FII sold 5.9 K contract of Index Future worth 456 cores, Net OI has increased by 5.6 contract 342 Long contract were added by FII and 5.3 K Shorts were added by FII. Net FII Long Short ratio at 0.19 so FII used rise to enter long and enter short in Index Futures.

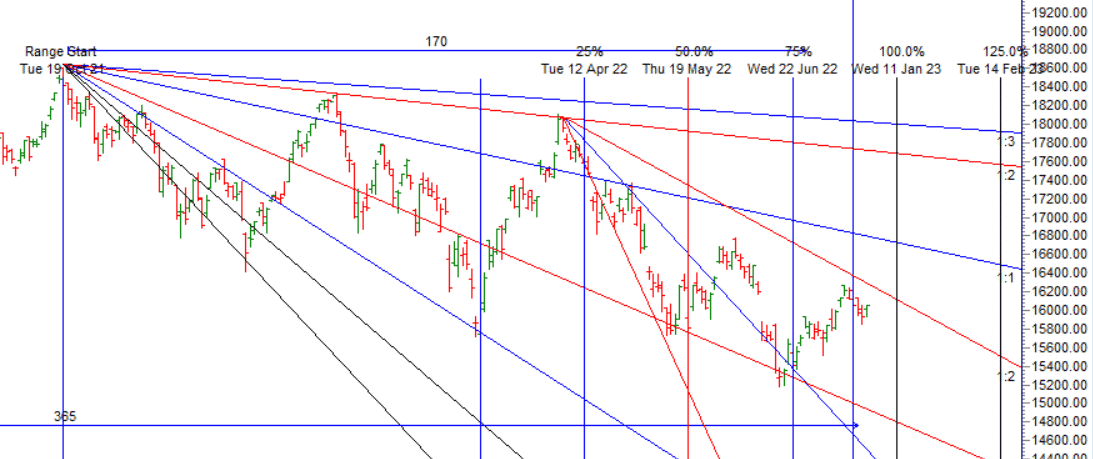

As Discussed in Last Analysis Weekend we have Double Ingress so aviod carrying overnight positions. 15-18 July are Astro Heavy dates suggesting we can see some positive coming from both Stock and Currency Markets. Bears below 15892 now waiting for 15829/15765.Bulls need to close above 15956 now waiting for target of 16020/16084/16147. For Intraday traders watch for first 15 mins High and Low to take the trades. Bears unable to break 15892 and bUlls above 15956 did 16020 and now wating for 16084/16147 which should be done with gap up open, Again Astro helped us in getting the right reversal point and levels helped in capturing the move. Now Bulls need to move above 16236 for a move towards 16299/16361. Bears will get active above 16047 for a move towads 15984/15921/15858

Intraday time for reversal can be at 9:15/10:37/11:32/1/1:31/2:24 How to Find and Trade Intraday Reversal Times

MAX Pain is at 16000 PCR at 0.86 PCR below 0.87 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty July Future Open Interest Volume is at 1.19 Cores with liquidation of 3.1 Lakh with decrease in cost of carry suggesting Short positions were closed today.

Nifty rollover cost @ 15801 and Rollover @66.1 % Closed above the rollover level suggesting bias is Bullish

Nifty Future have 73 Lakh OI added in range of 15933-15670 price zone out of today 1.19 Cores which is more than 60% and yesterday we have closed above 15933 suggesting we should see a move towards 16253 and any close above it Bears will b eunder water and will rally price towards 16500 by next week based on OI data.

Maximum Call open interest of 34 lakh contracts was seen at 16100 strike, which will act as a crucial resistance level and Maximum PUT open interest of 24 lakh contracts was seen at 15800 strike, which will act as a crucial Support level. There is total OI of 18.2 Cr on the Call side and 10.2 Cr on the Put side. So, the activity is more on PUT side indicating Option Writers are having BULLISH Bias.

FII’s sold 1649 cores and DII’s bought 1059 cores in cash segment.INR closed at 77.95

Retailers have bought 460 K CE contracts and 699 K CE contracts were shorted by them on Put Side Retailers bought 610 K PE contracts and 492 K shorted PE contracts were coveed by them suggesting having BEARISH outlook,On Flip Side FII bought 74.4 K CE contracts and 63.3 K CE were shorted by them, On Put side FII’s bought 91.5 K PE and 59.1 K PE were shorted by them suggesting they have a turned to BULLISH Bias.

Above 16108 rally towards 16573 as per Musical Octave. Failed to close above 16108 heading towards 15780/15642 till below 16108.

One of the reason why beginners trader blow up their trading account and have to leave trading forever is that they are extremely undercapitalized. They are forced out due to market noise

Good analysis.

thanks a lot !!