Finance Nifty formed an Inside bar pattern on astro date its a lethal combo for a good move. Price has closed above 20340 Rahu Ingress High so its advantage Bull till we are above 20340. Finance Nifty moved on upside and made a fresh all time high, Inside Bar with Astro date 70% of time gives an excellent move as we have discussed. Ride the trend till it bends with strict SL. Today IT stocks will take a beating and Index needs to be manged Bank and Finance stocks will be taken refuge into.

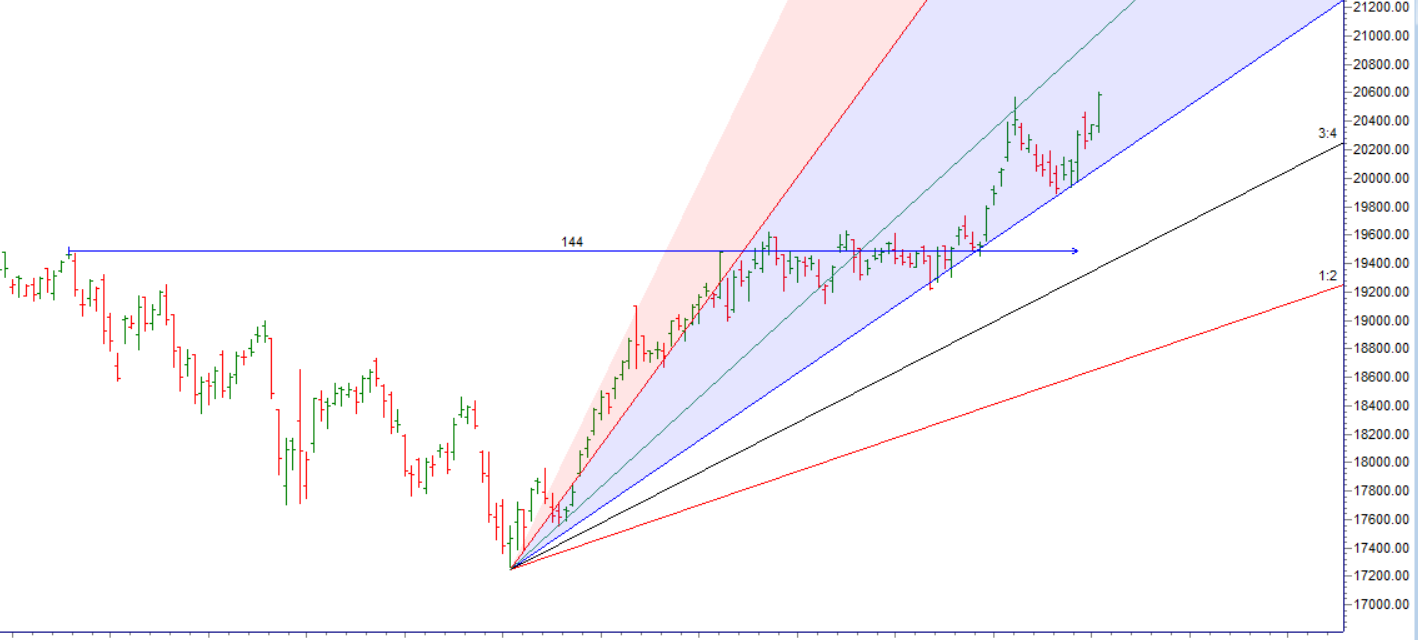

Finance Nifty Trade Plan Based Bulls will get active above 20564 for a move towards 20635/20706/20777. Bears will get active below 20493 for a move towards 20421/20350/20279.

Traders may watch out for potential intraday reversals at 9:53,10:35,1:01,1:46,2:40 How to Find and Trade Intraday Reversal Times

Finance Nifty June Futures Open Interest Volume stood at 61280 with liquidation of 7600 contracts. Additionally, the decrease in Cost of Carry implies that there was a addition of LONG positions today.

Finance Nifty Advance Decline Ratio at 12:7

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Finance Nifty may follow a path of 20529-19953-19376 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is near 20529

According to the Finance Nifty options chain, the call side has the highest open interest (OI) at the 20500 strike, followed by the 20600 strike. On the put side, the 20300 strike has the highest OI, followed by the 20300 strike. This indicates that market participants anticipate Bank Nifty to stay within the 20300-20600 range.

The FinanceNifty options chain shows that the maximum pain point is at 20500 and the put-call ratio (PCR) is at 1.15. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

To make One Good Trade you must prepare properly, work hard, and have patience

For Positional Traders, The Finance Nifty Futures’ Trend Change Level is At 20190. Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 20466 , Which Acts As An Intraday Trend Change Level.