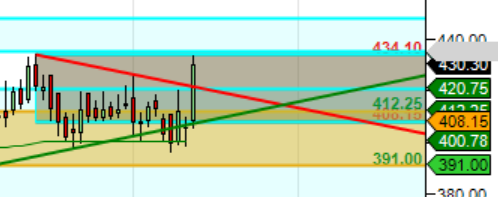

BPCL

Positional Traders can use the below mentioned levels

Close below 426 Target 412

Intraday Traders can use the below mentioned levels

Buy above 434 Tgt 437, 441 and 445 SL 431

Sell below 426 Tgt 423, 419 and 416 SL 429

Chola Finance

Positional Traders can use the below mentioned levels

Close below 220 Target 212

Intraday Traders can use the below mentioned levels

Buy above 223 Tgt 225, 228 and 231 SL 221.5

Sell below 220 Tgt 217, 214 and 212 SL 222

ZEE L

Positional Traders can use the below mentioned levels

Positional Traders can use the below mentioned levels

Close below 220 Target 212

Intraday Traders can use the below mentioned levels

Buy above 223 Tgt 225, 228 and 231 SL 221.5

Sell below 220 Tgt 217, 214 and 212 SL 222

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is discussed for Aug Month, Intraday Profit of 5.61 Lakh and Positional Profit of 0.91 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if Trading Systems are followed with discipline. Performance “Will differ” from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.