Foreign Institutional Investors (FIIs) exhibited a Bearish Stance in the Bank Nifty Index Futures market by Shorting 16629 contracts with a total value of 1254 crores. This activity led to a increase of 12285 contracts in the Net Open Interest.

Bank Nifty opened with a gap-up but was quickly sold into, as the price was unable to breach the high of the first 15 minutes. Once the Outside Bar low was broken, a waterfall decline followed. In the last 30 minutes, we witnessed a decline of over 200 points, likely due to insiders anticipating the hotter-than-expected inflation data, which came in at 6.21%.

We had anticipated heightened volatility due to Rahu’s aspect on the market. The decline was largely driven by HDFC Bank and SBIN. As explained in the video below, Rule No. 38: Mercury Latitude Heliocentric states that “Significant tops and bottoms are often produced when Mercury, in this motion, passes certain degrees,” indicating that today could be a potential turning point. The selling pressure in HDFC Bank and SBIN can be attributed to Foreign Institutional Investors (FII) offloading their core holdings, which they had initially bought as a hedge against weekly expiry.

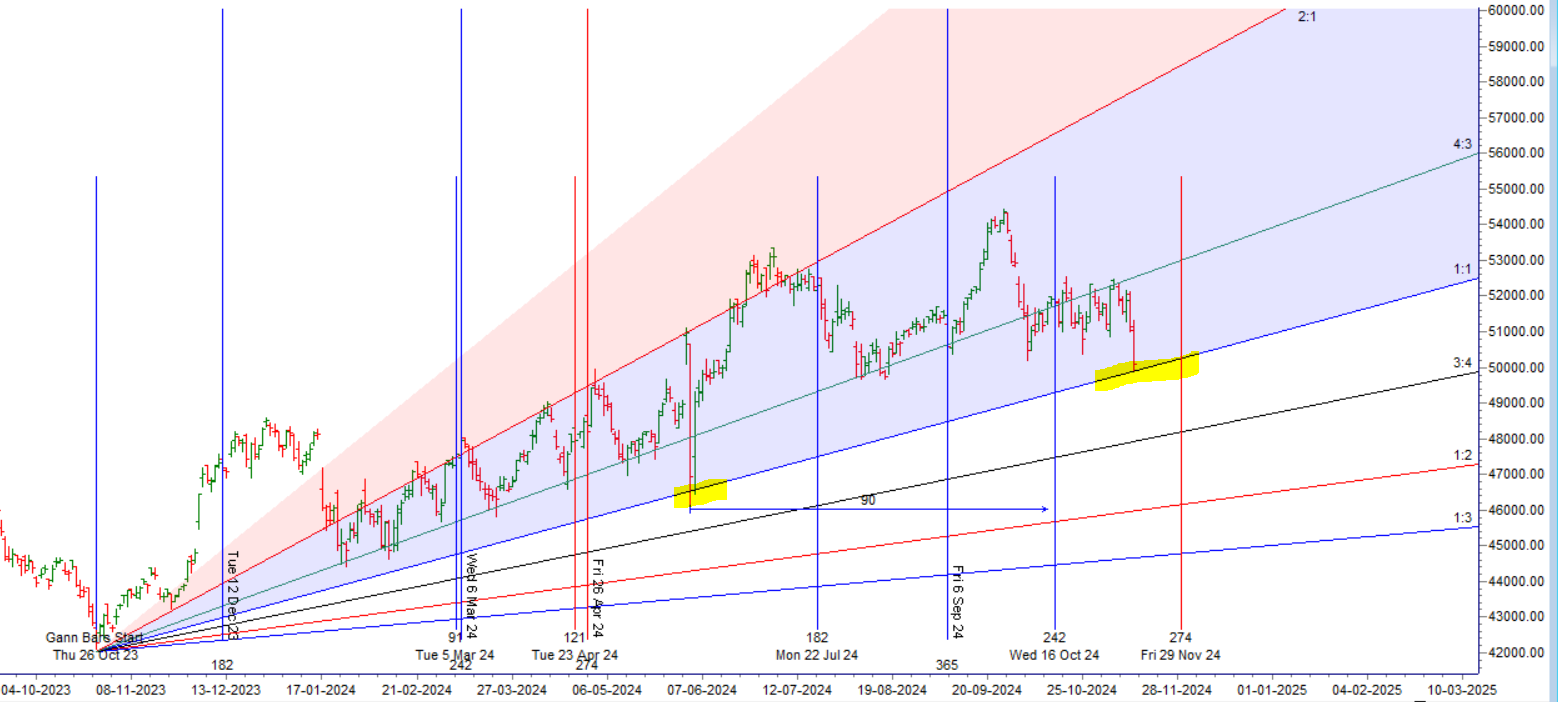

Currently, the price has returned to its 1×2 Gann angle support level. A breakdown below this support for two consecutive days could open up further downside potential, possibly targeting the 49,656-49,800 range.

Bank Nifty experienced a waterfall decline today showing the impact of astro date as discussed in below vidro, with the price breaking below 07 October Low of 50194. The price is back to its gann angle support of 1×1.

Tomorrow, we have the weekly close (as Friday is a trading holiday), Bulls will like to get support in range of 49676-49700 range . The second half of tomorrow’s session is crucial, as it could lead to short covering if the price holds above 50194.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 50220 for a move towards 50447/50673/50900.Bears will get active below 49993 for a move towards 48767/48540

Traders may watch out for potential intraday reversals at 09:47,10:51,11:59,02:16 How to Find and Trade Intraday Reversal Times

Bank Nifty November Futures Open Interest Volume stood at 29.4 lakh, with liquidation of 0.27 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Bank Nifty Advance Decline Ratio at 00:12 and Bank Nifty Rollover Cost is @52026 closed below it.

Bank Nifty Gann Monthly Trade level :51617 closed below it.

Bank Nifty closed below its 100 SMA @51617 Trend is Sell on Rise till below 50500. 200 SMA @49676

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 48819-50271-51724. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 50500 strike, followed by the 51000 strike. On the put side, the 50000 strike has the highest OI, followed by the 49500 strike.This indicates that market participants anticipate Bank Nifty to stay within the 49500-50500 range.

The Bank Nifty options chain shows that the maximum pain point is at 50000 and the put-call ratio (PCR) is at 0.62. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

To create money management, position size calculation or the elaboration of a profitable set of rules. All of these very useful tools are of little help if you are not able to use them in a disciplined manner

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 51222. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 50780, Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 50270 Tgt 50448, 50628 and 50888 ( BANK Nifty Spot Levels)

Sell Below 50000 Tgt 49729, 49555 and 49323 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.