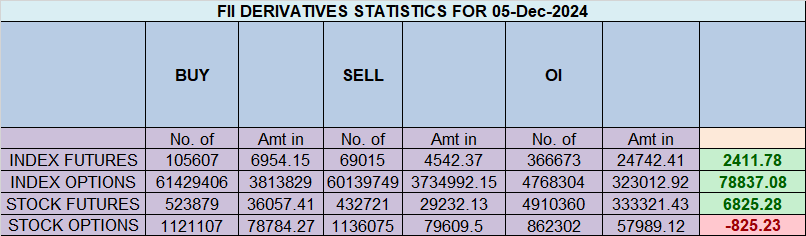

FII Activity: Bullish Sentiment in Nifty Index Futures

Foreign Institutional Investors (FIIs) displayed a bullish approach in the Nifty Index Futures market by buying 29,832 contracts worth ₹1,857 crores. This resulted in an increase of 22,928 contracts in the net open interest.

FIIs added 27,941 long contracts and covered 9,225 short contracts, reflecting a preference for building long positions while reducing their short exposure in Nifty Futures. With a net FII long-short ratio of 0.49, it is evident that FIIs strategically utilized the market rise to enter long positions while exiting shorts.

On the other hand, Clients covered 45,919 long contracts and 6,353 short contracts, indicating a shift toward covering both long and short positions.

Current Positioning in Index Futures:

- FIIs: Holding 44% long and 56% short positions.

- Clients: Holding 58% long and 42% short positions.

Analysis:

This data highlights a bullish sentiment from FIIs, as they actively increased their long positions while reducing shorts, showing confidence in the market’s upward trajectory. Meanwhile, clients have reduced their exposure on both the long and short sides, signaling a cautious approach.

Traders should pay close attention to these shifts in positioning, as they could shape market dynamics in the coming sessions.

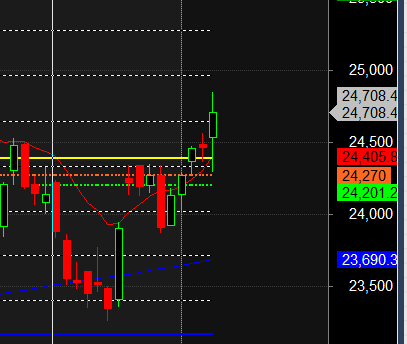

Nifty formed a perfect Doji on an important Gann Anniversary Date, as highlighted in the video below. Doji patterns on Astro or Gann dates are often among the most profitable trade setups, as they offer small stop-losses and excellent risk-to-reward opportunities.

Key Levels to Watch:

- For Bulls: The 24,366-24,389 range must be held during any dips. If this support level is defended, the rally could extend toward the 24,700-24,779 range.

- For Bears: A close below 24,270 could trigger a quick fall toward 24,144/24,040.

Key Reminder for Traders:

- Important Astro Dates: Several significant astrological dates coincide with 6th December, the day of the RBI policy announcement, which could result in heightened volatility.

- Hedge Overnight Positions: To manage risks, avoid carrying overnight positions on 6th December without proper hedging.

Conquering Fear in Trading: Overcoming Emotional Traps to Build a Successful Trading Career

One of the Most Insanely Volatile Days in Market History

NIFTY saw unbelievable swings:

- -244

- +562

- -362

- +265Nifty has been rallying, and we’ve been on the right side of the trade, capitalizing on the trend based on our Astro and Gann cycles, as explained in the videos below.

Tomorrow brings important astrological events, including:

- Mercury at Inferior Conjunction

- Mercury at Perihelion

- Sun Conjunct Mercury

- Mars Ingress

These alignments suggest that we are in for another volatile session.

Key Levels to Watch:

- Bulls need to defend the 24,600 level. If this support holds, the rally may continue.

- If 24,600 breaks, bears could gain control, especially after the RBI policy announcement, leading to potential selling pressure.

Caution:

This could play out as a classic case of “Buy the Rumor, Sell the News”, so traders should prepare for heightened volatility and manage positions carefully.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 24763 for a move towards 24841/24919/25000. Bears will get active below 24607 for a move towards 24529/24451/24373.

Traders may watch out for potential intraday reversals at 09:19,10:55,12:22,01:35,02:36 How to Find and Trade Intraday Reversal Times

Nifty December Futures Open Interest Volume stood at 1.11 lakh cr , witnessing liquidation of 3.7 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was liquidation of SHORT positions today.

Nifty Advance Decline Ratio at 41:09 and Nifty Rollover Cost is @25178 closed below it.

Nifty Gann Monthly Trade level :24201 close above it.

Nifty has closed below its 20 SMA @ 24200 Trend is Buy on Dips till holding 24200.

Nifty options chain shows that the maximum pain point is at 24600 and the put-call ratio (PCR) is at 0.92Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 24800 strike, followed by 25000 strikes. On the put side, the highest OI is at the 24500 strike, followed by 24400 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24500-25000 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 8539 crores, while Domestic Institutional Investors (DII) sold 2303 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23218-23889-24600-25310 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Don’t trade when you’re tired or emotional. (angry and upset) Trading is a complex activity, and it’s important to be mentally sharp when you’re trading. If you’re tired or emotional, it’s best to take a break from trading.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 24432. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 24694, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 24729 Tgt 24777, 24816 and 24888 ( Nifty Spot Levels)

Sell Below 24666 Tgt 24616, 24575 and 24515 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.