Foreign Institutional Investors (FIIs) exhibited a Bullish Stance in the Bank Nifty Index Futures market by Buying 8032 contracts with a total value of 651 crores. This activity led to a decrease of 3396 contracts in the Net Open Interest.

We saw volatlity today with nifty making a new life high and got sold off from morning high after forming double top. Mid and Small cap bore the brunt with a sharp decline and also recovery in the fag end session showing impact of Uranus. Bulls till holding 52777-52800 range have upper hand to make another rally towards 53500-54000 range. Bulls need to break 53353 in next 2 trading session else bears once below 52777 can cause serious damage.

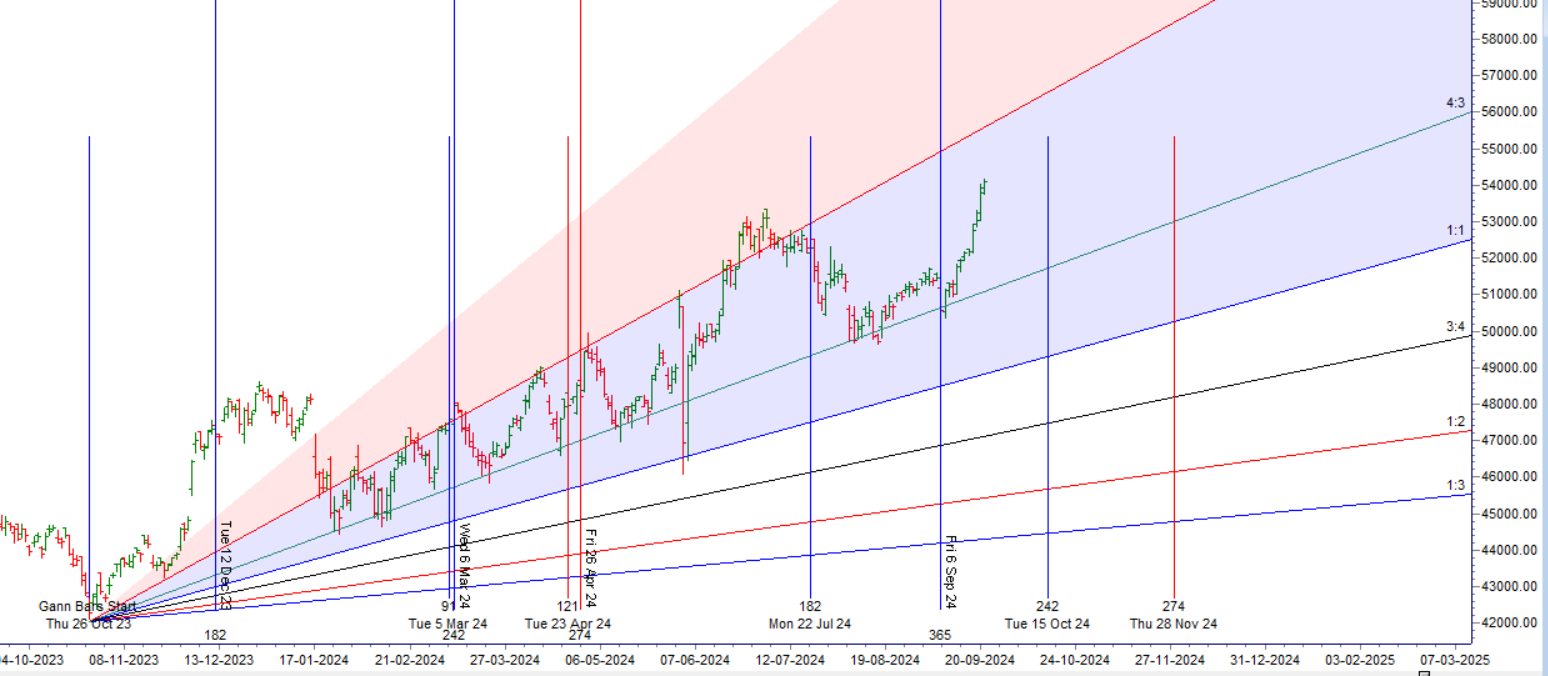

Bank Nifty continued its rally to the upside, rising for the 8th day in a row. Price is also approaching important Gann angle resistance in the 54800-54872 range, which could be a potential zone for profit booking.

Today, we have Venus Ingress into Scorpio, which falls under a Water Sign and is bearish in nature. Additionally, “RULE NO. 40 VENUS HELIOCENTRIC LATITUDE DIVIDED INTO PARTS 0*0’ 2*30’ 0*13’ 3*00’ 1*50’ 3*17’ 2*17’ 3*23’” will come into effect. Only a break below 53741 will signal a reversal.

Also, according to the Gann Rule: If a price rises for 9 consecutive days in a stretch, there is a high probability of a correction lasting for 5 consecutive days (Ratio 9:5) — this rule is expected to come into effect tomorrow.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 54189 for a move towards 54419/54649/54880 .Bears will get active below 53958 for a move towards 53728/53498/53267

Traders may watch out for potential intraday reversals at 10:47,11:09,12:46,01:48,02:17 How to Find and Trade Intraday Reversal Times

Bank Nifty September Futures Open Interest Volume stood at 14.7 lakh, with liquidation of 2.8 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a covering of LONG positions today.

Bank Nifty Advance Decline Ratio at 10:02 and Bank Nifty Rollover Cost is @51260 closed above it.

Bank Nifty Gann Monthly Trade level :52751 closed above it.

Bank Nifty closed above its 50 SMA @51800 Trend is Buy on Dips.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 48819-50271-51724-53263. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 54300 strike, followed by the 54500 strike. On the put side, the 53500 strike has the highest OI, followed by the 53000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 53500 -54500 range.

The Bank Nifty options chain shows that the maximum pain point is at 54000 and the put-call ratio (PCR) is at 1.3 . Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

The biggest The trader’s enemy is fear, Fear generates thoughts and Reactions. And these thoughts and reactions cause when trading often behaviour that leads to unsuccessful behaviour. That is why there is fear the greatest hindrance to success in trading.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 51934. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 53981, Which Acts As An Intraday Trend Change Level.

Bank Nifty Intraday Trading Levels

Buy Above 54200 Tgt 54325, 54471 and 54610 ( Bank Nifty Spot Levels)

Sell Below 54000 Tgt 53840, 53610 and 53444 (Bank Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.