FII bought 15.71 K contract of Index Future worth 1414 cores, Net OI has increased by 16.5 K contract 15.8 K Long contract were added by FII and 707 Shorts were added by FII. Net FII Long Short ratio at 2.6 so FII used rise to enter long and enter short in Index Futures.

ON 28 we have Venus Yod Uranus and Mercury Square Jupiter HELIO Aspect which is crucial for Global Market , Uranus is Stock Market plannet so will have big impact on Global Stock Market.

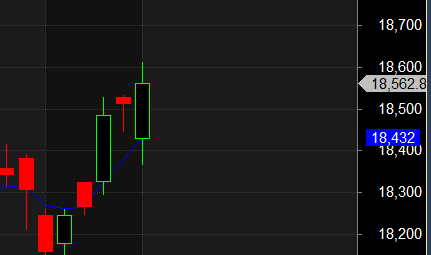

Nifty has made a new all time high today after 14 months, Now Bulls need a close above 18629-18636 very very important level else we can revisit the swing low formed today 18365

Tommrow Bayrs Rule 9 will come into affect Bayer Rule 9: Big changes on market are when Mercury passes over 19 degrees 36 minutes of Scorpio and Sagittarius,also over 24 degrees 14 minutes of Capricorn. For Intraday traders first 15 mins High and LOw will guide for the day.

For Swing Trade Bulls need to move above 18568 for a move towards 18636/18704/18772/18839 . Bears will get active below 18504 for a move towards 18433/18365/18312.

Intraday time for reversal can be at 10:36/11:39/12:07/1:13/2:01 How to Find and Trade Intraday Reversal Times

MAX Pain is at 18600 PCR at 0.92 PCR below 0.78 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Maximum Call open interest of 32 lakh contracts was seen at 18600 strike, which will act as a crucial resistance level and Maximum PUT open interest of 30 lakh contracts was seen at 18300 strike, which will act as a crucial Support level

Retailers have bought 525 K CE contracts and 488 K CE contracts were shorted by them on Put Side Retailers bought 712 K PE contracts and 627 K PE shorted contracts were added by them suggesting having BULLISH outlook.

FII bought 48.4 K CE contracts and 24.3 K CE were shorted by them, On Put side FII’s bought 77.9 K PE and 78.6 K PE were shorted by them suggesting they have a turned to neutral Bias.

Nifty Dec Future Open Interest Volume is at 1.19 Cr with addition of 6 Lakh with increase in Cost of Carry suggesting Long positions were added today. NIfty Future is in 132 points premium to Spot.

Nifty Rollover cost @18392 and Rollover % @75.1 Closed above it.

Till Nifty is above 18432 on closing basis Bulls will have upper hand.

FII’s bought 935 cores and DII’s bought 87 cores in cash segment.INR closed at 81.66

#NIFTY50 as per musical octave trading path can be 18058-18595-19132 take the side and ride the move !! — 18595 done

As a short-term trader, even if you develop the correct bias about the direction of the market, You still must possess the trading skills to capture these moves.

Positional Traders Trend Change Level is 18616 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18692 will act as a Intraday Trend Change Level.