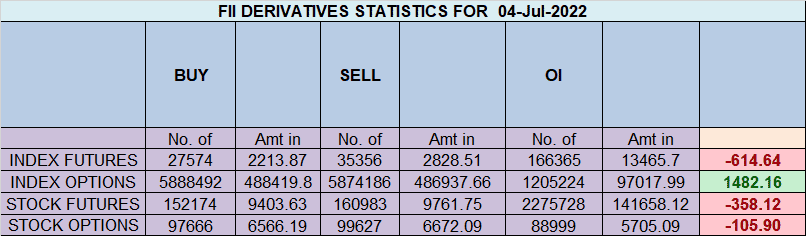

FII sold 7.7 K contract of Index Future worth 614 cores, Net OI has increased by 4.1 K contract 1.8 K Long contract were covered by FII and 5.9 K Shorts were added by FII. Net FII Long Short ratio at 0.16 so FII used fall to exit long and enter short in Index Futures.

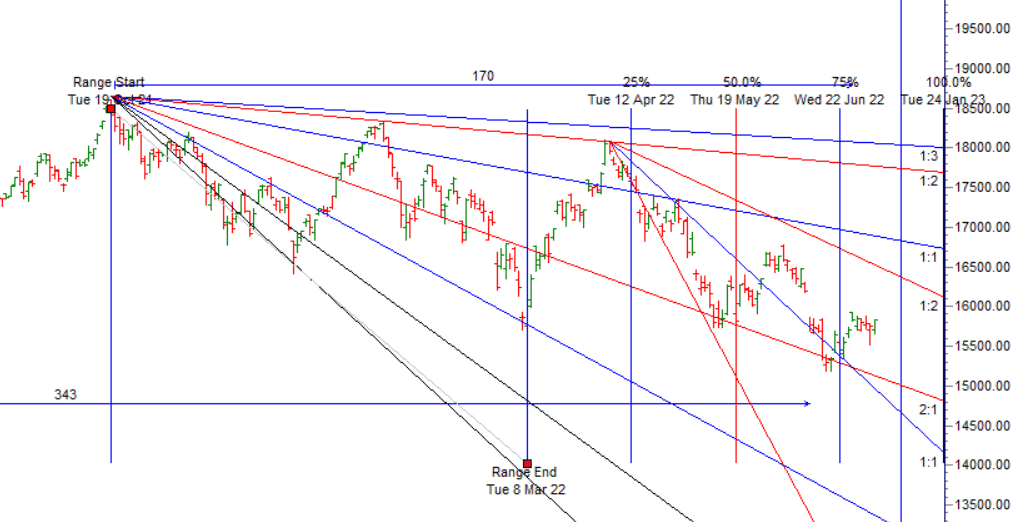

As Discussed in below video We had Important astro date today and tommrow we have double ingress For Swing Traders Bulls need to move above 15912 for a move towards 15974/16037/16099. Bears need to move below 15781 for a move towards 15729/15661.

Intraday time for reversal can be at 9:16/10:35/11:47/12:20/1:53/2:20 How to Find and Trade Intraday Reversal Times

MAX Pain is at 15800 PCR at 0.87 PCR below 0.88 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty July Future Open Interest Volume is at 1.21 Cores with addition of 3.1 Lakh with increase in cost of carry suggesting Long positions were added today.

Nifty rollover cost @ 15801 and Rollover @66.1 % Closed above the rollover level suggesting bias is bullish as of today.

Maximum Call open interest of 54 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 51 lakh contracts was seen at 15700 strike, which will act as a crucial Support level. There is total OI of 6.2 Cr on the Call side and 7.2 Cr on the Put side. So, the activity is more on PUT side indicating Option Writers are having Bullish Bias.

FII’s sold 2149 cores and DII’s bought 1688 cores in cash segment.INR closed at 79.10

Retailers have bought 545 K CE contracts and 623 K CE contracts were shorted by them on Put Side Retailers bought 716 K PE contracts and 693 K PE shorted contracts were added by them suggesting having BEARISH outlook,On Flip Side FII bought 40.3 K CE contracts and 52.6 K CE were shorted by them, On Put side FII’s bought 84.4 K PE and 69.2 K PE were shorted by them suggesting they have a turned to Bullish Bias.

As per Musical Octave Above 15642 Rally towards 16108

For Positional Traders Stay long till we are holding Trend Change Level 15732 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 15745 will act as a Intraday Trend Change Level.