Foreign Institutional Investors (FIIs) displayed a Bullish approach in the Nifty Index Futures market by Buying 271 contracts worth ₹17.12 crores, resulting in a increase of 5371 contracts in the net open interest. FIIs covered 2480 long contracts and added 3806 short contracts, indicating a preference for covering long positions and adding short positions. With a net FII long-short ratio of 2.13 , FIIs utilized the market fall to cover long positions and enter short positions in Nifty futures. Clients added 8167 long contracts and added 7138 short contracts.

Nifty witnessed a sharp bounce today as Mercury transitioned into a new house. This evening, we are expecting the release of inflation data, which, along with crude oil trading at a three-year low, is likely to have a positive influence on the market.

For the bullish momentum in Nifty to continue, it is crucial for the bulls to maintain the 24950-24980 range. A breakdown below 24950 could trigger a sharp decline, potentially pushing the index towards the 24800-24751 levels.

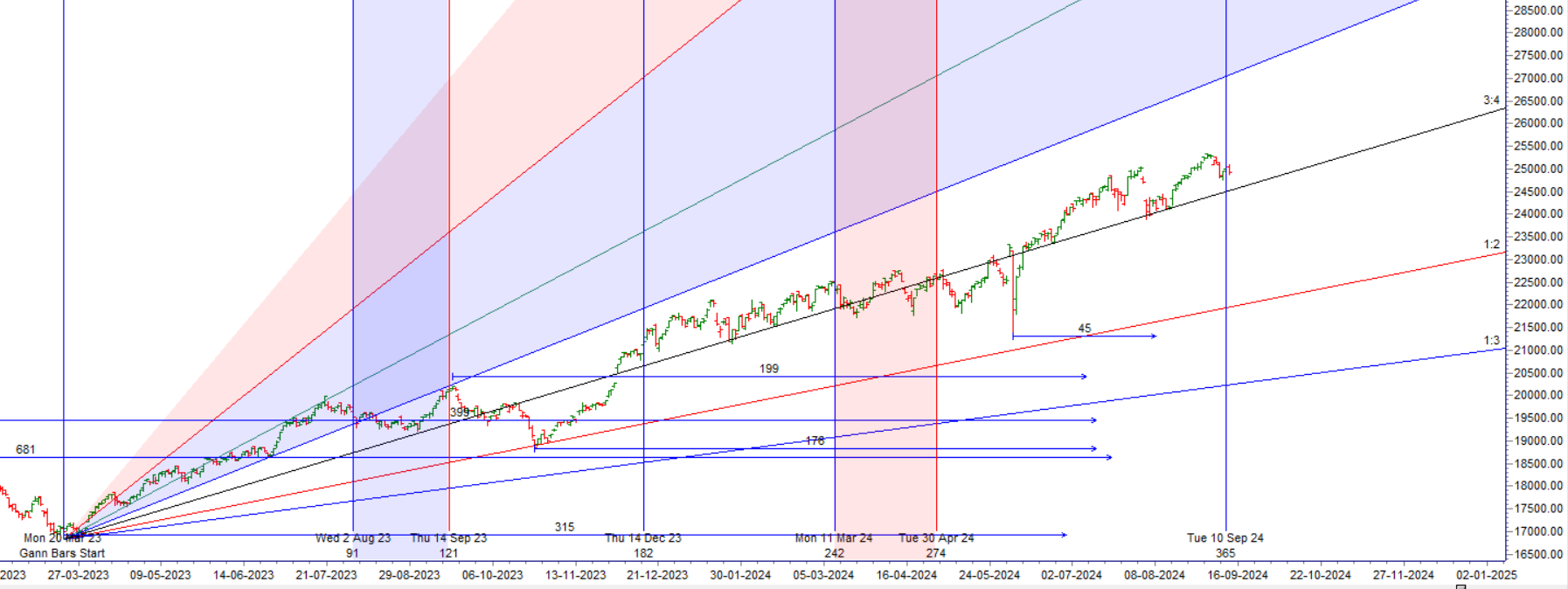

The upcoming data and price action will be pivotal in shaping Nifty’s short-term direction as both Gann and Astro cycle confluence.

Nifty failed to close above 24950 range suggesting bears are gaining upper hand , tommrow Nifty needs to break 24885 for a bearish expiry towards 24751/24700. Till price is below 24957 Mercury Ingress High Bears are having upper hand.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 25067 for a move towards 25146/25225/25303. Bears will get active below 24831 for a move towards 24910/24831/24753— Waiting for 24831/24753

Traders may watch out for potential intraday reversals at 10:20,11:52,01:06,02:07 How to Find and Trade Intraday Reversal Times

Nifty Sep Futures Open Interest Volume stood at 1.32 lakh cr , witnessing a liquidation of 4.2 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of LONG positions today.

Nifty Advance Decline Ratio at 12:38 and Nifty Rollover Cost is @25178 closed above it.

Nifty Gann Monthly Trade level :25089 close below it.

Nifty closed below its 20SMA @24924 Trend is Sell on Rise till below 24950

Nifty options chain shows that the maximum pain point is at 25000 and the put-call ratio (PCR) is at 1.12 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 25000 strike, followed by 25100 strikes. On the put side, the highest OI is at the 24900 strike, followed by 24800 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 24800-25000 levels.

In the cash segment, Foreign Institutional Investors (FII) bought 1755 crores, while Domestic Institutional Investors (DII) bought 230 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23889-24600-25310 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

Profitable trader, must sit and process the data the market offers with an open mind. Too many traders color the data the market offers with their own biases.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 25178. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 25026, Which Acts As An Intraday Trend Change Level.

Nifty Expiry Range

Upper End of Expiry : 25095

Lower End of Expiry : 24740

Nifty Intraday Trading Levels

Buy Above 24950 Tgt 24988, 25025 and 25075 ( Nifty Spot Levels)

Sell Below 24880 Tgt 24830, 24800 and 24740 (Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.