Foreign Institutional Investors (FIIs) exhibited a Bearish Stance in the Bank Nifty Index Futures market by Shorting 1934 contracts with a total value of 153 crores. This activity led to a increase of 3280 contracts in the Net Open Interest.

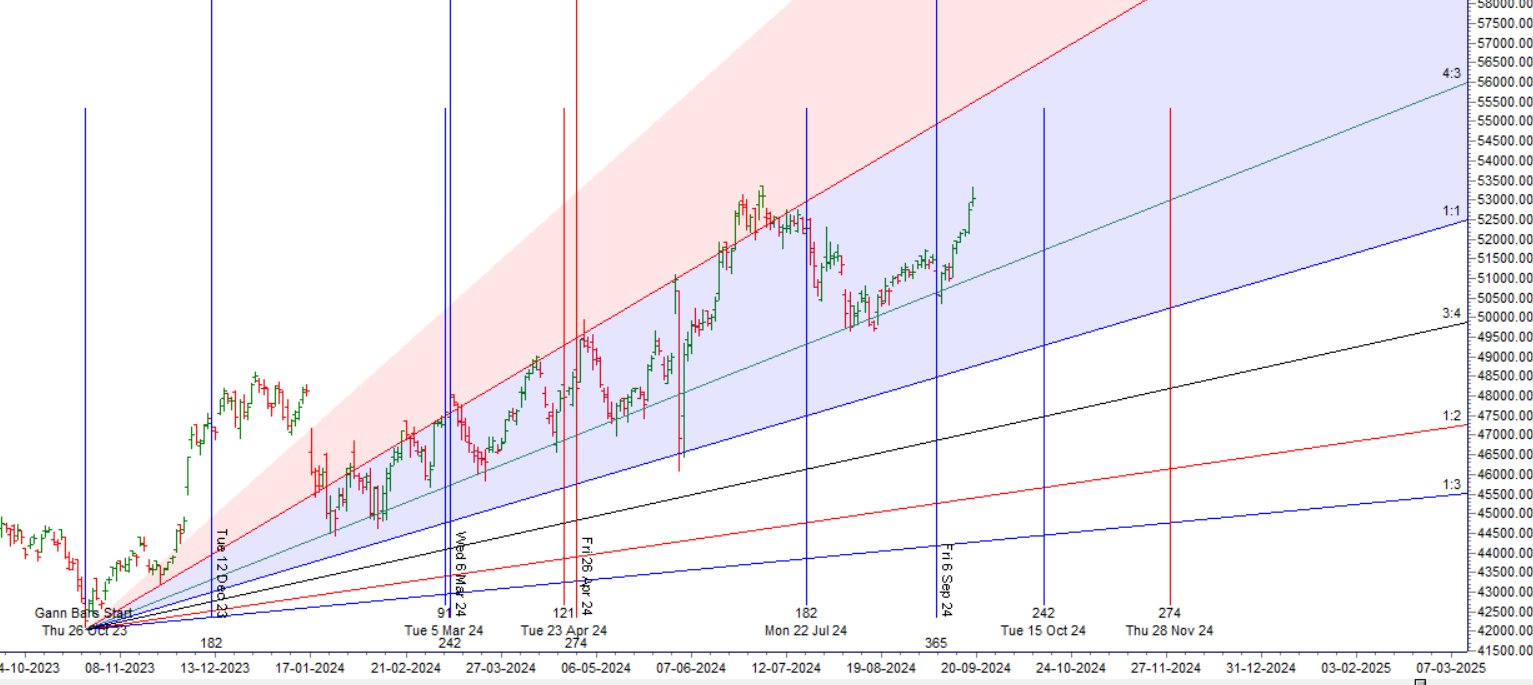

Bank Nifty broke out of the NR21 pattern on the upside and delivered the big move we were expecting. The US Fed has cut interest rates by 50 BPS, and tomorrow we have the Sun Trine Uranus aspect, which is crucial for the indices, as discussed in the video below.

The Sun trine Uranus is an aspect often associated with breakthroughs, sudden changes, and innovation. This aspect can indicate unexpected shifts or positive surprises. In financial astrology, Uranus governs sudden disruptions and the breaking of old patterns, while the Sun symbolizes vitality and central authority. When they form a harmonious trine, it can lead to market optimism, technological breakthroughs, or shifts in leadership and policy that affect investor sentiment.

However, these surprises can sometimes trigger volatility or trend reversals, especially when Uranus is involved, as markets may react unpredictably to new developments.

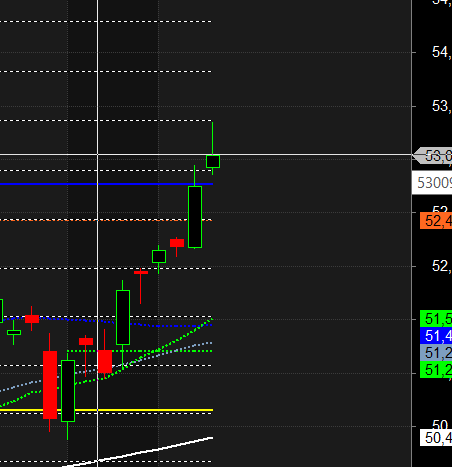

Bulls need to hold 52,434 for a move towards the all-time high of 53,357. Any break below 52,400 could lead to a quick fall towards 52,000/51,750.

We saw volatlity today with nifty making a new life high and got sold off from morning high after forming double top. Mid and Small cap bore the brunt with a sharp decline and also recovery in the fag end session showing impact of Uranus. Bulls till holding 52777-52800 range have upper hand to make another rally towards 53500-54000 range. Bulls need to break 53353 in next 2 trading session else bears once below 52777 can cause serious damage.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 53226 for a move towards 53454/53683/53911 .Bears will get active below 52891 for a move towards 52660/52429/52198

Traders may watch out for potential intraday reversals at 09:49,11:23,12:34,01:59,02:35 How to Find and Trade Intraday Reversal Times

Bank Nifty September Futures Open Interest Volume stood at 19.3 lakh, with liquidation of 0.16 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a covering of LONG positions today.

Bank Nifty Advance Decline Ratio at 07:05 and Bank Nifty Rollover Cost is @51260 closed above it.

Bank Nifty Gann Monthly Trade level :51204 closed above it.

Bank Nifty closed above its 50 SMA @51500 Trend is Buy on Dips.

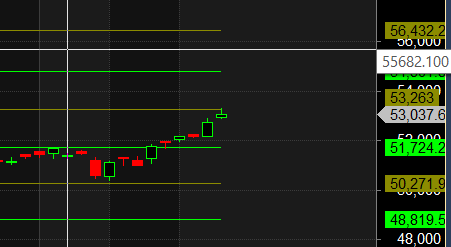

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 48819-50271-51724-53263. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 53000 strike, followed by the 53500 strike. On the put side, the 52500 strike has the highest OI, followed by the 52000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 52500-53500 range.

The Bank Nifty options chain shows that the maximum pain point is at 53000 and the put-call ratio (PCR) is at 1.01. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

The biggest The trader’s enemy is fear, Fear generates thoughts and Reactions. And these thoughts and reactions cause when trading often behaviour that leads to unsuccessful behaviour. That is why there is fear the greatest hindrance to success in trading.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 51739 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 53136, Which Acts As An Intraday Trend Change Level.

Bank Nifty Intraday Trading Levels

Buy Above 53100 Tgt 53225, 53444 and 53585 ( Bank Nifty Spot Levels)

Sell Below 52950 Tgt 52805, 52610 and 52444 (Bank Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.