

-

A 25 bps rate cut is widely expected, and markets have likely already priced it in.

-

The focus will shift to the RBI’s commentary on liquidity, inflation, and growth outlook.

️ Short Week Alert

-

Thursday is a trading holiday — expect position squaring and profit booking.

-

The last 45 minutes of today’s session will be crucial, as traders may avoid carrying risk overnight.

Key Technical Levels for Nifty

-

Bulls need a close above: 50809→ to regain control.

-

Bears will dominate below: 50359→ may trigger fresh downside.

-

Between 50359 –50809: Expect continued volatile, range-bound action.

Strategy Note:

Increased global tensions + event risk (RBI Policy + holiday) = High volatility.

✅ Trade light, stay hedged, and focus on intraday setups.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 50359 for a move towards 50809/51261 Bears will get active below 49912 for a move towards 49466/49022.

Traders may watch out for potential intraday reversals at 09:26,10:26,12:42,01:57,02:56 How to Find and Trade Intraday Reversal Times

Bank Nifty April Futures Open Interest Volume stood at 22.4 lakh, with liquidation of 0.44 lakh contracts. Additionally, the Increase in Cost of Carry implies that there was a closeure of LONG positions today.

Bank Nifty Advance Decline Ratio at 11:01 and Bank Nifty Rollover Cost is @52173 closed below it.

Bank Nifty Gann Monthly Trade level :48414 closed above it.

Bank Nifty closed above 20 SMA @49520,Trend is Buy on Dips till above 50000

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 48521-49965-51408. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 50500 strike, followed by the 51000 strike. On the put side, the 49500 strike has the highest OI, followed by the 49000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 51000-52000 range.

The Bank Nifty options chain shows that the maximum pain point is at 51000 and the put-call ratio (PCR) is at 0.78. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

It’s not just putting in the hours that will make you successful; it’s the persistent intention to improve by examining your results, tweaking your approach, and making incremental progress.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 50982. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 50673, Which Acts As An Intraday Trend Change Level.

Intraday Levels for Bank Nifty:

Buy Above 50478 Tgt 50701, 50925 and 51149 ( Bank Nifty Spot Levels)

Sell Below 50254 Tgt 50030, 49822 and 49600 (Bank Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

► Join Youtube channel : Click here

► Check out Gann Course Details: W.D. Gann Trading Strategies

► Check out Financial Astrology Course Details: Trading Using Financial Astrology

► Check out Gann Astro Indicators Details: Gann Astro Indicators