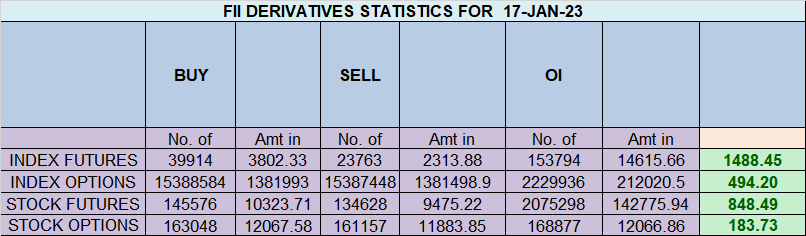

FII bought 16.1 K contract of Index Future worth 1488 cores, Net OI has decreased by 7.5 K contract 4.2 K Long contract were added by FII and 11.8 K Shorts were covered by FII. Net FII Long Short ratio at 0.80 so FII used ride to exit Long and enter short in Index Futures.

Mercury Retrograde is getting over tommrow its crucial day based on past data as shown and discussed in below video.

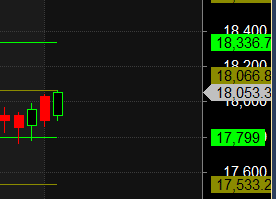

For Swing Traders Bulls need to move above 18094 for a move towards 18040/ 18161/18228/18294. Bears will get active below 18025 for a move towards 17961/17894

NIfty has finally closed above 20 SMA now price can target 18256-18288 zone where 50 SMA lies.

MAX Pain is at 18100 PCR at 0.95 Markets tend be range-bound when PCR OI (Open Interest) ranges between 0.90 and 1.05.

Maximum Call open interest of 30 lakh contracts was seen at 18200 strike, which will act as a crucial resistance level and Maximum PUT open interest of 32 lakh contracts was seen at 18000 strike, which will act as a crucial Support level

Retailers have sold 959 K CE contracts and 641 K shorted CE contracts were covered by them on Put Side Retailers bought 383 K PE contracts and 251 K PE shorted contracts were added by them suggesting having NEUTRAL outlook.

FII sold 30.9 K CE contracts and 94.2 K shorted CE were covered by them, On Put side FII’s sold 7.9 K PE and 43.9 K shorted PE were covered by them suggesting they have a BULLISH Bias.

Nifty Jan Future Open Interest Volume is at 1.15 Cr with liquidation of 2.1 Lakh with increase in Cost of Carry suggesting Long positions were closed today.

Nifty Rollover cost @18178 and Rollover % @72.5 Closed below it.

Nifty has again bounced from 50% point now need close above 18066 for trend to change from SELL of RISE to BUY on DIPS.

FII’s bought 211 cores and DII’s bought 90 cores in cash segment.INR closed at 81.56

#NIFTY50 as per musical octave trading path can be 17538-17804-18072 take the side and ride the move !!

Do not trade with tiny account, Its better to paper trade and build yourself until there is reasonable amount in your account. The market will wait for you. You want odds to be with you not against you, so be patient with right amount of capital.

Positional Traders Trend Change Level is 18088 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18037 will act as a Intraday Trend Change Level.