Foreign Institutional Investors (FIIs) exhibited a Bearish stance in the Bank Nifty Index Futures market by Shorting 7448 contracts with a total value of 507 crores. This activity led to a increase of 12434 contracts in the Net Open Interest.

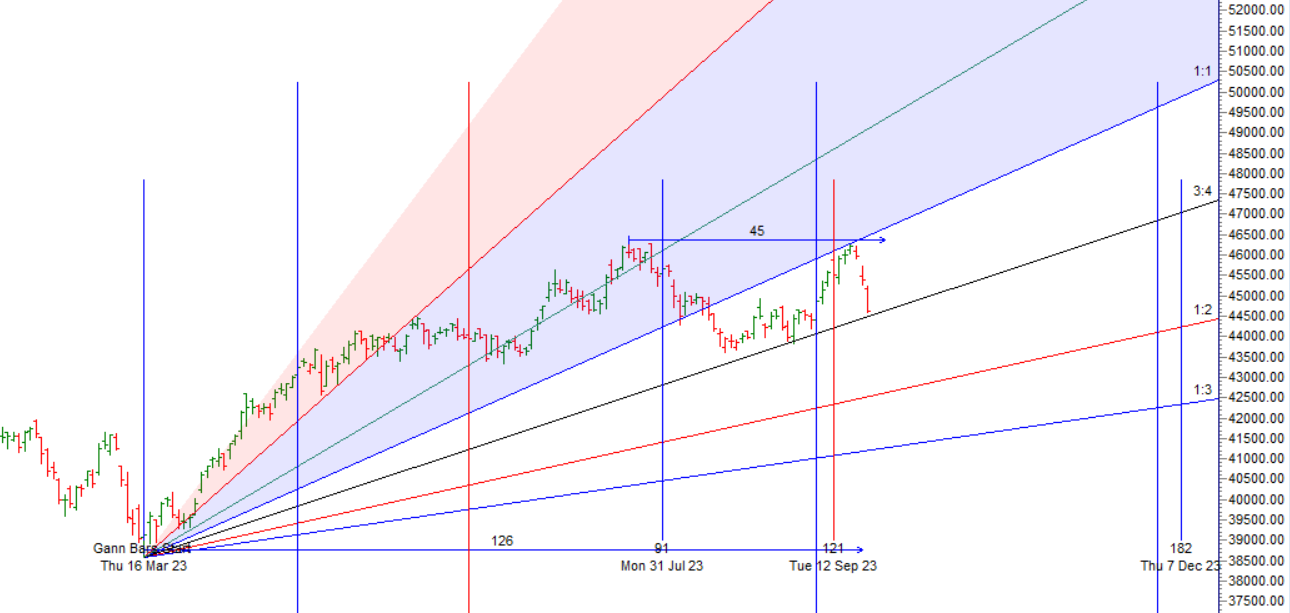

Bank Nifty has reacted from the Gann angle and astro date as discussed in below video, All thanks to HDFC Bank we have seen a decent cut in Bank nifty. We have 2 important astro date coming tommrow and we will see market reaction to FOMC meeting today with gap down. Watch out for price action near 45000 it will act as a trend change level till expiry.

Bayer Rule 6: The price is in bottom/top when Mars was in 16 degrees 35 minutes of some sign and plus 30 degrees.

Bayer Rule 27: Big tops and big major bottoms are when Mercury’s speed in Geocentric longitude is 59 minutes or 1 degree 58 minutes.

First 15 mins High and low will guide for the day.

Bank Nifty is back towards its 100 DMA and Gann angle support as shown below.Today being weekly close bears would like to close below 44485 for dowmove to continue towards 44000/43500. Today we have Mercury at Greatest Elong: 17.9°W and tommrow Autumnal Equinox so watch for 15 mins high and low to capture trend for the day.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 45449 for a move towards 45664/45880/46095. Bears will get active below 45234 for a move towards 45019/44804/44588. All Target done Now break of 44480 can lead to fall towards 44225/44000

Traders may watch out for potential intraday reversals at 9:48,11:43,12:40,02:22 How to Find and Trade Intraday Reversal Times

Bank Nifty Sep Futures Open Interest Volume stood at 15.6 lakh, addition of 2.2 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Bank Nifty Advance Decline Ratio at 0:12 and Bank Nifty Rollover Cost is @44639 closed above it.

Bank Nifty is back towards its 100 DMA @44485 close below it can lead to fall towards 44225/44000.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 43444-44634-45923 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price has closed below 44634.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 45000 strike, followed by the 45500 strike. On the put side, the 44500 strike has the highest OI, followed by the 44000 strike.This indicates that market participants anticipate Bank Nifty to stay within the 44300-44800 range. Total Call OI is 1.34 cr and Total Put OI is 1.45 cr

The Bank Nifty options chain shows that the maximum pain point is at 44600 and the put-call ratio (PCR) is at 0.89. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

To outperform the market and to succeed in trading, a trader needs to take charge of his emotions. To start off, he requires a patient and confident mind.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 45293. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 44986, Which Acts As An Intraday Trend Change Level.

Bank Nifty Intraday Trading Levels

Buy Above 44727 Tgt 44831, 44934 and 45069 (Bank Nifty Spot Levels)

Sell Below 44525 Tgt 44385, 44225 and 44108 (Bank Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.