When market are trending and you are making money, trading seems to be the best profession in the world, But market like last week trading in small range with fast volatile swing trading seems frustrating and difficult to you. Most of traders, begin their trading careers with lofty goals and a dream of making big , but those things “WILL” fade very quickly if you aren’t approaching the market from the right ‘angle’.

Trading success requires A Winning Mindset and trading on strategy and time frame which suits your personality. As a trader, and unless you have access to extremely large sums of money / the ability to withstand large draw downs, you are not going to last very long if you don’t employ the proper trading method.

I See most of traders doing intraday trading without having any edge and losing out as they are not equipped with risk and money management and most of them are working professional who cannot see the the market every mins. Thats where Swing trading come in picture and should be used by all new traders to start with.

Swing Trading

The big players in the market, like Prop Desk FII funds, . know where smaller retail traders place their orders and what they typically ‘do’ in the market (buy breakouts, day-trade, etc.). They know all the small-timer strategies and believe it or not, they enjoy taking your money every day in the market. You can’t survive without a stop loss, but they can, or at least they can for much longer than you or I. Also Brokers get lot of commissions when you do day trading with 10X leverage they provide, More you trade irrespective of you make or lose money, You broker will always make money.

In short, day-trading is a game of professional traders who know there system better and focus on risk and money management and have very fast reflexes to change positions as per market conditions.

On the opposite end of the trading scale, we have position trading /Swing Trading in which you do not want to see market moves every min and you do not want to be over leveraged and you can wait for the trade to come.

That brings us to what I call the trading ‘sweet spot’; swing trading. If you don’t already know, here’s what swing trading is: Swing Trading is a method of technical analysis to help you spot strong directional moves in the market that last on average, two to six days. Swing trading allows individual traders like us to exploit the strong short-term moves created by large institutional traders who cannot move in and out of the market as quickly.

What is a ‘swing point’ in the market?

