Foreign Institutional Investors (FIIs) exhibited a Bullish Stance in the Bank Nifty Index Futures market by Buying 13511 contracts with a total value of 1031 crores. This activity led to a decrease of 4863 contracts in the Net Open Interest.

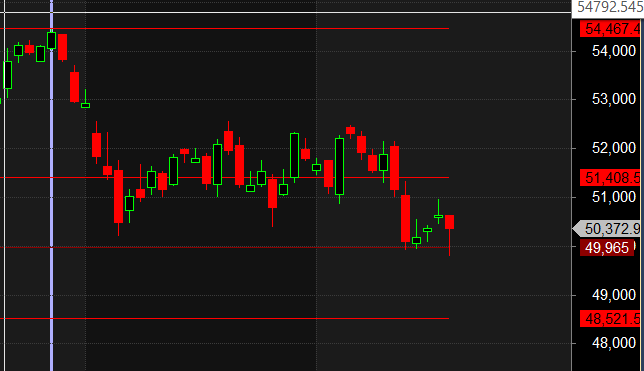

Bank Nifty saw a decline due to the Adani News, but the price managed to hold its 200 DMA. With the Sun entering Sagittarius, a bullish zodiac sign, the bulls may attempt a comeback today. Since today marks the weekly close, the bulls will aim to close within the 50666-50729 range.

The 25th is a critical astro date, so it is advisable to carry overnight positions with proper hedging. Keep an eye on HDFC AND ICICI Stock.

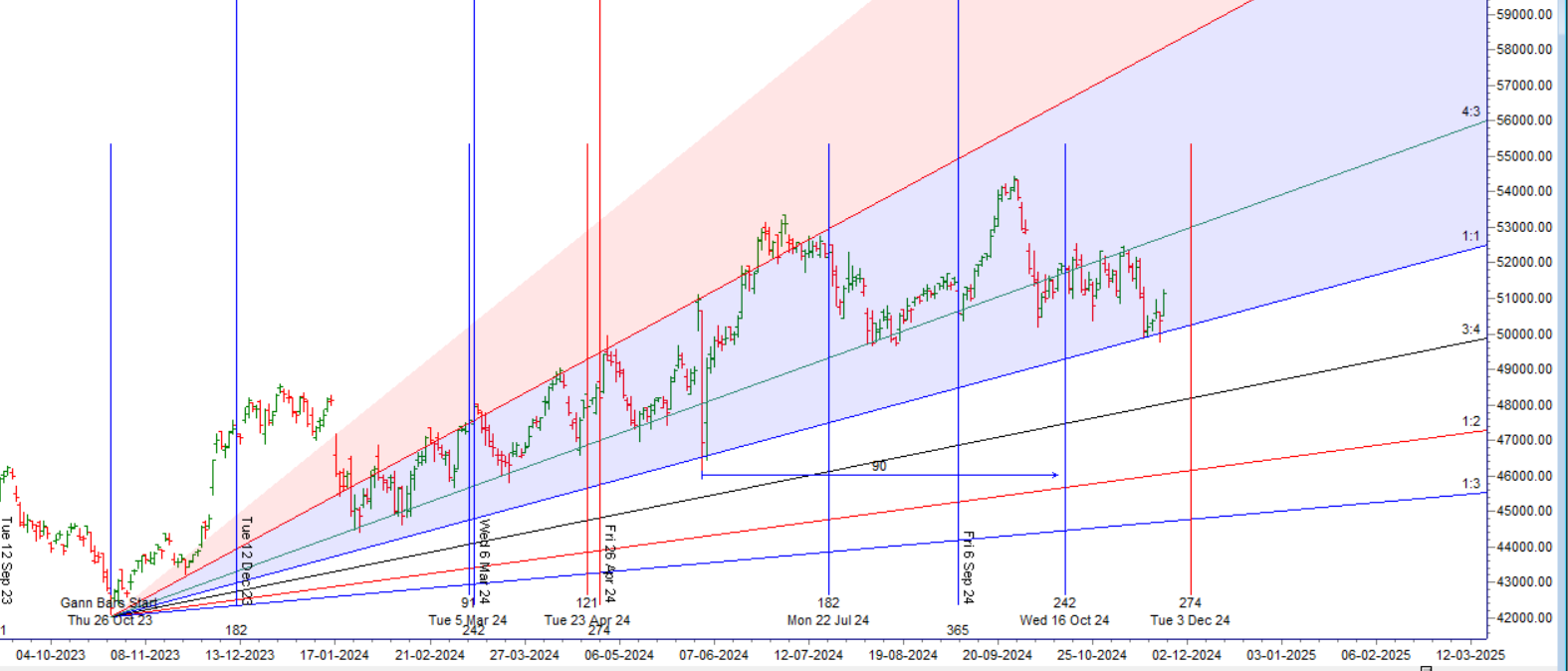

Bank Nifty saw a perfect bounce from the 200 SMA and Gann Angle, forming a textbook price-time squaring, as shown in the chart below. This alignment highlights the precision of Gann levels, offering a strong indication of market direction. Additionally, with the Sun entering Sagittarius, a bullish zodiac sign, bulls regained momentum on Friday, as discussed in the video.

The 51796-51850 range is now a crucial resistance zone for Bank Nifty. If bulls manage to close above this level, the price is expected to rally toward the 52330-52400 range, making it a critical level to watch for traders.

Political Impact: Maharashtra Election and Market Stability

Maharashtra, often referred to as the financial capital of India, plays a pivotal role in shaping the country’s political and economic landscape. The recent BJP-led NDA victory in Maharashtra reinforces political stability, a key factor for market sentiment.

Political stability ensures policy continuity and fosters confidence among both domestic and foreign investors. This stability supports sectors tied to Maharashtra’s economy, such as infrastructure, banking, and real estate, strengthening the broader market outlook.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 51910 for a move towards 52136/52361/52587.Bears will get active below 51684 for a move towards 51458/51232/51006.

Traders may watch out for potential intraday reversals at 10:56,11:46,12:32,01:28,02:12 How to Find and Trade Intraday Reversal Times

Bank Nifty November Futures Open Interest Volume stood at 23.8 lakh, with liquidation of 1.3 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a covering of SHORT positions today.

Bank Nifty Advance Decline Ratio at 11:01 and Bank Nifty Rollover Cost is @52026 closed below it.

Bank Nifty Gann Monthly Trade level :51617 closed below it.

Bank Nifty closed below its 100 SMA @51288 Trend is Buy on Dips till above 50500. 200 SMA @49811

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 51724-53263-54801. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 52000 strike, followed by the 525000 strike. On the put side, the 51500 strike has the highest OI, followed by the 51000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 51500-52500 range.

The Bank Nifty options chain shows that the maximum pain point is at 52000 and the put-call ratio (PCR) is at 0.85 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

If there were no goals in football, there would beno one go into the stadium and watch the mere running back and forth. Without goal results, success in football would be unthinkable and not measurable. Most of them play football here, just without goals and without a ball.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 51485. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 50968 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 51973 Tgt 52086, 52200 and 52325 ( BANK Nifty Spot Levels)

Sell Below 51860 Tgt 51747, 51633 and 51520 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.