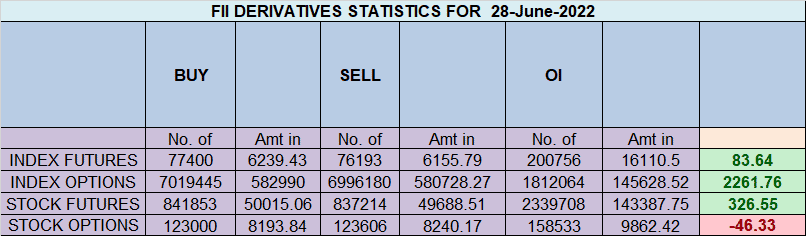

FII bought 1.2 K contract of Index Future worth 83 cores, Net OI has increased by 7.6 K contract 4.4 K Long contract were added by FII and 3.1 K Shorts were added by FII. Net FII Long Short ratio at 0.32 so FII used rise to enter long and enter short in Index Futures.

As Discussed in Last Analysis Nifty did all target on upside and Now we have Neptune Retrograde /New Moon and Moon Declination today suggesting important Astro High Intensity date. Today first 15 mins High and Low will decide the trend for the day.For Swing traders Bulls need to move above 15801 for a move towards 15864/15927/16000 . Bears will get active below 15738 for a move towards 15675/15611/15548. Bears got whipsawed today Bulls were able to do 1 target on upside. For Swing traders Bulls need to move above 15835 for a move towards 15898/15960/16023 . Bears will get active below 15738 for a move towards 15675/15611/15548.

Intraday time for reversal can be at 9:41/11:17/12:50/1:59/2:43 How to Find and Trade Intraday Reversal Times

MAX Pain is at 15850 PCR at 0.80 PCR below 0.9 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty May Future Open Interest Volume is at 0.77 Cores with liquidation of 6.9 Lakh with decrease in cost of carry suggesting Long positions were closed today.

Maximum Call open interest of 59 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 72 lakh contracts was seen at 15600 strike, which will act as a crucial Support level. There is total OI of 7.88 Cr on the Call side and 9.77 Cr on the Put side. So, the activity is more on PUT side indicating Option Writers are having Bullish Bias.

FII’s sold 1278 cores and DII’s bought 1184 cores in cash segment.INR closed at 78.61

Retailers have bought 423 K CE contracts and 368 K CE contracts were shorted by them on Put Side Retailers bought 283 K PE contracts and 244 K PE shorted contracts were added by them suggesting having BEARISH outlook,On Flip Side FII bought 61.3 K CE contracts and 45.9 K CE were shorted by them, On Put side FII’s bought 38.9 K PE and 23 K PE were shorted by them suggesting they have a turned to Bullish Bias.

As per Musical Octave Above 15642 Rally towards 16108

For Positional Traders Stay long till we are holding Trend Change Level 15661 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 15784 will act as a Intraday Trend Change Level.