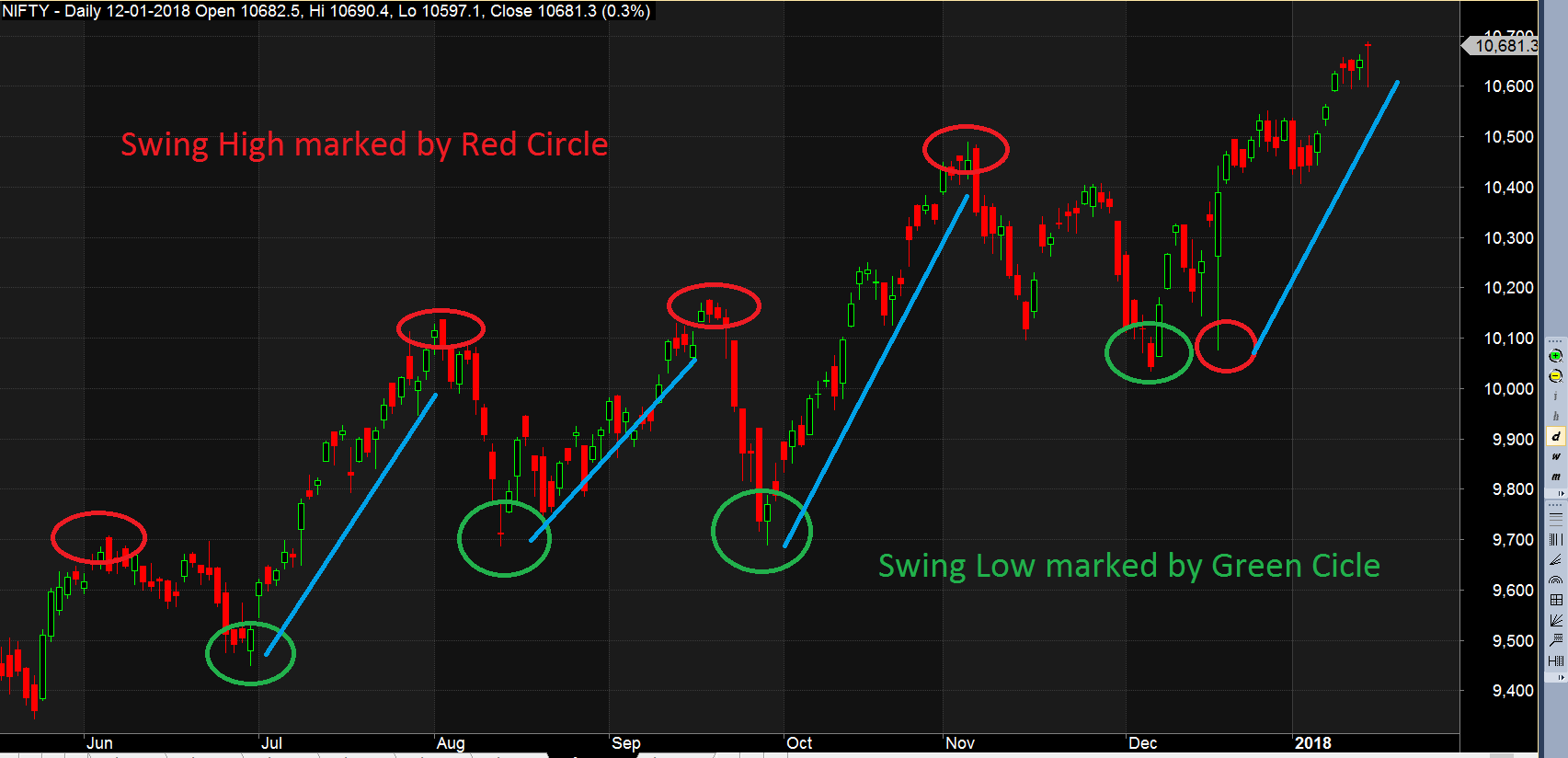

The chart below shows us what swing high points and swing low points look like. This market was trending higher, so as swing traders we would have looked for an entry near the swing lows…

Swing trading is the art and skill of reading a price chart to anticipate the next ‘swing’ in the market. I use Gann trading strategies to find high-probability entries in the market at these swing points and taking the trade with good risk to reward ratio.

Why you should become a swing trader

Focus on Higher time Frame:Daily/Weekly charts

Swing Trading allows you to skip all the market ‘noise’ of short time frames, like those under the 1-hour chart. New event like yesterday of Judges calling media led to fast drop in market, but daily chart pattern was not damaged.

Swing trading on higher time frames like daily allows you to take the big move, and it also allows you to place your stop loss not so small which will get triggered easily , thus giving you greater ‘staying power’ so that you can stay in the market longer and increase your chances of getting aboard a big, profitable move.

Fit trading in around your schedule

Swing trading allows you to fit trading in around whatever busy schedule you may have, or if you don’t have a busy schedule it will allow you to make money trading and still enjoy your free time. There’s nothing more boring than having to sit in front of the charts all day, not to mention that it’s bad for your trading and your health.

Swing trading allows you to analyze the markets on your schedule, for short periods of time, because you are focusing on higher time frames as mentioned above.

People over-complicate their trading by simply being too involved. Swing trading is the best method because it’s complementary to how you should behave in the market because it rewards you for being less involved and taking less trades over time, which is exactly what you need to do if you want to have any chance at success.

In my Gann trading strategies teach my students the same swing trading techniques I have used to trade with for the past decade methods which have stood the test of time across a range of different markets and conditions.

Tips to Remmber

- When swing trading, adjust your expectations. The lower your expectations, the happier you will be and, ironically, the more money you will probably make! Entries are a piece of cake, but you must also trust yourself to get out of bad situations and trades. It is important to use tighter stops when trading swings and wider stops when trading trends.

- This method teaches you to anticipate! Never react! Know what you are going to do before the market opens. Always have a plan–but be flexible!

- Never chase a market.

- Do not carry a losing position overnight. Exit and play for better position the next day.

- The goal always is to minimize risk and create “Freebies.”

- NEVER, ever, average a loss! Sell out if you think you are wrong. Buy back when you believe you are right.

- NEVER, NEVER, NEVER listen to anyone else’s opinion! Only YOU know when your trade isn’t working.

Below Videos we have discussed 2 Swing trading Strategies