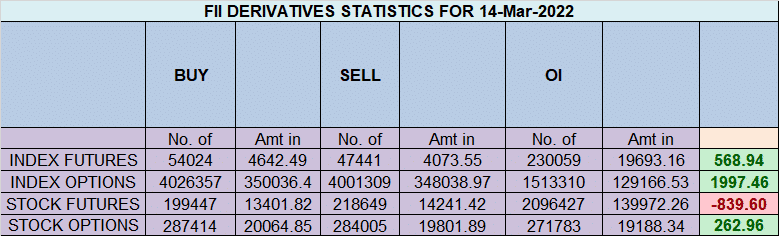

FII bought 6.8 K contract of Index Future worth 568 cores, Net OI has increased by 1.4 K contract 3.9 K Long contract were added by FII and 2.5 K Shorts were covered by FII. Net FII Long Short ratio at 0.80 so FII used rise to enter long and exit short in Index Futures.

We had Mercury Ingress today and 2 Lunar Cycle suggesting tommrow again we will see big move and we also have weekly closing. Bulls need to move above 16627 for a move towards 16692/16757. Bears will get active below 16498 for a move towards 16433/16369/16304. Friday close was above 16627 and all target done on upside so Mercury Ingress played its role. Nifty 200 DMA is at 16972 level to be watched out tommrow. 16972-17011 is zone of resistance so try to lighten up longs in this zone. Bulls need a move above 16928 for a move towards 16993/17057/17122. Bears below 16799 can see fall towards 16735/16670/16006. We are at 99 days from 19 Oct top.

Intraday time for reversal can be at 9:20/10:55/11:46/12:20/1:11/2:21 How to Find and Trade Intraday Reversal Times

MAX Pain is at 16700 PCR at 0.77 , Rollover cost @16997 closed below it.

Nifty March Future Open Interest Volume is at 1.30 Cores with addition of 5.5 Lakh with increase in cost of carry suggesting LONG positions were added today.

The option table data indicates decent support at 16500 and reasonable resistance at 17000.

It was decent rally which caused maximum pain to maximum participants as most retail traders lose money by looking for a trending move in non-trending environments and staying out in trending environments.

We do not get into strong bull trend with out sufficient backup in the equity segment. Probably the institutions also are adopting a wait-and-watch policy till the Fed Policy – and are playing the market with a very short term outlook – perhaps manipulating the index on a series by series basis.

I will not be surprised if we get a ranged movement in the next two days – where option premium gets killed. We are having High Theta Value in most of the Options.

16344 Nfty watch out closely its important Gann TC level 300-500 pt up and down move will be seen. 500 Points done from this level.

FII’s sold 176 cores and DII’s bought 1098 cores in cash segment.INR closed at 76.64. FII Selling was lowest in 2022 suggesting some sanity returning.

Retailers have bought 111 K CE contracts and 210 K short CE contracts were shorted by them on Put Side Retailers bought 558 K PE contracts and 519 K PE contracts were shorted by them suggesting having BEARISH outlook,On Flip Side FII bought 19.9 K CE contracts and 3.3 K shorted CE were covered by them, On Put side FII’s bought 47 K PE and 45 K PE were shorted by them suggesting they are having to BULLISH Bias

For Positional Traders Stay long till we are holding Trend Change Level 16424 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 16671 will act as a Intraday Trend Change Level.