Introduction

As the United States gears up for its election, the world watches closely, especially nations like India. The outcome of the U.S. presidential race can significantly influence global markets, including those in India. In this article, we will explore the candidates—Donald Trump and Kamala Harris—analyze their policies, and forecast their potential impacts on the Indian economy and stock markets.

Why the U.S. Election Matters to India

The United States is not just the world’s largest economy; it is also one of India’s key trading partners. The election results can sway trade policies, technology partnerships, and geopolitical alliances. Thus, Indian investors must keep an eye on the candidates’ positions on crucial issues such as trade, technology, and foreign policy.

Candidate Profiles: Trump vs. Kamala Harris

Donald Trump: The Incumbent

Background: Donald Trump, a businessman and reality TV star turned politician, is seeking re-election. His administration has focused on “America First” policies, impacting international relations and trade agreements.

Key Policies:

- Trade: Advocates for reducing trade deficits, especially with countries like China. His administration previously imposed tariffs that impacted global supply chains, including those in India.

- Technology: Emphasizes protecting American intellectual property and is wary of Chinese tech dominance. This can influence the Indian IT sector, which relies on U.S. clients.

- Immigration: Aims to reduce immigration, impacting skilled worker visas, essential for the Indian tech industry.

Kamala Harris: The Challenger

Background: Kamala Harris, the first female vice president and a senator from California, brings a progressive approach to governance, emphasizing equality and social justice.

Key Policies:

- Trade: Supports multilateral trade agreements and is likely to strengthen ties with allies, including India.

- Technology: Advocates for robust regulations on tech giants and increased investment in clean energy technologies, opening avenues for collaboration with India.

- Immigration: Plans to reform immigration policies to support skilled immigrants, benefiting Indian professionals.

Comparative Analysis of Candidates’ Policies

To understand how these candidates might influence India, we’ll compare their policies side-by-side:

| Policy Area | Donald Trump | Kamala Harris |

|---|---|---|

| Trade | Focus on reducing deficits; tariffs on imports | Supports multilateral agreements; pro-India |

| Technology | Emphasizes IP protection; cautious of China | Advocates regulation; investment in green tech |

| Immigration | Restrictive; limits skilled visas | Reformative; supports skilled immigrants |

| Foreign Policy | Nationalistic; favors bilateral over multilateral | Collaborative; strengthens alliances |

Infographic: Key Policies of Trump and Harris

| Policy Area | Donald Trump | Kamala Harris |

|---|---|---|

| Tax Policy | – Tax Cuts and Jobs Act (2017) reducing corporate tax rate to 21% – Focus on tax cuts to stimulate economy |

– Support for progressive taxation – Advocates for closing tax loopholes |

| Trade Policy | – America First trade policy – Imposition of tariffs on China and India – Renegotiation of trade agreements |

– Focus on equitable trade – Strengthening ties with allies, including India |

| Healthcare | – Attempts to repeal Affordable Care Act – Emphasis on private sector solutions |

– Expand ACA and access to affordable healthcare – Support for public option |

| Climate Change | – Rollback of environmental regulations – Withdrawal from Paris Agreement |

– Comprehensive climate change plan – Investments in renewable energy and infrastructure |

| Economic Recovery | – Focus on rapid economic recovery post-COVID-19 – Deregulation to boost growth |

– Sustainable and inclusive recovery – Federal investments in green jobs |

Potential Market Reactions in India

Sectoral Impacts

1. Information Technology (IT)

- Trump: His focus on American jobs might lead to restrictions on outsourcing, impacting Indian IT companies that depend on U.S. clients.

- Harris: A potential increase in H-1B visas could benefit Indian IT firms, fostering growth and investment in technology partnerships.

2. Pharmaceuticals

- Trump: May push for reduced drug prices in the U.S., affecting Indian pharma exports.

- Harris: Likely to support Indian pharmaceutical companies’ access to the U.S. market, promoting collaboration on healthcare initiatives.

3. Defense

- Trump: His administration has favored defense ties with India, which could continue.

- Harris: A focus on strategic partnerships may strengthen defense cooperation, benefiting the Indian defense sector.

Market Expectations: Nifty and Sensex

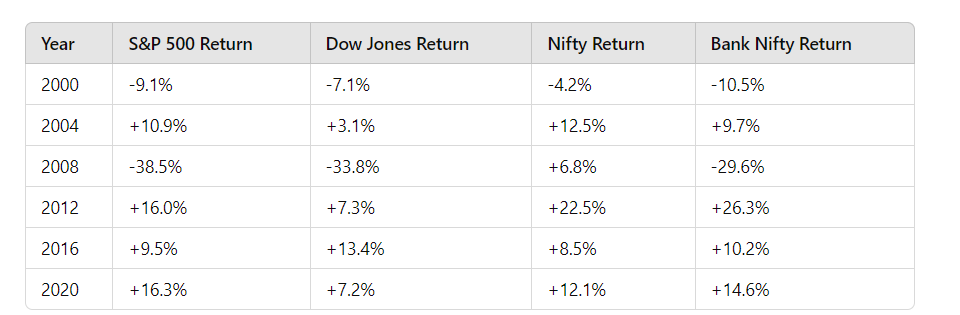

The outcome of the U.S. election can lead to significant movements in Indian markets. A study of past election cycles shows varying impacts:

Market Trend Charts

Historical Market Performance During U.S. Elections

- 2016 Election (Trump vs. Clinton)

- Market Reaction: After Trump’s win, the S&P 500 rose approximately 5% in the week following the election.

