Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Bank Nifty Index Futures market by Shorting 514 contracts worth 35 crores, resulting in a increase of 14 contracts in the Net Open Interest.

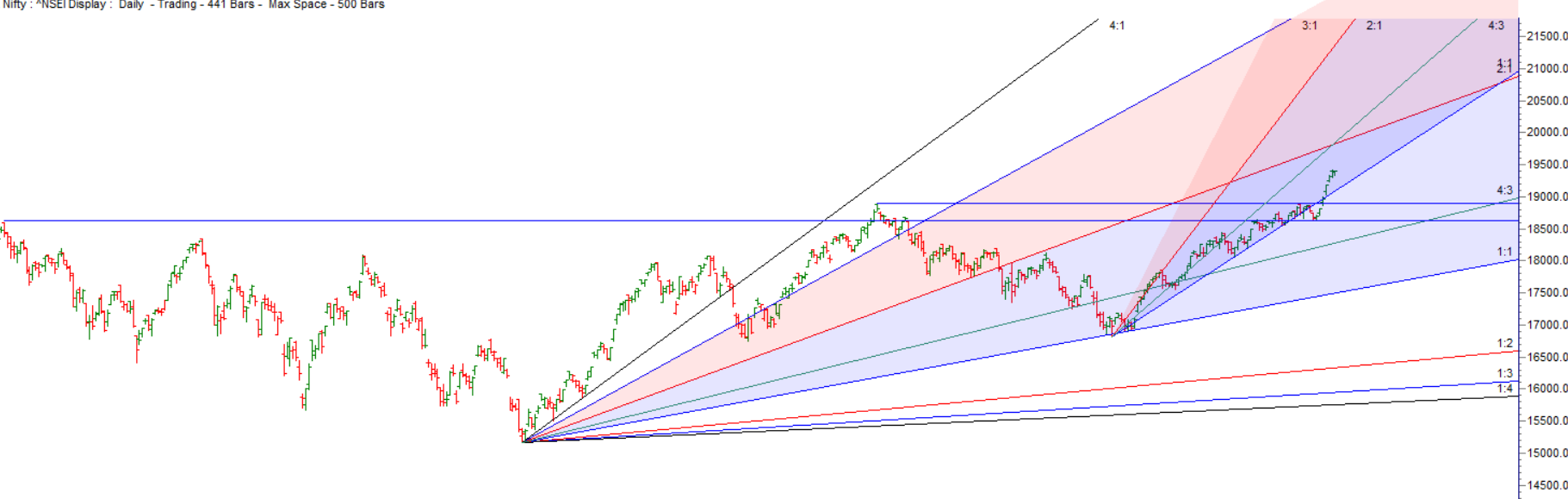

Bank NIfty move like this are one of its kind which we see once in 2-3 years. Nifty has rallied 38613-45655 till today which is 7042 points and its not an India Specific rally, Markets through out the world are rallying. Rise like these will get nullified by one big red candel which will take atleast 2-3 days of move. So LOng keep tsl below last day low .

For trend to reverse either we will get a Big Gap down or we will form an Outside bar with price closing below previous day low, TIll this conditions are not met trend continues on long side.

Also IF DIP comes in MOrning hours it will get bought into, Fall will come after 2 PM like today.

Tommrow we have Moon at Perigee and Bank Nifty has formed a DOJI Pattern first condition of pattern we have discussed here.

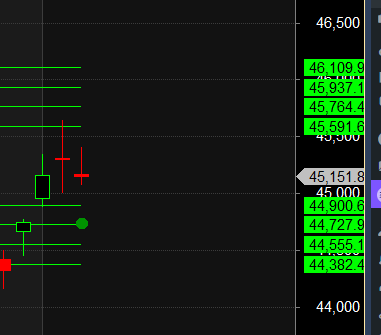

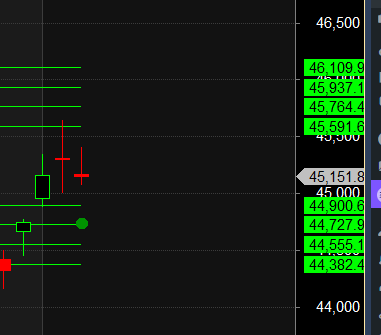

Bank Nifty has formed another Doji, indicating multiple Dojis, and is also currently forming an Inside Bar pattern. Despite the selling pressure from HDFC twins, Bank Nifty only experienced a modest decline of 100 points, highlighting the strength of the market. With today being the expiry day, it is crucial for the Bulls to defend the 45000 level. If successfully held, we may witness a rally towards 45356/45560. However, a break and close below 45000 could lead to a quick fall towards 44800/44666.

With VIX also showing Sign of Life we can have an Explosive Expiry.

Bank Nifty Trade Plan Based Bulls will get active above 45420 for a move towards 45591/45764/45937. Bears will get active below 45070 for a move towards 44900/44727/44555.

Traders may watch out for potential intraday reversals at 9:26,10:32,1:52,2:35 How to Find and Trade Intraday Reversal Times

Bank Nifty June Futures Open Interest Volume stood at 26.8 lakh, liquidation of 0.65 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a covering of LONG positions today.

Bank Nifty Advance Decline Ratio at 8:4 and Bank Nifty Rollover Cost is @44037 and Rollover is at 72.6%

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 43444-44634-45923 . This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable. Price is near 44634

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 45300 strike, followed by the 45500 strike. On the put side, the 45000 strike has the highest OI, followed by the 44800 strike. This indicates that market participants anticipate Bank Nifty to stay within the 44800-453 00 range.

The Bank Nifty options chain shows that the maximum pain point is at 45100 and the put-call ratio (PCR) is at 1.04. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

To create money management, position size calculation or the elaboration of a profitable set of rules. All of these very useful tools are of little help if you are not able to use them in a disciplined manner

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 45026 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 45283 , Which Acts As An Intraday Trend Change Level.