- Key Drivers: Anticipation of tax cuts and deregulation.

- 2020 Election (Biden vs. Trump)

- Market Reaction: The S&P 500 was volatile leading up to the election, but surged post-election, closing around 3% higher in the following week.

- Key Drivers: Stimulus package anticipation and vaccine news.

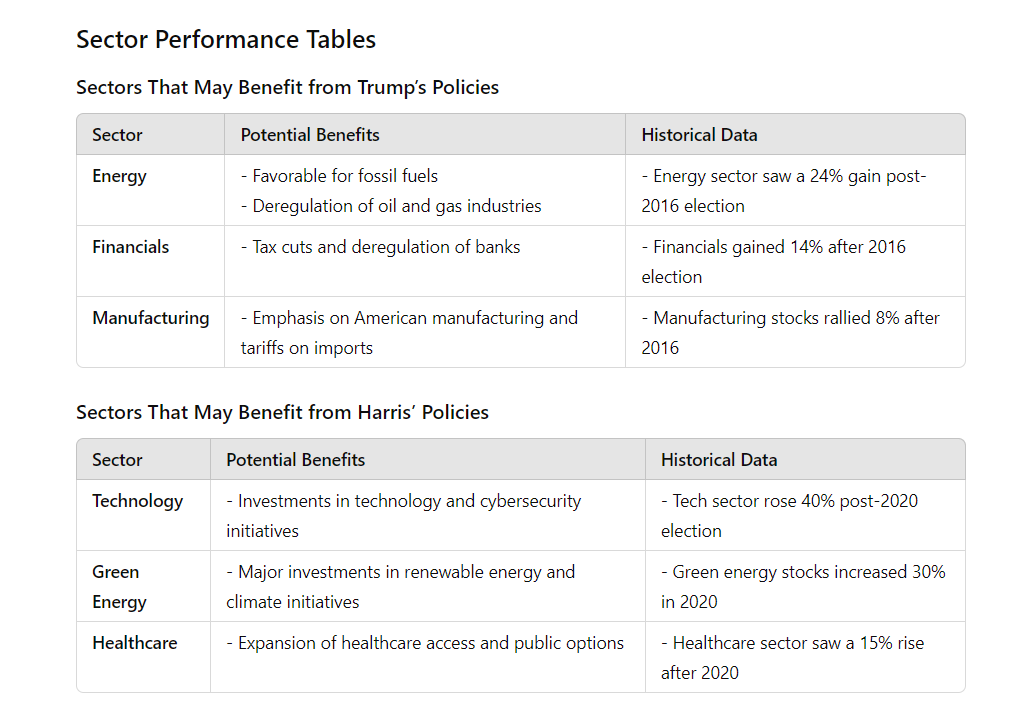

Sector Performance Tables

Sectors That May Benefit from Trump’s Policies

| Sector | Potential Benefits | Historical Data |

|---|---|---|

| Energy | – Favorable for fossil fuels – Deregulation of oil and gas industries |

– Energy sector saw a 24% gain post-2016 election |

| Financials | – Tax cuts and deregulation of banks | – Financials gained 14% after 2016 election |

| Manufacturing | – Emphasis on American manufacturing and tariffs on imports | – Manufacturing stocks rallied 8% after 2016 |

Sectors That May Benefit from Harris’ Policies

| Sector | Potential Benefits | Historical Data |

|---|---|---|

| Technology | – Investments in technology and cybersecurity initiatives | – Tech sector rose 40% post-2020 election |

| Green Energy | – Major investments in renewable energy and climate initiatives | – Green energy stocks increased 30% in 2020 |

| Healthcare | – Expansion of healthcare access and public options | – Healthcare sector saw a 15% rise after 2020 |

This table indicates that markets have historically reacted positively to Trump’s policies, which could hint at investor confidence in his potential re-election.

Geopolitical and Economic Scenarios

India-U.S.-China Relations

The U.S. election outcome can shift the balance in international relations. With China being a key competitor for both candidates, the approaches to trade and foreign policy could influence India’s strategic positioning:

- Trump’s Policies: Likely to focus on confronting China, which may benefit India as the U.S. seeks allies in the region.

- Harris’s Policies: Could foster a more collaborative approach to countering China, strengthening partnerships with India.

Investor Takeaways

For Indian investors, the electoral outcome may present opportunities or challenges depending on the candidate. Here’s a summary of possible investment strategies:

| Investment Type | Under Trump | Under Harris |

|---|---|---|

| Equities | Focus on sectors benefiting from national policies | Diversify into sectors with global collaborations |

| Bonds | Monitor U.S. bond rates; potential volatility | Stable U.S. bond market; safer investments |

| Gold | May increase as a safe haven during uncertainty | Stability might reduce gold prices |

Conclusion

As Indian investors prepare for the U.S. election, understanding the candidates’ policies is crucial. Whether Trump or Harris wins, the implications for the Indian economy are significant. Investors must remain vigilant, ready to adapt their strategies based on the election’s outcome and its ripple effects on the global market.

Final Thoughts

The U.S. election is not just a political event; it’s a global economic turning point that could reshape the financial landscape. With the potential to influence markets, trade, and international relations, this election warrants careful observation from investors in India. By analyzing the candidates’ policies and anticipating market reactions, Indian investors can position themselves for success in the coming months.

Thank you for this detailed information.